Business & Politics

Korean Chips Act set to pass parliament in March; coverage expanded

The amendment to the tax law, to be passed on March 30, will also benefit the hydrogen and future car sectors

By Mar 17, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

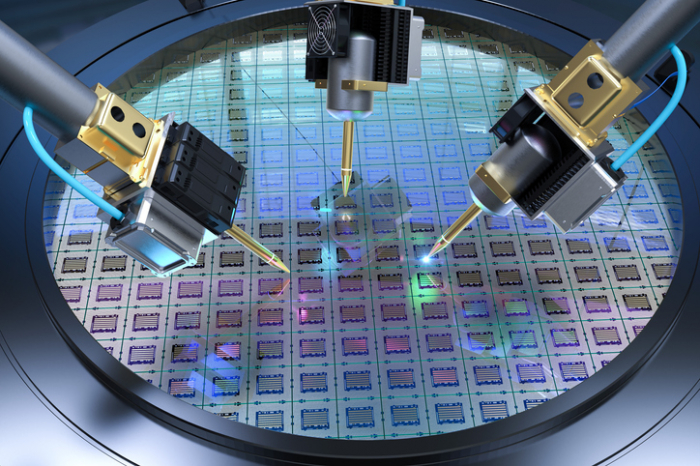

South Korea’s answer to the US CHIPS and Science Act is on course for National Assembly approval by the end of this month as the ruling and opposition parties have agreed on up to 25% tax breaks for facility investments by chipmakers.

This time, the ruling People Power Party and the main opposition Democratic Party of Korea (DPK) have also agreed to expand the coverage to the hydrogen and future car-related businesses.

The rival parties on Thursday held a tax subcommittee meeting and approved a government plan to raise tax deductions on facility investments by big companies such as Samsung Electronics Co. and SK Hynix Inc. to 15% from the current 8%.

Companies can receive tax benefits as high as 25% as the ministry proposal includes an additional tax deduction of 10% for this year only on investments exceeding their average annual facility spending over the previous three years.

The tax incentives will be retroactively applied to the investment amount made since the start of this year.

Barring the unexpected, the amendment to the tax law, dubbed the Korean Chips Act, will go through the Finance Committee on March 22 and get the final go-ahead at the plenary session of the National Assembly scheduled for March 30.

HYDROGEN, ELECTRIC VEHICLES INCLUDED

The Korean Chips Act was originally designed to support Korea’s four strategic tech sectors – semiconductors, displays, rechargeable batteries and vaccines.

At Thursday’s tax subcommittee meeting, however, lawmakers agreed to expand the tax credit coverage to the hydrogen and future car businesses as proposed by the main opposition DPK, which controls the National Assembly.

“Those who have the upper hand in eco-friendly vehicles will assume the automotive industry’s global hegemony,” DPK leader Lee Jae-myung said at EV Trend Korea 2023 on Wednesday.

Under the CHIPS and Science Act passed in the US Congress last July, a company that builds a chip manufacturing facility in the US receives a 25% tax credit – a move aimed at attracting investments from global chipmakers such as Samsung and Taiwan’s TSMC, the world’s top foundry player.

On Wednesday, the Korean government announced the creation of the world’s largest semiconductor cluster near Seoul by attracting 340 trillion won ($261 billion) in private investment from Samsung and other domestic companies.

The plan is part of the government’s 550 trillion won mega project to nurture six major industries – chips, displays, batteries, biotech, future cars and robots – as key growth drivers of the Korean economy, Asia’s fourth-largest.

Korea is home to the world’s two largest memory chipmakers – Samsung and SK Hynix – but the government has been under fire for insufficient state support for chips and other backbone industries.

Samsung, which reported a 97% decline in its semiconductor operating profit in the fourth quarter of 2022 from the year-earlier period, is widely expected to post an operating loss to the tune of 1 trillion won from its semiconductor business in the current quarter.

SK Hynix, which posted its first quarterly operating loss in a decade in the fourth quarter, is also forecast to report a significant loss in the January-March quarter.

Write to Kyung-Mok Noh, Jae-Yeon Ko and Bum-Jin Chun at autonomy@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung Electronics establishes new LSI chip research center in Japan

Korean chipmakersSamsung Electronics establishes new LSI chip research center in JapanMar 15, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsSouth Korea eyes $261 billion chip cluster; Samsung takes lead

Business & PoliticsSouth Korea eyes $261 billion chip cluster; Samsung takes leadMar 15, 2023 (Gmt+09:00)

4 Min read -

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issues

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsKorean lawmakers mull higher chip tax credits, battery subsidies

Business & PoliticsKorean lawmakers mull higher chip tax credits, battery subsidiesMar 07, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractive

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractiveMar 06, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN