Business & Politics

South Korea eyes $261 billion chip cluster; Samsung takes lead

The mega project comes as Korea is feeling the heat, caught in the US-China crossfire over tech leadership

By Mar 15, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea said on Wednesday it will create the world’s largest semiconductor cluster near Seoul by attracting 340 trillion won ($261 billion) in private investment from Samsung Electronics Co. and other domestic companies.

The plan is part of the government’s 550 trillion won mega project to nurture six major industries – chips, displays, batteries, biotech, future cars and robots – as key growth drivers of the Korean economy, Asia’s fourth-largest.

“We (Korea) already possess state-of-the-art technologies and production capabilities in areas such as memory chips and OLED displays. The government must provide firm support to private sector investment for further growth,” President Yoon Suk Yeol said while presiding over an economic policy meeting earlier in the day.

Funding for the 550 trillion won project planned through 2026 will primarily come from the private sector, while the government will offer tax benefits and speedy regulatory approvals, the Ministry of Trade, Industry and Energy said in a statement.

Korea’s bold investment plan – its most aggressive ever to win a heated race for tech supremacy – comes as “every country is sparing nothing in large-scale subsidies and tax benefits to build cutting-edge manufacturing facilities at home,” President Yoon said at the meeting.

Home to the world’s two largest memory chipmakers – Samsung and SK Hynix Inc. – Korea is feeling the heat, caught between its ally the US, and its largest trading partner China, in an escalating fight over chip leadership.

Korea’s battery trio LG Energy Solution Ltd., Samsung SDI Co. and SK On Co., which are industry leaders, heavily depend on China for mineral procurement, but at the same time are forced to build production facilities in North America.

SAMSUNG TAKES THE LION’S SHARE

Samsung said it will invest around 300 trillion won over the next two decades through 2042 to create the mega chip cluster in Yongin, Gyeonggi Province, near Samsung’s and SK Hynix’s existing chip manufacturing plants in Hwaseong, Icheon and Pyeongtaek cities.

Once completed, the government plans to attract up to 150 materials, parts and equipment makers as well as fabless chipmakers and design houses to the cluster.

“By connecting to the existing chip facilities in nearby cities, the mega cluster will cover almost all processes throughout the (Korean) chip supply chain,” Industry Minister Lee Chang-yang said at a briefing before President Yoon.

As part of its efforts to become a major player in the much larger non-memory sector, Korea aims to foster 10 fabless companies until they post at least 1 trillion won in annual sales by providing them with advanced technologies for AI, automotive and home appliance chips.

The government said it will also spend big on developing advanced chip packaging technology and next-generation chips used in AI computers and future vehicles.

FIVE OTHER STRATEGIC SECTORS

Wednesday’s ambitious investment plans include building 14 industrial complexes across the country in addition to the envisioned chip cluster in Yongin.

Of the 550 trillion won spending plan, 95 trillion won will go to future vehicles, including autonomous driving cars, 62 trillion won to displays, 39 trillion won to rechargeable batteries, 13 trillion won to biotechnology and 1.7 trillion won to robotics, the ministry said.

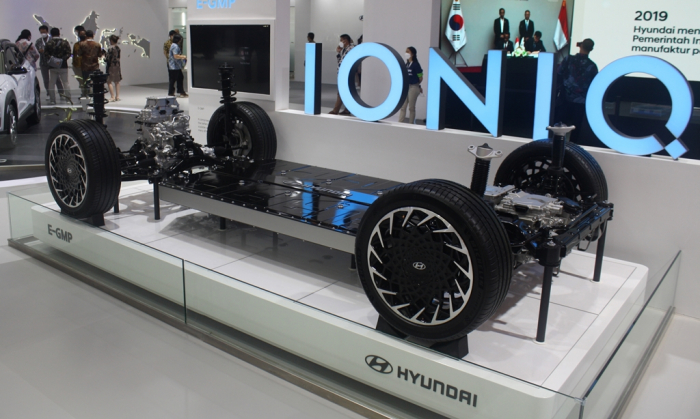

Investments in the five sectors will also be led by big companies, including Hyundai Motor Co.

Hyundai Motor Group, which owns Kia Corp. and Hyundai Mobis Co., plans to spend 21 trillion won by 2030 to expand its electric vehicle production facilities in Korea.

With the investment plan, the automotive group aims to quadruple its annual EV production capacity in Korea to 1.44 million vehicles by 2030 from 350,000 units in 2022.

SK Group is known to be spending 179 trillion won while LG Group plans to chip in 54 trillion won by 2027 in respective contributions to the government-led investment plans.

Samsung Group said it has earmarked 60.1 trillion won for its display, battery and other equipment-making units to build or expand facilities outside of Seoul over the next decade.

“The economic war that recently began with semiconductors is broadening to other industries such as batteries and future cars. It’s becoming a matter of life and death,” President Yoon said.

Next month, he is traveling to the US to meet with President Joe Biden over tricky issues involving the CHIPS and Science Act and the Inflation Reduction Act, which are increasingly becoming headaches for Korean companies.

Write to Jeong-Soo Hwang, Ji-Eun Jeong and Hyeong-Ju Oh at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investments

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investmentsMar 14, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersKorea to raise young chip engineers for Samsung, SK Hynix

Korean chipmakersKorea to raise young chip engineers for Samsung, SK HynixMar 13, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issues

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractive

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractiveMar 06, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN