Korean chipmakers

US CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

With the advent of the AI era, the US strives to regain its leadership in chip manufacturing and research

By Mar 02, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

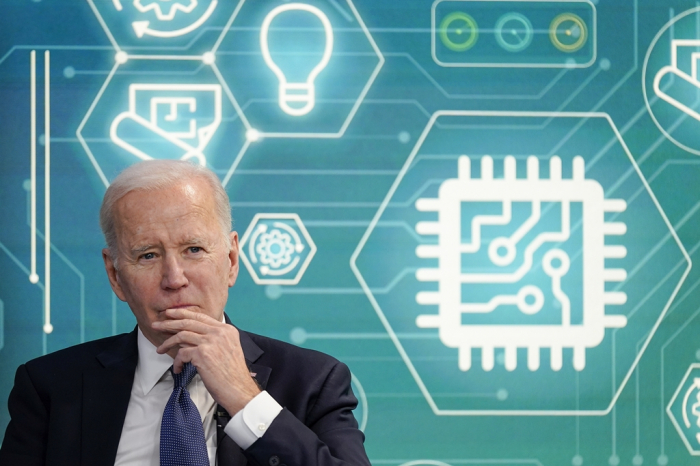

WASHINGTON D.C. – The Biden administration’s “Chips for America” program aims to keep China’s growing clout in the semiconductor industry in check and strengthen US companies’ competitiveness. There’s no doubt about it.

The first batch of guidelines of the CHIPS and Science Act unveiled on Tuesday, however, could inflict collateral damage to Samsung Electronics Co. and SK Hynix Inc., the world’s two largest memory chipmakers.

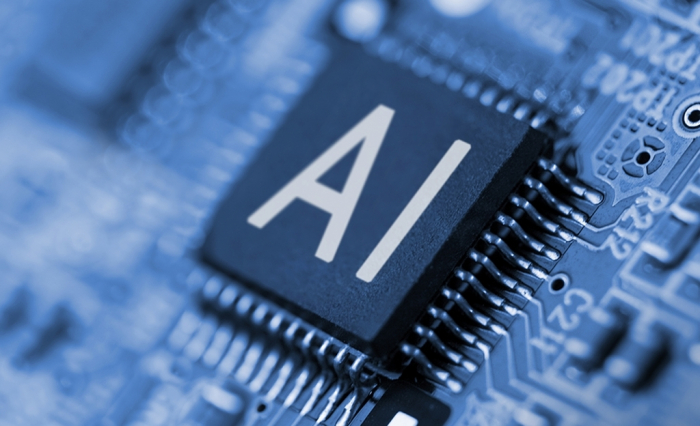

The US government stated in the guidelines that it hopes to regain its global hegemony in four core chip technologies – high-capacity memory chips, advanced chip packaging, chip processing and the creation of large-scale chip clusters – by 2030.

In the memory chip segment, typically DRAM and NAND flash, the two South Korean chipmakers have enjoyed dominant market leadership for decades with their production facilities largely in Korea and China.

While the US has been the leader in designing chips over the past three decades, most manufacturing has been taken over by companies in Taiwan and Korea under contract chipmaking at their foundries.

With the importance of advanced memory chips used in AI devices, supercomputers and autonomous cars increasing faster than ever, the US now hopes to tip the balance in its favor, analysts said.

A COMMODITY HAS-BEEN

For the US government and its chipmakers, memory chips have long been outside of their interest because the segment required heavy facility investment to make less profitable chips, often dubbed “cheap commodities.”

By the early 1980s, Intel Corp. and other US memory makers gave up their market leadership to their Japanese rivals such as Toshiba Corp. A decade later, the top posts were replaced by Samsung and SK Hynix, which now control more than half the DRAM and NAND markets.

US chipmaker Micron Technology Inc., the world’s No. 3 memory producer, has its main chip production factories in Taiwan and Singapore.

With the advent of the AI era, represented by the likes of ChatGPT, where high-capacity HBM3 DRAMs made by Samsung and SK Hynix play a key role, the Biden administration wants to build up memory research as well as manufacturing in the US.

Currently, Samsung operates state-of-the-art memory production lines in Hwaseong and Pyeongtaek, Korea and Xian, China. SK Hynix runs memory chipmaking facilities in Icheon and Cheongju, Korea and two Chinese cities, Wuxi and Dalian.

In its efforts to wean Korean chipmakers off Chinese dependence, a senior US government official said last month it may put a cap on technology levels that Samsung and SK Hynix could grow to in China.

Under pressure, Samsung reportedly is considering building a memory chip plant at its new US factory currently under construction in Taylor, Texas.

SK Hynix is also considering diversifying its global production facilities away from China. The company has already announced that it will build a chip packaging plant and a research center in the US.

Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), the world’s largest foundry player, is building a new chip factory in Arizona.

POISON PILL

The US Commerce Department on Tuesday began receiving applications for semiconductor manufacturing subsidies under the $53 billion Chips Act with conditions that the recipients do not make new, high-tech investments in China or other “countries of concern” for at least a decade.

Companies receiving more than $150 million in grants are also required to pay the US government a portion of their profits if their facilities are more profitable than projected.

The chip subsidies and incentives offered by the US government come with strings attached, which industry officials said could be hard for chipmakers to swallow.

Under the guidelines, the US government will demand companies receiving subsidies to turn over their account books, a list of their staple products and the names of key clients during the screening process – all of which are often business secrets.

US Secretary of Commerce Gina Raimondo also made clear that the subsidy program is a national security initiative requiring chipmakers that receive incentives to actively cooperate with the US military in maintaining chip supply and advancing military technology.

“Once the US initiative to nurture its own chip industry takes more concrete shape, Korean chipmakers could be in trouble. They must find a way to remain competitive while meeting US requirements,” said an executive at a Korean chip company.

Write to In-Seol Jeong, Jeong-Soo Hwang and Ji-Eun Jeong at surisuri@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung eyes wider foundry client base with Ambarella deal

Korean chipmakersSamsung eyes wider foundry client base with Ambarella dealFeb 21, 2023 (Gmt+09:00)

2 Min read -

PerspectivesBiden must ensure US allies aren’t China collateral damage

PerspectivesBiden must ensure US allies aren’t China collateral damageFeb 15, 2023 (Gmt+09:00)

4 Min read -

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai Motor

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai MotorJan 03, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN