Korean chipmakers

Samsung, SK Hynix face cap on tech level of chips made in China

As the Biden administration hobbles China’s chip industry, Korean chipmakers are moving to diversify away from China

By Feb 24, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

WASHINGTON D.C. – Samsung Electronics Co. and SK Hynix Inc., the world’s two largest memory chipmakers, might be unable to manufacture advanced semiconductors at their plants in China as early as October, as the US moves to tighten its sanctions against the Chinese chip industry.

At a business forum held in Washington D.C. on Thursday, Alan Estevez, the US Commerce Department's undersecretary for industry and security, said there “will likely be a cap on the levels that they can grow to in China.”

The remarks came in response to a question of what the South Korean chipmakers should expect after the end of their one-year reprieve from US restrictions on equipment exports to China.

"If you're at whatever layer of NAND, we'll stop it somewhere in that range," he said at the forum co-hosted by the Korea Foundation and the Center for Strategic & International Studies.

Last October, Washington released new regulations requiring companies looking to supply chipmakers in China with advanced manufacturing equipment to first obtain a license from the US Department of Commerce, effectively banning exports of advanced chipmaking machines to China.

However, the US government granted Samsung and SK Hynix a one-year waiver, allowing them to continue to take chips and chipmaking equipment to their factories in China.

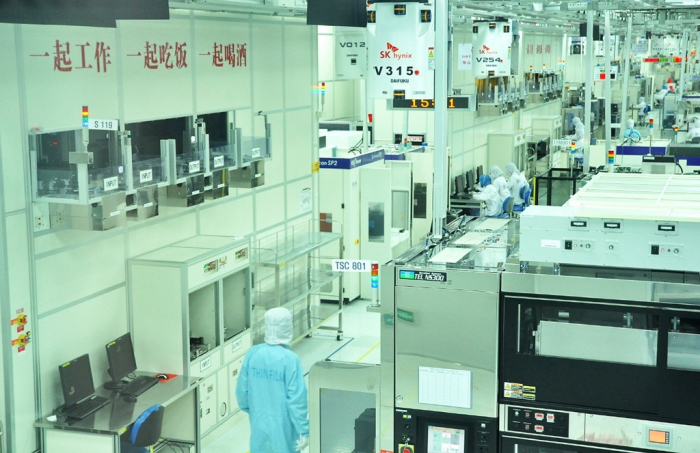

Currently, Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing.

Samsung’s Xian plant accounts for nearly 40% of the company’s entire NAND production globally while SK Hynix’s Wuxi plant produces about 48% of its global DRAM output.

CAUGHT IN THE CROSSFIRE

The never-ceasing faceoff between the US and China is posing a growing risk for Samsung and SK Hynix as China plus Hong Kong account for nearly two-thirds of their exports.

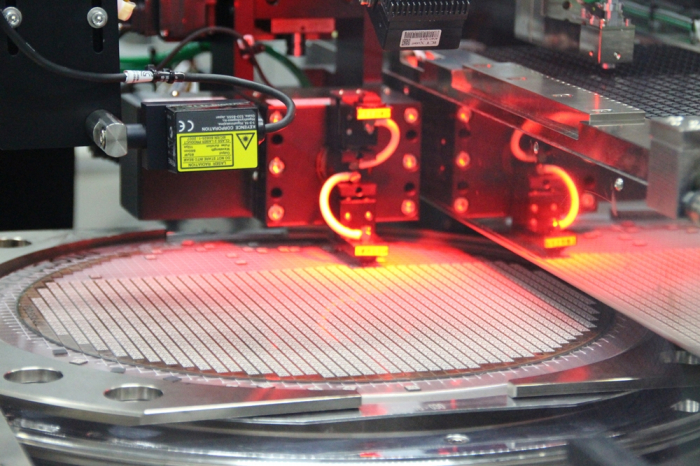

Samsung and SK Hynix aren’t producing state-of-the-art semiconductors at their Chinese plants, but they have been ramping up facilities to produce advanced chips.

Samsung has invested $25.8 billion in its NAND flash plant in Xian since 2021. Combined with SK Hynix, the two Korean chipmakers’ spending on their Chinese factories would reach more than 50 trillion won ($38.3 billion), industry officials said.

Samsung is said to be making 128-layer NAND chips in China while more advanced 176-layer and 192-layer chips are produced in Korea and other overseas locations.

SK Hynix produces 1y and 1z DRAMs, not regarded as cutting-edge chips, in China.

“If the Korean chipmakers are banned from advancing their technology in China, they will lose their competitiveness not just in China but globally,” said an industry executive.

Estevez said the US government is in “deep dialogue” with the Korean chipmakers and its government.

Korea’s Ministry of Commerce, Industry and Energy said there have been no specific discussions between the two allies on setting a cap on the chip technology level.

"Both South Korea and the United States have formed a consensus that current operations and future investment by Korean chip makers should not be disrupted," the ministry said in a statement.

A ministry official said the Korean government plans to closely discuss the extension of chipmaking equipment imports to China.

EXIT FROM CHINA?

Industry watchers said Korean chipmakers might be tempted to gradually lower their Chinese production while increasing output in other countries, including the US.

Samsung Electronics is said to be considering a plan to build a memory chip production facility at its new US factory currently under construction in Taylor, Texas.

SK Hynix said it is actively considering diversifying its global production facilities away from China. The company has already announced that it will build a chip packaging plant and a research center in the US.

Meanwhile, the US government said it will offer chipmakers generous subsidies unless they make fresh investments in China or other countries of concern over the next 10 years.

US Secretary of Commerce Gina Raimondo said on Thursday that her department will begin receiving applications for a total of $39 billion in chip funding next Tuesday to incentivize companies to produce chips in the US.

Samsung and SK Hynix are expected to apply for the subsidies.

Write to In-Seol Jeong, Ji-Eun Jeong and Jeong-Soo Hwang at surisuri@hankyung.com

In-Soo Nam edited this article.

More to Read

-

PerspectivesBiden must ensure US allies aren’t China collateral damage

PerspectivesBiden must ensure US allies aren’t China collateral damageFeb 15, 2023 (Gmt+09:00)

4 Min read -

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai Motor

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai MotorJan 03, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersUS to allow Samsung, SK Hynix to import to China for 1 year

Korean chipmakersUS to allow Samsung, SK Hynix to import to China for 1 yearOct 12, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN