LG Energy in cobalt, lithium deals with three Canadian suppliers

The move is part of LG's efforts to establish a local supply chain in North America to respond to the IRA

By Sep 23, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s LG Energy Solution Ltd. said on Friday it has signed battery materials supply deals with three Canadian minerals companies – a move seen in response to the US tax credit law that favors electric vehicles with battery cells processed in North America.

LG Energy, a leading global battery maker, which counts Tesla Inc. as one of its key clients, said it has signed a binding agreement with Electra Battery Materials Corp. to receive 7,000 tons of cobalt sulfate annually for three years from 2023.

Electra is the only supplier capable of refining cobalt sulfate in North America.

The Korean company has also signed non-binding memorandums of understanding with Avalon Advanced Materials Inc. and Snow Lake Resources Ltd.

Under the initial agreements, Avalon and Snow Lake will supply LG with 55,000 tons a year of lithium hydroxide for five years from 2025 and 200,000 tons of lithium hydroxide annually for 10 years from 2025, respectively.

LG said in a statement the agreements were part of its efforts to expand mid- to long-term supply contracts with companies that mine and process key battery materials in North America.

“These partnerships serve as a crucial step towards securing a stable key raw material supply chain in the region,” said LG Energy Chief Executive Kwon Young-soo.

“By constantly investing in upstream suppliers and establishing strategic partnerships with major suppliers of critical minerals, LG will continue to ensure the steady delivery of our top-quality products, further advancing the global transition to EVs and ultimately to a sustainable future.”

CRITICAL MINERALS

The US Inflation Reduction Act (IRA), signed into law by US President Joe Biden in August, requires a certain percentage of critical minerals used in EV batteries to come from the US or its free trade partners.

From next year, EV makers must use batteries with materials sourced primarily in North America for their cars to be eligible for the tax credit of up to $7,500 per unit.

Qualifying EVs must contain at least 40% of the battery minerals and 50% of the battery components from those countries. The proportion will rise to 80% for minerals by 2027 and 100% for parts by 2029.

The act, aiming to diminish China’s power in the global EV market, is also expected to impact Korea’s finished car makers and battery suppliers. Hyundai Motor Group’s main EVs, such as the IONIQ 5 and the EV6, are manufactured in Korea.

Korean battery makers are also taking the issue seriously as their batteries are dependent on raw materials from China.

LOCAL SUPPLY CHAIN

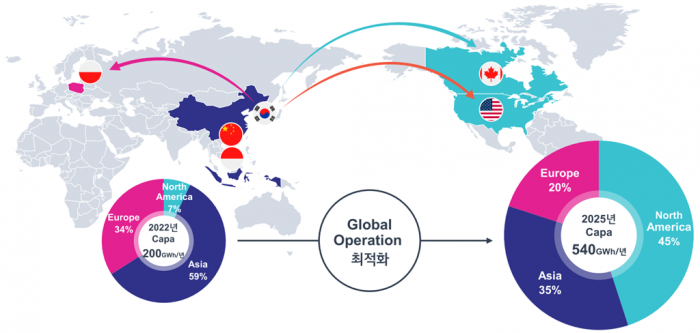

LG Energy said the IRA underscores the significance of battery manufacturers’ ability to establish a local supply chain within North America.

LG has been ramping up efforts to diversify its raw materials procurement channels.

In July, the company signed a non-binding MOU with Kansas-headquartered Compass Minerals International Inc. to receive 40% of lithium carbonate and lithium hydroxide produced at the US facilities for seven years from 2025.

LG has also signed a binding battery-grade lithium agreement with Canada’s Sigma Lithium.

LG’s other key raw material suppliers include Australia’s Liontown Resources Ltd., Germany’s Vulcan Energy Resources Ltd. and Chile’s SQM.

LG’s latest supply deals come as the Korean government, carmakers and battery manufacturers are scurrying to work out measures to respond to the IRA.

Meanwhile, Henrik Hololei, director-general of the European Commission’s department for mobility and transport, said in a recent interview with The Korea Economic Daily that the US tax incentives may violate World Trade Organization (WTO) provisions and could be detrimental to Washington.

Discriminating against foreign manufacturers makes it difficult for them to contribute to the electrification of vehicles in the US, reducing the choice of US consumers when they buy electric vehicles, he said.

Last week, the Korean government banned L&F Co., a battery materials maker, from building a new plant in the US, citing the possibility of key technology leaks.

L&F, which counts Tesla among its major clients, is specialized in manufacturing nickel, cobalt and manganese (NCM) batteries with high nickel content for use in electric cars.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

-

Electric vehiclesEV tax credits may prove detrimental to the US: EU official

Electric vehiclesEV tax credits may prove detrimental to the US: EU officialSep 22, 2022 (Gmt+09:00)

2 Min read -

Electric vehiclesKorean PM Han says EV tax credits may violate FTA rules

Electric vehiclesKorean PM Han says EV tax credits may violate FTA rulesSep 21, 2022 (Gmt+09:00)

1 Min read -

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK On

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK OnSep 16, 2022 (Gmt+09:00)

3 Min read -

BatteriesSouth Korea bans L&F from building a battery material plant in US

BatteriesSouth Korea bans L&F from building a battery material plant in USSep 15, 2022 (Gmt+09:00)

2 Min read -

AutomobilesHyundai to build Santa Fe hybrid at Alabama plant ahead of schedule

AutomobilesHyundai to build Santa Fe hybrid at Alabama plant ahead of scheduleSep 13, 2022 (Gmt+09:00)

3 Min read -

BatteriesHyundai Motor, LG Energy secure $710 mn for battery JV in Indonesia

BatteriesHyundai Motor, LG Energy secure $710 mn for battery JV in IndonesiaAug 22, 2022 (Gmt+09:00)

2 Min read -

BatteriesLG Energy, China’s Huayou Cobalt to build battery recycling joint venture

BatteriesLG Energy, China’s Huayou Cobalt to build battery recycling joint ventureJul 26, 2022 (Gmt+09:00)

4 Min read