Batteries

South Korea bans L&F from building a battery material plant in US

The move, which came amid a controversy over the US EV tax breaks law, could affect the likes of Tesla

By Sep 15, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The South Korean government has banned L&F Co., a battery materials maker, from building a new plant in the US amid a controversy over the Inflation Reduction Act, which favors electric vehicles using materials processed in the US.

At an Industrial Technology Protection Committee meeting held on Wednesday, the trade ministry made the decision, citing the possibility of key technology leaks, which could damage Korea’s national security.

The company also didn’t provide clear reasons for technology transfer linked to the plant construction, nor came up with sufficient measures to protect technology and prevent potential tech leaks, the ministry said.

The committee, affiliated with the ministry, reviews requests by Korean companies and grants them export approval on 73 national core technologies, including semiconductor design, process and device technology; and lithium battery and material-related design, process and manufacturing.

L&F is specialized in manufacturing nickel, cobalt and manganese (NCM) batteries with high nickel content for use in electric cars.

With its cutting-edge technology, the company supplies cathode active materials to Korea’s three major lithium-ion cell manufacturers – LG Energy Solution Ltd., SK On Co. and Samsung SDI Co.

TESLA COULD BE AFFECTED

The move comes as the Korean government, carmakers and battery manufacturers are scurrying to work out measures to respond to the IRA, which took effect in mid-August to allow tax credits for EVs that use batteries made in North America with minerals mined or components made in the region.

Qualifying EVs must contain at least 40% of the battery minerals and 50% of the battery components supplied from or processed in the US or its free trade partner countries. The proportion will rise to 80% for minerals by 2027 and 100% for parts by 2029.

If L&F fails to build a battery material plant in the US, it may be difficult for US companies, including Tesla Inc., to receive subsidies if their electric cars use materials made outside of the US.

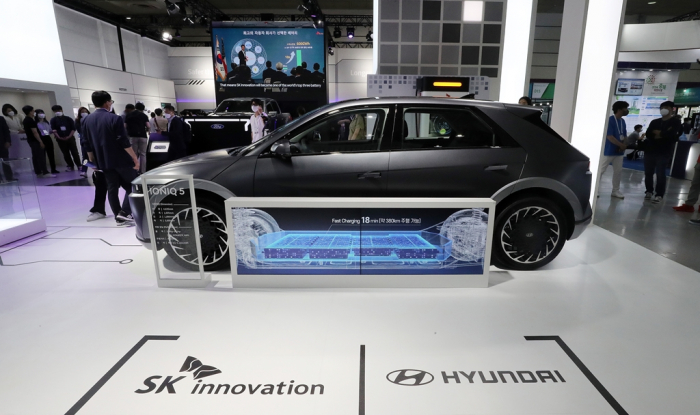

The act, aiming to diminish China’s power in the global EV market, is expected to impact Korea’s finished car makers. Hyundai Motor Group’s main EVs, such as the IONIQ 5 and the EV6, are manufactured in Korea.

Korean battery makers are also taking the issue seriously as their batteries are dependent on raw materials from China.

Write to So-Hyeon Kim and Ji-Hoon Lee at alpha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

AutomobilesHyundai to build Santa Fe hybrid at Alabama plant ahead of schedule

AutomobilesHyundai to build Santa Fe hybrid at Alabama plant ahead of scheduleSep 13, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesKorea resolution on US EV incentives passes parliament

Electric vehiclesKorea resolution on US EV incentives passes parliamentSep 02, 2022 (Gmt+09:00)

2 Min read -

Business & PoliticsWashington, Seoul to hold formal talks on US EV tax credit act

Business & PoliticsWashington, Seoul to hold formal talks on US EV tax credit actAug 31, 2022 (Gmt+09:00)

2 Min read -

AutomobilesHyundai’s Chung rolls up sleeves to counter US EV tax credit act

AutomobilesHyundai’s Chung rolls up sleeves to counter US EV tax credit actAug 25, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN