Automobiles

Hyundai’s Chung rolls up sleeves to counter US EV tax credit act

The carmaker is expected to double dealer incentives and move up its US EV line construction to offset the new law's impact

By Aug 25, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

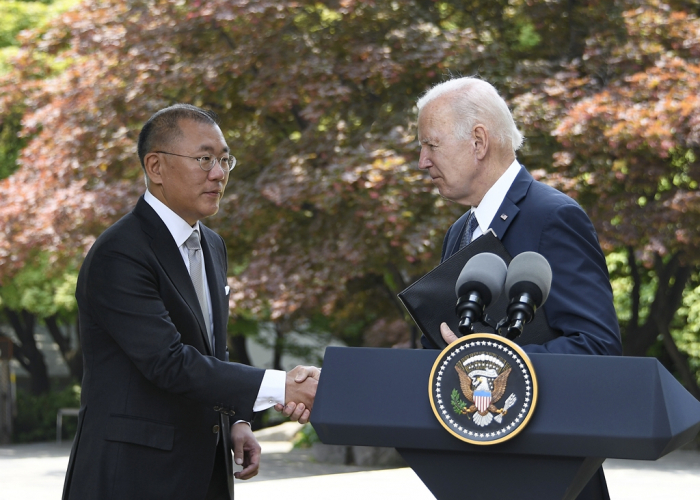

Hyundai Motor Group Chairman Chung Euisun is off to the US to meet government officials and business leaders as the recently passed Inflation Reduction Act (IRA) is setting alarm bells for the top South Korean automaker.

Hyundai Motor Co., which stakes its future on strong electric vehicle sales overseas, including the all-important North American market, has more to lose than to gain from the US EV tax credits, which, as they stand now, put Korean cars at a disadvantage versus US vehicles.

His itinerary wasn’t known, but industry officials said he will meet with high-ranking government officials to express his concerns over the new law and seek ways to limit its negative impact on Korean cars and the US auto industry.

The automotive group, which includes Hyundai Motor and sister firm Kia Corp., is also said to be working on measures to counter the IRA, which excludes EVs built outside the US from tax breaks.

Last week, US President Joe Biden signed the $430 billion IRA, which gives as much as $7,500 in tax credits to “Made in USA” electric vehicles.

The act, aiming to diminish China’s power in the global EV market, is expected to impact Korea’s finished car makers as well. Hyundai Motor Group’s main EVs, such as the IONIQ 5 and the EV6, are manufactured in Korea and exported to the US.

TO DOUBLE DEALER INCENTIVES, ADVANCE START OF US EV PLANT

Industry sources said Hyundai Motor and Kia are considering doubling the incentives they offer to US dealers to $1,000 per car to promote retail sales.

Before the IRA, the Hyundai IONIQ 5 was sold at a competitive price of $39,950.

Under the new EV subsidy program, the IONIQ 5 will be priced at $47,450, higher than the Tesla Model 3’s price tag of $46,990.

Hyundai Motor is also considering advancing the production of the all-electric version of the Genesis GV70 SUV at the Alabama plant from the original schedule for December.

Kia, for its part, could move up the production of the EV9 at its Georgia plant from the second half of next year, industry officials said.

Hyundai’s Georgia electric car plant, the construction of which is scheduled to begin in the first half of next year, will likely move up to as early as October this year, with an aim to begin operations by the end of 2024.

Chairman Chung met with Pat Wilson, economic development minister of the US state of Georgia, during his recent visit to Korea.

Manufacturing the IONIQ 5 and EV6 cars in the US is also under consideration, according to people familiar with the matter.

Moving part of the production of the two EVs to the US factories requires the consent of Hyundai’s domestic labor union.

MID-TERM ELECTIONS, A VARIABLE

The outcome of the US mid-term elections scheduled for November will likely be a key variable for the Hyundai Motor Group.

Biden’s approval rating has recovered to the 40% level after passing the IRA. If he wins the mid-term polls, he may attempt to partially amend the act to address the concerns raised across the auto industry.

Meanwhile, the Korean government is moving to take the issue to the World Trade Organization.

Earlier this week, government officials said Seoul, which has already conveyed its concerns to the US via various channels, is considering filing a complaint with the WTO.

The Korean government also said it would review its EV subsidy policy and may exclude foreign carmakers from tax benefits.

From next year, Seoul plans to offer EV subsidies to carmakers based on the level of their after-sales service infrastructure, a move widely seen as putting foreign carmakers at a disadvantage.

According to the Korea Automobile Manufacturers Association (KAMA), the Korean government provided a total of 82.3 billion won ($61.5 million) in subsidies to imported EVs in the first half. Tesla was the top beneficiary, receiving 44.2 billion won in subsidies for its 6,746 vehicles sold in Korea.

Write to Il-Gue Kim and Han-Shin Park at Black0419@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Electric vehiclesKorea targets Tesla, imported EVs with new subsidy policy

Electric vehiclesKorea targets Tesla, imported EVs with new subsidy policyAug 24, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesKorea may file complaint with WTO against US' Inflation Reduction Act

Electric vehiclesKorea may file complaint with WTO against US' Inflation Reduction ActAug 22, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesTesla sweeps local EV subsidies as Korean firms at disadvantage in US

Electric vehiclesTesla sweeps local EV subsidies as Korean firms at disadvantage in USAug 22, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesSeoul says US tax credit bill risks violation of FTA, WTO

Electric vehiclesSeoul says US tax credit bill risks violation of FTA, WTOAug 12, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN