Batteries

Ford CEO heads to Korea to discuss EV tax credit with LG Energy, SK On

While in Seoul, Jim Parley will meet with CEOs of LG and SK to work out countermeasures to the EV tax credit law

By Sep 16, 2022 (Gmt+09:00)

3

Min read

Most Read

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

Korea's Lotte Insurance put on market for around $1.5 bn

Ford Motor Co. Chief Executive Jim Parley will visit South Korea early next week to meet with chief executives of its battery suppliers LG Energy Solution Ltd. and SK On Co. to jointly explore ways to respond to the Inflation Reduction Act, which favors electric vehicles using materials processed in the US.

While in Seoul, Parley and senior Ford executives will tour the two Korean companiesŌĆÖ battery plants and meet with LG Energy Chief Executive Kwon Young-soo and SK On Vice Chairman Chey Jae-won, people familiar with the matter said on Friday.

Ford, which ranks second in the US EV market after Tesla Inc., is using LG battery cells in its electric sport utility vehicle (SUV) Mustang Mach-E and SK batteries in its electric truck F-150 Lightning.

Ford executives and its Korean battery suppliers are expected to seek ways to meet battery mineral and component requirements stipulated in the EV tax credit law, sources said.

POSSIBLE US FACILITY RAMP-UP

The three companies may also discuss a possible expansion of the Korean companies' battery-making facilities in the US, the people said.

"Ford will come up with a plan to cooperate with LG and SK in order to reflect its position in the specific guidelines for minerals and parts being prepared by the US Treasury Department,ŌĆØ said one of the sources.

The Ford CEOŌĆÖs Seoul visit comes as the Korean┬Āgovernment, carmakers and battery manufacturers are scurrying to work out measures┬Āto respond to the IRA, which took effect in mid-August to allow tax credits for EVs that use batteries made in North America with minerals mined or components made in the region.

Qualifying EVs must contain at least 40% of the battery minerals and 50% of the battery components supplied from or processed in the US or its free trade partner countries. The proportion will rise to 80% for minerals by 2027 and 100% for parts by 2029.

The act, aiming to diminish ChinaŌĆÖs power in the global EV market, is expected to impact KoreaŌĆÖs finished car makers. Hyundai Motor GroupŌĆÖs main EVs, such as the IONIQ 5 and the EV6, are manufactured in Korea.

Korean battery makers are also taking the issue seriously as their batteries are dependent on raw materials from China.

ŌĆśSHOOTING ITSELF IN THE FOOTŌĆÖ

From next year, EV makers must use batteries with materials sourced in the US ┬Āfor their cars to be eligible for the tax credit of up to $7,500 per unit.

However, battery manufacturers and automakers, including Ford, heavily rely on China for key raw materials such as lithium, cobalt and graphite. For some minerals, their dependence rises to as high as 70%.

Ford, which recently signed an additional supply contract with Chinese battery company CATL, could be ineligible for subsidies unless it remedies the situation.

ŌĆ£The new law, designed to assist US companies, may rather hurt them. The US could be shooting itself in the foot,ŌĆØ said an industry official.

ŌĆ£Ford wants to check with LG and SK if they can reduce their dependence on Chinese minerals and parts and what is needed to do so.ŌĆØ

LG Energy previously said it would double its production lines for Ford EVs in Poland by the end of 2023. The Korean company already operates the world's largest production facility in the US.

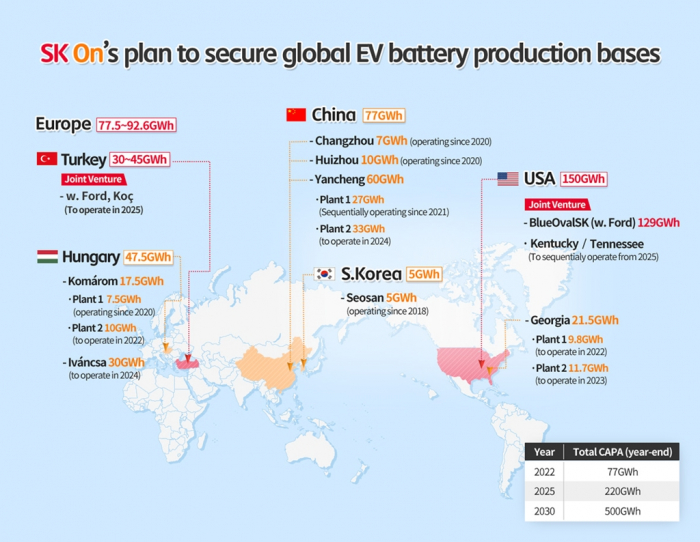

SK and Ford officially launched the joint venture, BlueOval SK, in July.

The two partners invested a total of 10.2 trillion won ($7.8 billion) in the JV, spending 5.1 trillion won each,┬Āto build a battery plant in Tennessee, and two more factories in Kentucky to be completed in 2025.

SK is also increasing the production of its existing plant in Georgia.

(Updates with more comments from sources and Korean battery firms' US plans)

Write to Il-Gue Kim and Hyung-Kyu Kim at Black0419@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesSouth Korea bans L&F from building a battery material plant in US

BatteriesSouth Korea bans L&F from building a battery material plant in USSep 15, 2022 (Gmt+09:00)

2 Min read -

Business & PoliticsWashington, Seoul to hold formal talks on US EV tax credit act

Business & PoliticsWashington, Seoul to hold formal talks on US EV tax credit actAug 31, 2022 (Gmt+09:00)

2 Min read -

-

BatteriesSK On to bolster US business with Ford's EV pickup truck sales

BatteriesSK On to bolster US business with Ford's EV pickup truck salesMay 29, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN