Batteries

SK On, Ford launch battery JV for N.America EV market

BlueOval SK is set to meet most of Ford’s needs for North America as the automaker aims to dominate electric pickup truck market

By Jul 14, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s battery maker SK On Co. and US automaker Ford Motor Co. on Wednesday officially launched a joint venture for the North American electric vehicle market even as doubts grew over the cell industry’s planned investments on rising inflation and interest rates.

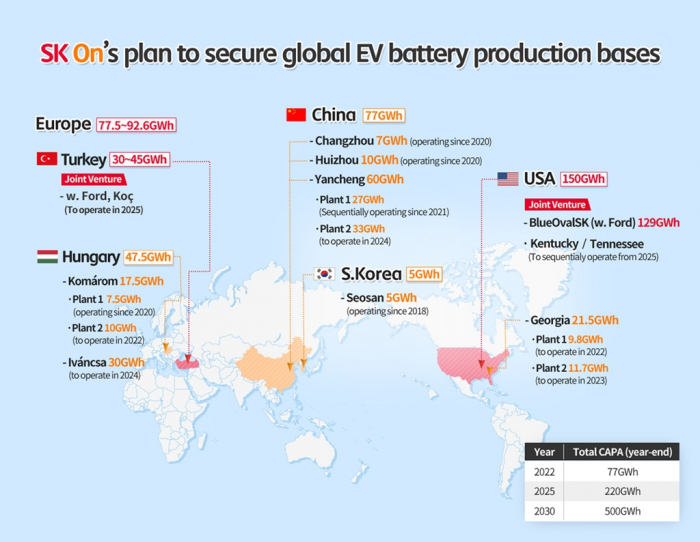

SK On and Ford invested a total of 10.2 trillion won ($7.8 billion) in the JV BlueOval SK, spending 5.1 trillion won each, to build a battery plant in Tennessee, and two more factories in Kentucky to be completed in 2025, according to the world’s fifth-largest battery maker. The battery output of the three facilities is set to total 129 gigawatt-hours (GWh) a year, more than 92% of Ford’s annual needs of 140 GWh for North America by 2030.

“With the strong partnership between these two companies, we will secure unparalleled competitiveness in the global EV market,” said BlueOval SK’s first Chief Executive David Hahm, SK On’s CEO, in a statement. Hahm, who has been in charge of investments, as well as mergers and acquisitions for SK On’s parent SK Innovation Co., led the JV’s establishment.

Ford’s Chief Operating Officer Jiem Cranney will become the JV’s chief financial officer. After approximately three years, SK On and Ford will exchange the positions.

In March, SK On and Ford agreed to set up another battery JV in Turkey with a local company as the US automaker plans to launch new EVs in Europe.

SK TO FUEL FORD’S AMBITION IN ELECTRIC PICKUP TRUCK MARKET

SK On plans to expand its production capacity to 77 GWh by the end of this year from a mere 1.6 GWh in 2017 through steady investments in the US, Hungary, and China. By 2030, it is expected to expand to more than 500 GWh.

Ford, a powerhouse of pickup trucks, aims to dominate the electrified pickup truck market with the success of the F-150 Lightning, an all-electric version of its best-selling model in the segment, whose pre-orders exceeded 200,000 units. The automaker filed for trademarks for electric versions of its smaller Maverick and Ranger pickup trucks.

The more of those models Ford sells, the more batteries SK On produces.

Global battery makers are rushing to invest in North America where EV demand is growing.

Japan’s Panasonic Energy Co., a major supplier of the EV giant Tesla Inc., unveiled a plan to spend $4 billion on a battery factory in Kansas on Thursday. The plant is expected to produce the 4680 battery cell applied with the next-generation technology for Tesla.

Panasonic had been criticized due to its passive stance on capacity expansion.

Write to Hyung-Kyu Kim at khk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

BatteriesSK On to bolster US business with Ford's EV pickup truck sales

BatteriesSK On to bolster US business with Ford's EV pickup truck salesMay 29, 2022 (Gmt+09:00)

2 Min read -

-

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JV

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JVSep 28, 2021 (Gmt+09:00)

3 Min read -

BatteriesSK Innovation, Ford agree to launch $5.3 bn EV battery JV in US

BatteriesSK Innovation, Ford agree to launch $5.3 bn EV battery JV in USMay 20, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN