LG Energy, China’s Huayou Cobalt to build battery recycling joint venture

Meanwhile, the US government has offered LG and its US partner GM a $2.5 billion loan to help build their new battery plants

By Jul 26, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s top battery maker LG Energy Solution Ltd. and China’s mining company Zhejiang Huayou Cobalt Co. have agreed to launch a battery recycling joint venture to secure a stable supply of raw materials.

Under a memorandum of understanding on the JV signed on Tuesday, the two companies will build two factories in China to extract nickel, cobalt and lithium – key minerals used to make lithium-ion batteries for electric vehicles – from scrap batteries and used batteries.

The so-called pre-treatment plant that processes scraps, a byproduct produced from manufacturing batteries, will be built in Nanjing, where LG’s battery production facility is located. The other plant, a back-end factory that processes recycled metal, will be established in Quzhou, western Zhejiang, where Huayou has its operations.

LG Energy said it aims to complete the construction of the two plants by the end of this year.

Recycled battery materials will be supplied to LG’s Nanjing plant for reuse. LG may need to discuss with Tesla Inc., the primary client of LG batteries made at the Nanjing plant, to recover used batteries from Tesla EVs, industry officials said.

The battery recycle joint venture is the first such cooperation between a Korean company and a Chinese company, according to LG.

“The joint venture will help us establish a system that manages the entire battery lifecycle, which is essential for a sustainable and stable battery supply chain,” said Kwon Young-soo, vice chairman and chief executive of LG Energy.

ALREADY STRONG PARTNERSHIP

LG and Zhejiang Huayou, the world’s largest producer of refined cobalt, have already established three joint-venture factories to gain ground in the fast-growing EV battery materials market.

In 2009, LG Chem Ltd., the parent of LG Energy, and its Chinese partner built a precursor plant in Zhejiang Province and a cathode plant in Wuxi, Jiangsu Province.

A precursor is a material created by mixing nickel, cobalt and manganese, and is added to lithium to make the cathode, the positive end of a lithium-ion battery.

In May of this year, the two companies built a cathode plant in Gumi, Korea.

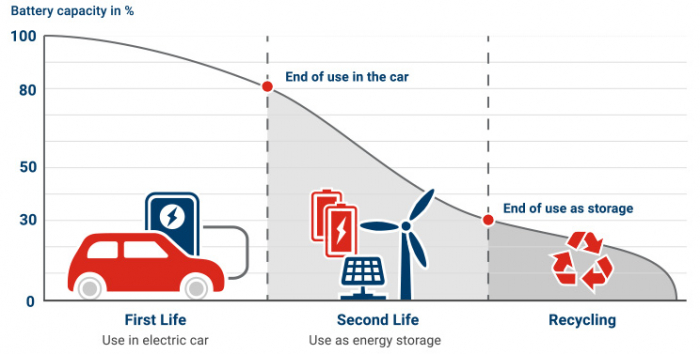

With electric vehicles increasingly going mainstream, the world’s major carmakers and battery companies are waging another type of turf war: battery recycling and reuse.

Analysts say battery recycling and reuse are emerging as booming industries amid global initiatives by both governments and private sectors to prevent tens of thousands of tons of lithium-ion batteries from entering landfills, creating environmental problems.

The average life of an EV battery, including those made by LG Energy, is about 15 years.

The EV battery recycling market is forecast to grow to 87 trillion won ($74 billion) by 2040 from 400 billion won in 2020, according to market tracker SNE Research.

As part of its efforts to secure a global supply chain, LG Energy and LG Chem jointly acquired a 2.6% stake in Li-Cycle, a Toronto-based recycling startup, for 60 billion won last December.

Separately, LG signed a deal to receive a total of 20,000 tons of nickel from Li-Cycle over 10 years starting from 2023. The amount is enough to manufacture 300,000 batteries for high-performance electric cars with 80 kWh.

US SUPPORT FOR ULTIUM CELLS

Meanwhile, the US Energy Department said on Monday it will lend $2.5 billion to Ultium Cells LLC, a joint venture between LG Energy and General Motors Co., to aid in Ultium’s planned construction of three battery factories in Ohio, Tennessee and Michigan.

The loan, which is conditional on the companies’ meeting certain requirements, is the first in more than a decade by a government program that provided $465 million to help Tesla produce its first sedan, the Model S, according to a New York Times report.

But it would be the first loan exclusively granted to an EV battery manufacturer. The funds will come from the US government’s Advanced Technology Vehicles Manufacturing (ATVM) loan program.

LIFTING OF SHARE LOCKUP

On Tuesday, shares of LG Energy closed up 0.8% at 394,000 won, while LG Chem finished 2% higher at 567,000 won.

Investors have been closely watching LG Energy’s and LG Chem’s share movements ahead of the lifting on Wednesday of the six-month lockup on LG Energy, a ban on share sale by institutional investors who purchased the stock when the battery maker went public early this year.

About 201.5 million LG Energy shares, or 86.1% of the company’s total outstanding shares, could theoretically hit the market as soon as the ban is lifted, leading the stock to fall sharply.

LG Chem’s shares have risen about 10% so far this month on market chatter that the company may seek to hand over a large chunk of its LG Energy shares to an automaker in an off-the-market block deal to prevent any significant price drop in LG Energy shares.

LG Chem holds 191.5 million shares, or an 81.8% stake, in LG Energy as its largest shareholder.

LG Chem denies market speculation that it may engage in a block deal, but industry watchers said it may do so to raise funds to expand LG Energy’s battery material production facilities.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

-

BatteriesLG Energy to supply $765 million batteries to Japan’s Isuzu Motors

BatteriesLG Energy to supply $765 million batteries to Japan’s Isuzu MotorsJul 05, 2022 (Gmt+09:00)

3 Min read -

BatteriesLG Energy considers billion-dollar battery plant in Arizona

BatteriesLG Energy considers billion-dollar battery plant in ArizonaMar 22, 2022 (Gmt+09:00)

3 Min read -

BatteriesLG Energy, German institutes to jointly research advanced batteries

BatteriesLG Energy, German institutes to jointly research advanced batteriesJun 08, 2022 (Gmt+09:00)

1 Min read -

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JV

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JVJun 02, 2022 (Gmt+09:00)

1 Min read -

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in Canada

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in CanadaMar 24, 2022 (Gmt+09:00)

4 Min read -

Battery materialsLG Chem, China’s Huayou Cobalt to build battery metal JV in Korea

Battery materialsLG Chem, China’s Huayou Cobalt to build battery metal JV in KoreaJan 05, 2022 (Gmt+09:00)

3 Min read -

BatteriesLG Chem, LG Energy acquire 2.6% of battery startup Li-Cycle for $51 million

BatteriesLG Chem, LG Energy acquire 2.6% of battery startup Li-Cycle for $51 millionDec 15, 2021 (Gmt+09:00)

1 Min read