Korean lawmakers mull higher chip tax credits, battery subsidies

The main opposition party’s proposal for the Korean Chips Act promises more than 25% tax deductions

By Mar 07, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

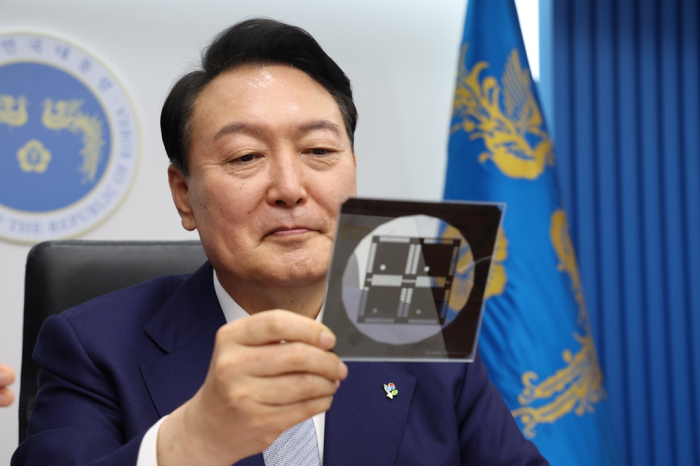

South Korea’s main opposition party will propose higher tax credits and subsidies for domestic chipmakers and battery manufacturers as early as this week.

The Democratic Party of Korea (DPK), which controls the National Assembly, is seeking a revised legislation bill to offer higher tax benefits than the government-proposed 25% incentives for facility investments by Korean chipmakers, people familiar with the matter said on Tuesday.

Some members of the majority party are calling for tax credits as high as 30%, sources said.

The proposal will be part of the Korean version of the US Inflation Reduction Act (IRA), likely to be announced by the end of this week, they said.

While the US IRA favors batteries with materials sourced primarily in North America, the Korean IRA is designed to offer state subsidies and investment-related tax deductions to local companies, which transition to more eco-friendly energy sources, including electric vehicle batteries.

In January, the Ministry of Economy and Finance submitted to the National Assembly a revised bill to raise tax breaks for facility investments by big companies, including chipmakers, to as much as 25%.

However, the so-called Korean Chips Act, which is aimed at supporting the country’s semiconductor sector and other key industries through increased tax incentives, hit a roadblock as the main opposition party balked at the passage of the amendment.

Under the ministry’s latest proposal, the government hopes to raise tax breaks on facility investments by big companies such as Samsung Electronics Co. and SK Hynix Inc. to 15% from the current 8%.

For smaller firms, the ministry proposed a 25% tax credit, up from 16%.

The ministry also proposed an additional tax deduction of 10% for this year only if the big and small companies’ investments exceed their average annual facility spending over the previous three years.

Korea, home to the world’s two largest memory chipmakers – Samsung and SK Hynix – has promoted semiconductors as the backbone of its economy, but has been slow to provide infrastructure and build a skilled workforce, critics said.

BARGAINING CHIP?

With the Democratic Party’s new proposal, the possibility of the Korean Chips Act and related bills passing at the National Assembly during the extraordinary session in March has increased.

Political pundits said the opposition party may be leveraging its new tax credit and subsidy proposal as a bargaining chip in settling political wrangling over DPK leader Lee Jae-myung, who is undergoing prosecutors’ investigation into his alleged wrongdoings.

The US IRA, aimed at diminishing China’s power in the global EV market, is generating headwinds for Hyundai Motor Co. and Kia Corp., which make most of their EVs in Korea and export them overseas.

Hyundai’s $5.5 billion EV and battery factory in the US state of Georgia is only set to open in 2025.

The Korean government, carmakers and battery manufacturers have been striving to work out measures to respond to the IRA.

Industry officials said the finance ministry may be dissatisfied with the expected DPK proposal for higher tax incentives and state subsidies as the new law could significantly reduce tax revenues, already dwindling rapidly due to the government’s economy-boosting measures.

Write to Bum-Jin Chun and Kyung-Mok Noh at forward@hankyung.com

In-Soo Nam edited this article.

-

Business & PoliticsKorean Chips Act revision hits roadblock as opposition lawmakers balk

Business & PoliticsKorean Chips Act revision hits roadblock as opposition lawmakers balkFeb 15, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractive

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractiveMar 06, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliers

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliersSep 23, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesKorea may file complaint with WTO against US' Inflation Reduction Act

Electric vehiclesKorea may file complaint with WTO against US' Inflation Reduction ActAug 22, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesSeoul says US tax credit bill risks violation of FTA, WTO

Electric vehiclesSeoul says US tax credit bill risks violation of FTA, WTOAug 12, 2022 (Gmt+09:00)

2 Min read -

Artificial intelligenceSouth Korea to invest $794 million in AI chips, nurture 7,000 experts

Artificial intelligenceSouth Korea to invest $794 million in AI chips, nurture 7,000 expertsJun 28, 2022 (Gmt+09:00)

2 Min read