Business & Politics

Korean Chips Act revision hits roadblock as opposition lawmakers balk

Analysts warn a delayed revision would put Korean chipmakers at disadvantage vis-à-vis rivals

By Feb 15, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

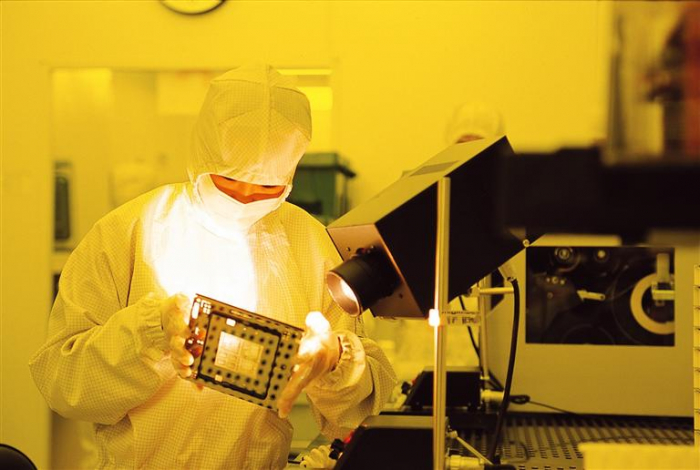

The proposed revision to South Korea’s answer to the US CHIPS and Science Act has hit a roadblock as the main opposition party, which controls the National Assembly, balked at the passage of the amendment, saying new tax breaks are “excessive.”

The National Assembly’s finance committee on Tuesday held a tax subcommittee meeting to discuss the revision bill proposed by the government in mid-January but made little progress as some lawmakers from the main opposition Democratic Party of Korea (DPK) opposed further hikes in tax benefits for domestic chipmakers.

It may be undesirable for the legislature to revisit a bill passed just a month earlier, DPK lawmakers said.

“Any significant hikes from the current level are excessive. It will only benefit chaebol companies,” DPK representative Yang Kyung-sook said, referring to Korea’s big conglomerates in a pejorative way.

On Jan. 19, the finance ministry submitted to the National Assembly a revision to a bill passed a few weeks earlier, aimed at supporting the country’s semiconductor sector and other key industries through increased tax incentives.

Under the ministry’s latest proposal, the government hopes to raise tax breaks on facility investments by big companies such as Samsung Electronics Co. and SK Hynix Inc. to 15% from the current 8%.

For smaller firms, the ministry newly proposed a 25% tax credit, up from 16%.

In late December, ruling and opposition party lawmakers approved a government-proposed bill, under which large companies would be eligible for a tax credit of up to 8% from the previous 6% cap for their investment in chip manufacturing facilities. For mid-tier and small-sized firms, the tax benefit ceilings were unchanged at 8% and 16%, respectively.

However, Korean President Yoon Suk-yeol ordered the finance ministry to revise the December ‘K-Chips Act’ following a public outcry that state support measures failed to meet expectations.

Korea, home to the world’s two largest memory chipmakers – Samsung and SK Hynix – has promoted semiconductors as the backbone of its economy, but has been slow to provide infrastructure and build a skilled workforce, critics said.

The main opposition party, while rejecting the government’s new proposal for a 15% tax benefit, is said to be supporting a 10% tax credit for conglomerates.

CHIP SUPREMACY WAR INTENSIFIES

The Korean chip industry expressed concerns over the stalled negotiations, saying domestic chipmakers could lose their competitiveness against rivals.

Under the CHIPS and Science Act passed in the US Congress last July, a company that builds a chip manufacturing facility in the US receives a 25% tax credit – a move aimed at attracting investments from global chipmakers such as Samsung and foundry leader Taiwan Semiconductor Manufacturing Company Ltd., more commonly known as TSMC.

Japan offers chipmakers a third of the investments they need to build chipmaking facilities in the country on condition that they run the plants for at least 10 years.

The Japanese government is said to have earmarked 368.6 billion yen ($2.78 billion) in the 2023 budget to that end.

Taiwan offers a 5% tax credit for facility investments, lower than Korea's tax breaks, but recently raised its tax credit rate for research and development to 25%.

According to the Korea Customs Service, Korea’s chip product exports fell for a sixth straight month in January.

Samsung Electronics last month reported a 97% decline in its semiconductor operating profit in the fourth quarter of 2022 from the year-earlier period.

SK Hynix said it swung to a 1.7 trillion won operating loss in the fourth quarter from a profit of 4.21 trillion won a year earlier.

“There are 1,400 semiconductor-related companies in Korea,” said Finance Minister Chu Kyung-ho at the National Assembly on Tuesday. “We shouldn’t waste time in passing the new bill.”

Write to Jin-gyu Kang and Kyung-Mok Noh at josep@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung secures $16 bn loan from display unit for chipmaking

Korean chipmakersSamsung secures $16 bn loan from display unit for chipmakingFeb 14, 2023 (Gmt+09:00)

2 Min read -

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

4 Min read -

EarningsSamsung vows no chip output cut, eyes second-half demand recovery

EarningsSamsung vows no chip output cut, eyes second-half demand recoveryJan 31, 2023 (Gmt+09:00)

5 Min read -

Business & PoliticsKorea proposes bigger tax breaks for chipmakers, key industries

Business & PoliticsKorea proposes bigger tax breaks for chipmakers, key industriesJan 03, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsKorea plans to raise tax breaks for chipmakers, key industries

Business & PoliticsKorea plans to raise tax breaks for chipmakers, key industriesDec 30, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN