SK Hynix to halve investment after posting first quarterly loss in decade

Echoing rivals’ views, the chipmaker expects industrywide inventory buildup to peak in the first half

By Feb 01, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

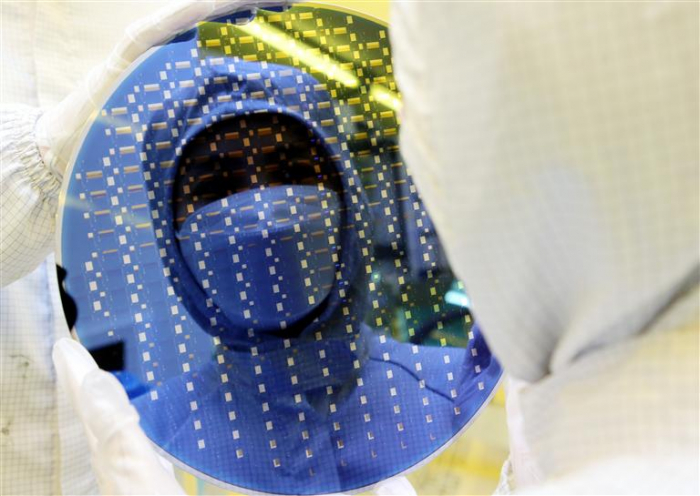

SK Hynix Inc., the world’s second-largest memory chipmaker, said on Wednesday it will significantly slash its investment for this year after posting its first quarterly operating loss in a decade.

The South Korean tech company also warned that the semiconductor industry downturn will worsen in the first half as consumers tighten their spending on electronic gadgets while tech companies continue to deplete their inventories.

“With uncertainties still lingering, we will continue to reduce investments and costs, while trying to minimize the impact of the downturn by prioritizing markets with high growth potential,” SK Hynix said in a statement.

As announced last October, the company said it would spend less than half its 2022 investment of 19 trillion won ($15.4 billion) this year.

NO FURTHER CAPEX CUTS FROM THE CURRENT PLAN

However, it is not considering any further capital expenditure cuts in addition to the October announcement because its current spending plan fully reflects market conditions, said a company executive during a conference call with analysts and investors.

Since the fourth quarter of last year, SK Hynix has been cutting down on wafter inputs at some production lines producing low-end, less profitable chip products.

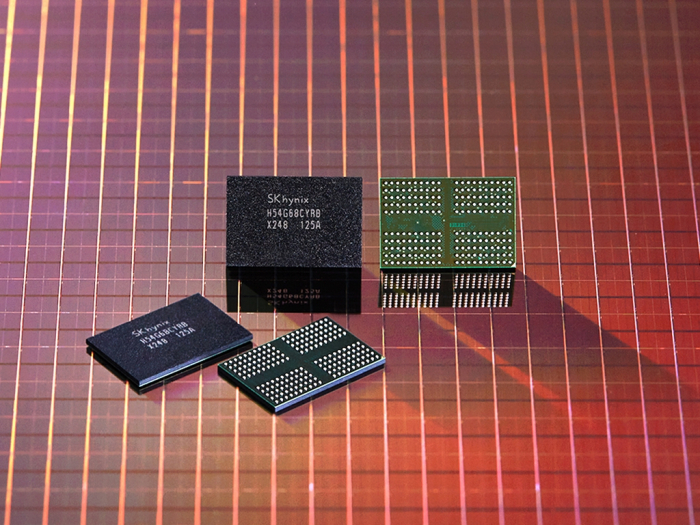

Instead, it will continue to invest in its core products such as DDR5, the next-generation standard for DRAM chips, and ramp up advanced facilities, including extreme ultraviolet (EUV) equipment, to improve productivity and cut costs, it said.

Company executives said the company is experiencing a cashflow squeeze after incurring 600 billion won in one-off charges related to the worsened NAND business at its two overseas invested firms – Japan’s Kioxia and San Jose-based Solidigm.

SK Hynix launched NAND chipmaker Solidigm in 2021 following its $9 billion acquisition of Intel Corp.’s NAND and solid-state drive (SSD) business.

But for now, the company is ruling out fundraising through a rights offer, company officials said.

WORST QUARTERLY PERFORMANCE IN DECADE

Earlier on Wednesday, the company said it swung to a 1.7 trillion won operating loss in the fourth quarter of 2022 from a profit of 4.21 trillion won in the year-earlier period.

The quarterly loss marks its first since the third quarter of 2012.

It also posted 3.52 trillion won in net losses, swinging from a profit of 3.31 trillion won. Sales fell 38% year-on-year to 7.69 trillion won.

For all of 2022, the company reported 2.43 trillion won in net profit, down 74.6% from a year earlier. Full-year operating profit fell 43.5% to 7 trillion won while sales gained 3.8% to 44.64 trillion won.

SK Hynix makes most of its profits from selling memory chips such as DRAM and NAND.

Analysts expect the company’s losses to worsen in the current quarter and it could remain in the red throughout the year.

INVENTORY BUILDUP TO PEAK IN H1

Regarding the industry outlook, the company echoed the views of its rivals, which earlier said market conditions to gradually improve in the second half.

“Industry experts do not expect an increase in the supply of memory chips as market players are planning to reduce investments and production, which will lead inventories to peak in the first half,” SK Hynix said.

On Tuesday, Samsung Electronics Co., the world’s No. 1 memory chipmaker, reported a 69% plunge in its quarterly operating profit with its chip business barely missing losses.

Unlike its peers, however, Samsung said it has no plans to cut semiconductor production even if it incurs losses.

Samsung executives said the company will continue to make necessary investments to meet mid- to long-term demand, keeping this year’s capital expenditure at similar levels to last year.

Samsung’s capital spending in 2022 reached 53.1 trillion won, including 47.9 trillion won for semiconductors.

As industrywide chip inventory buildup is at a worrisome level, industry leaders such as SK Hynix, Micron Technology and Kioxia have been implementing production cuts since October 2022.

SK Hynix said a market rebound anticipated in the second half will be led by Intel’s launch of new server CPUs adopting DDR5 and growing demand for new artificial intelligence (AI)-based server memory chips.

“With the world’s best technologies for DDR5 for data centers and 176-layer NAND flash-based enterprise SSD, we expect to see a quick turnaround when the market bottoms out,” said Chief Financial Officer Kim Woo-hyun.

(Updated with executive comments from the conference call on capital expenditure and rights offering plans)

Write to Sungsu Bae at baebae@hankyung.com

In-Soo Nam edited this article.

-

EarningsSamsung vows no chip output cut, eyes second-half demand recovery

EarningsSamsung vows no chip output cut, eyes second-half demand recoveryJan 31, 2023 (Gmt+09:00)

5 Min read -

Korean chipmakersSK Hynix unveils industry’s fastest mobile DRAM chip LPDDR5T

Korean chipmakersSK Hynix unveils industry’s fastest mobile DRAM chip LPDDR5TJan 25, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix to benefit from Intel’s Sapphire Rapids CPU

Korean chipmakersSamsung, SK Hynix to benefit from Intel’s Sapphire Rapids CPUJan 11, 2023 (Gmt+09:00)

2 Min read -

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai Motor

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai MotorJan 03, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix starts shipping low-power, high-efficiency LPDDR5X chips

Korean chipmakersSK Hynix starts shipping low-power, high-efficiency LPDDR5X chipsNov 09, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix eyes DDR5 dominance with industry’s fastest chip modules

Korean chipmakersSK Hynix eyes DDR5 dominance with industry’s fastest chip modulesOct 25, 2022 (Gmt+09:00)

2 Min read