Earnings

Samsung vows no chip output cut, eyes second-half demand recovery

Bucking the industry trend, the top memory chipmaker says it plans to keep up with its heavy R&D investment to stay ahead

By Jan 31, 2023 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

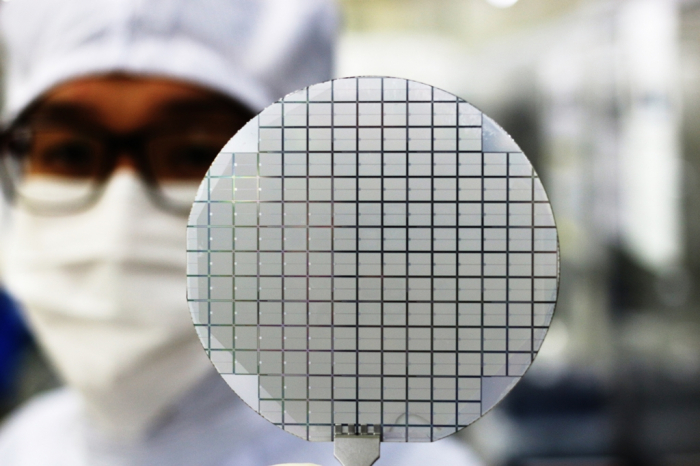

Samsung Electronics Co. said on Tuesday it has no plans to cut semiconductor production even if it incurs temporary losses as the world’s largest memory chipmaker intends to solidify its market leadership.

The South Korean tech giant forecast adverse market conditions would persist throughout this year, although it cautiously expects chip demand to begin recovering in the second half.

“The current unfavorable market conditions are expected to persist. This, on the flip side, is a good opportunity for us to prepare for the future,” a senior Samsung executive told analysts and investors during a conference call.

Executives said the company will continue to make necessary investments to meet mid- to long-term demand, keeping this year’s capital expenditure at similar levels to last year.

Rather, Samsung will increase the proportion of capital investment that goes into research and development, they said.

Samsung’s capital spending in 2022 reached 53.1 trillion won ($43.1 billion), including 47.9 trillion won for semiconductors. In the fourth quarter alone, it spent 20.2 trillion won on infrastructure, including 18.8 trillion won chip investment in new manufacturing facilities and technology advancement.

BUCKING THE TREND

Samsung’s decision to stick with its current investment plan and production volumes is in stark contrast with its rivals, which have announced deep investment and output cuts to handle the supply glut and falling chip prices.

Last week, industry sources said Samsung was considering slashing semiconductor production as it was heading for a massive operating loss in the first quarter.

Samsung executives had seriously considered an output reduction through fewer wafer inputs, but dropped the idea later, sources said on Tuesday.

As the industrywide chip inventory buildup is at a worrisome level at a time when the global economy is fighting inflation and a potential recession, SK Hynix Inc., the world’s second-largest memory chipmaker, and other major chipmakers such as Micron Technology Inc. and Kioxia Corp. have been implementing production cuts since October 2022.

In foundry, or contract chip manufacturing, Samsung’s archrival Taiwan Semiconductor Manufacturing Co. (TSMC) has also announced a spending cut for this year.

Underscoring the depth of a sharp industry slowdown, TSMC, the top foundry player, said earlier this month its 2023 capital expenditure would decrease to a range of $32 billion and $36 billion from last year’s $36.3 billion.

NO WAFER INPUT CUTS BUT ORGANIC CURBS LIKELY

While vowing no “forced” production cuts by slashing wafer inputs, Samsung signaled that a decline in chip output in terms of bit growth is still possible.

“Given the scheduled equipment readjustment and line relocations and our technology moves toward advanced chipmaking nodes, a reduction in our bit growth seems inevitable,” said a company official.

Bit growth refers to the amount of memory produced. It is also a key indicator to gauge chip demand.

Analysts said Samsung is keeping up its investment to widen its market share gap with industry peers, betting on a possible chip demand recovery in the second half, although inventory adjustments are expected to continue for the time being.

“Customers’ inventory adjustment stance has remained unchanged as economic uncertainties continue. (But) we anticipate demand to begin recovering in the second half,” Samsung said in a statement.

The company said it will focus on addressing demand for high-end products, such as DDR5, LPDDR5x and 200-megapixel image sensors amid a weak memory market and soft global information technology (IT) product demand.

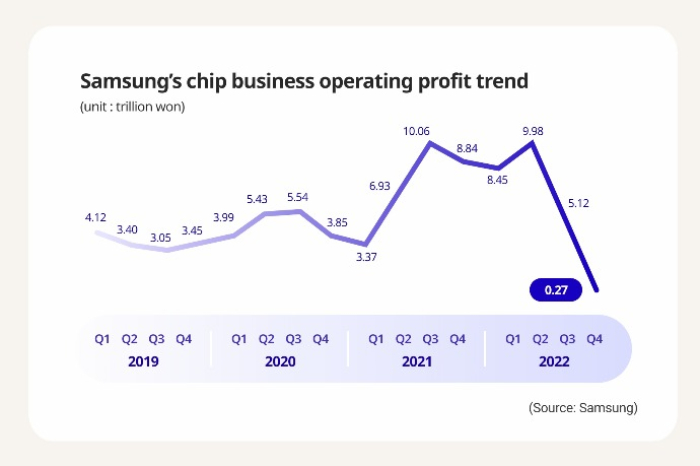

LOWEST QUARTERLY PROFIT IN 8 YEARS

Earlier in the day, Samsung reported its lowest quarterly operating profit in eight years, reflecting a widespread industry downturn.

Its fourth-quarter operating profit plunged 69% to 4.31 trillion won from 13.87 trillion won a year earlier.

Sales in the October-December period fell 8% on year to 70.5 trillion won.

The final results came in line with Samsung’s own estimates in early January.

Its foundry business, however, posted record quarterly sales while profit increased year on year on the back of advanced node capacity expansion and a diversified customer base, it said. The company didn’t provide details.

Samsung’s mobile phone and network business posted 1.7 trillion won in operating profit on sales of 26.9 trillion won in the fourth quarter.

Its visual display and digital appliance business posted an operating loss of 60 billion won on revenue of 15.58 trillion won in the final quarter of 2022.

For all of 2022, Samsung reported record sales of 302.2 trillion won overall, up 8.1% from the previous year. Full-year operating profit fell 16% to 43.38 trillion won while net profit declined 39.5% to 55.65 trillion won.

LIKELY TO POST FIRST-HALF LOSS

Some analysts expect Samsung to post an operating loss to the tune of 1 trillion won from its semiconductor business in the current quarter as inventory adjustments at its clients continue.

Samsung’s semiconductor loss could widen to 1.5 trillion won in the second quarter if the adverse market conditions continue, they warned.

Last week, Intel Corp., a US chipmaker, also said it expects to lose money in the first quarter as the PC market is still reeling from a chip glut.

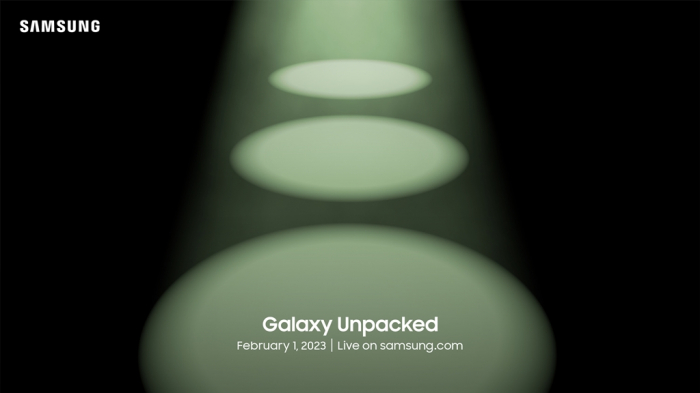

Samsung, also the world’s largest smartphone manufacturer by volume, said it expects a sequential decrease in market demand across all smartphone segments.

It said it will expand flagship product sales with a successful launch of the new Galaxy S23 series equipped with an enhanced camera and other advanced features.

At Galaxy Unpacked 2023 on Feb. 1, Samsung plans to unwrap several new models of its flagship Galaxy S23 series smartphones, which the company hopes to rival Apple Inc.’s high-end line of iPhones.

(Updated with Samsung executives’ comments from the conference call and business performances in other divisions)

Write to Jeong-Soo Hwang and Ji-Eun Jeong at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung considers chip output cut as first-quarter loss looms large

Korean chipmakersSamsung considers chip output cut as first-quarter loss looms largeJan 27, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by half

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by halfJan 06, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung may cut spending as foundry players brace for downturn

Korean chipmakersSamsung may cut spending as foundry players brace for downturnJan 13, 2023 (Gmt+09:00)

3 Min read -

ElectronicsSamsung touts Galaxy S23 Ultra smartphone as best of the best

ElectronicsSamsung touts Galaxy S23 Ultra smartphone as best of the bestJan 18, 2023 (Gmt+09:00)

3 Min read -

ElectronicsSamsung unveils 200-megapixel image sensor for Galaxy S23 Ultra

ElectronicsSamsung unveils 200-megapixel image sensor for Galaxy S23 UltraJan 17, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN