Samsung may cut spending as foundry players brace for downturn

SamsungŌĆÖs custom-tailored Shell-First strategy will remain intact, although a short-term spending cut appears to be inevitable

By Jan 13, 2023 (Gmt+09:00)

S.Korea's LS Materials set to boost earnings ahead of IPO process

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

Samsung Heavy Industries succeeds autonomous vessel navigation

Aman, Rosewood, Banyan, IHG rush to open luxury hotels in Seoul

NPS to hike risky asset purchases under simplified allocation system

Samsung Electronics Co., the worldŌĆÖs largest memory chipmaker, may slash its investment for contract chipmaking known as foundry, as its peers are cutting their spending to brace for an industry downturn.

With analysts forecasting a deeper-than-expected slowdown, however, Samsung will likely follow its foundry rivals in reducing capital expenditures, industry watchers said.

ŌĆ£While maintaining its stance to expand investment over the mid- to long-term, Samsung will be flexible in the near-term to meet slowing chip demand,ŌĆØ said an industry source.

SamsungŌĆÖs foundry investment this year will likely be lower than last year, in the vicinity of the 12 trillion won ($9.7 billion) seen in 2020 and 2021, industry officials said.

In a recent research report, Citigroup Global Markets said the chances of Samsung adjusting its chip supply strategy by slashing investments are growing as sharper-than-expected memory chip price declines are threatening to push SamsungŌĆÖs profitability below its breakeven point.

TSMC CUTS SPENDING FOR FIRST TIME IN 5 YEARS

Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), the worldŌĆÖs largest foundry player, on Thursday reported fourth-quarter profit that exceeded market expectations.

But the company said it has slashed its 2023 capital expenditure plan to $32 billion-$36 billion from $36.3 billion in 2022 to brace for softer demand. TSMC has steadily raised its investment since 2018 when it spent $11 billion.

The top foundry company also signaled that the first quarter of this year could mark its first revenue drop in four years, although executives forecast slight growth for the full year on an expected recovery in demand for server chips in the second half.

TSMC Chief Executive C.C. Wei said a rebound would be led by new product launches such as artificial intelligence (AI)-enabled goods.

The bearish outlook underscores the depth of a sharp slowdown in a global technology sector grappling with worsening consumer demand brought about by decades-high inflation rates, rising interest rates and an economic downturn.

Dwindling investments by foundry players are also affecting back-end companies, including TaiwanŌĆÖs ASE Group which saw its December sales fall 11% from the previous month.

SHELL-FIRST STRATEGY

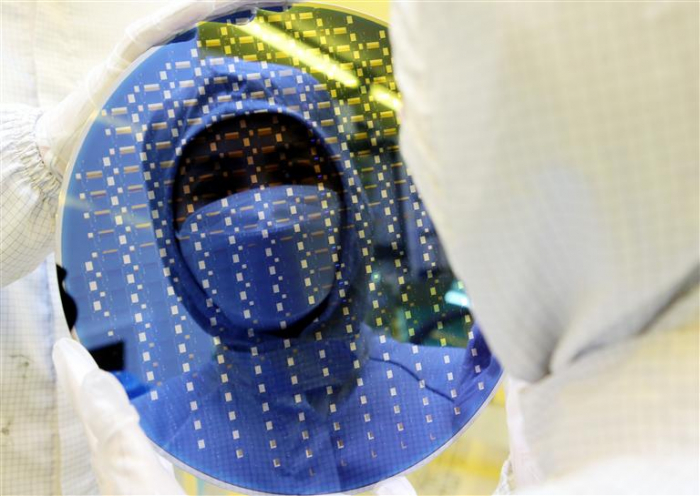

In November, Samsung said its foundry business strategy will be ŌĆ£Shell-First,ŌĆØ which is to build cleanrooms first ŌĆō regardless of market conditions ŌĆō to swiftly respond to customer demand.

With cleanrooms readily available, fab equipment can be installed later and flexibly set up as needed in line with demand, according to Samsung.

But the company may adjust its chip supply strategy as weak chip demand is set to hurt its earnings, analysts said.

Earlier this month, the South Korean tech giant posted its worst quarterly operating profit in eight years as a global economic slowdown dampened demand for semiconductors from electronics makers.

Its preliminary consolidated operating profit for last yearŌĆÖs October-December period fell 69% on-year to 4.3 trillion won, while sales declined 8.6% to 70 trillion won.

The company also gave a dim outlook, slashing its 2023 chip profit forecast by half as major chipmakers and their clients are struggling to adjust their high inventory levels.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

EarningsSamsungŌĆÖs Q4 profit tumbles; cuts 2023 chip profit forecast by half

EarningsSamsungŌĆÖs Q4 profit tumbles; cuts 2023 chip profit forecast by halfJan 06, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix to benefit from IntelŌĆÖs Sapphire Rapids CPU

Korean chipmakersSamsung, SK Hynix to benefit from IntelŌĆÖs Sapphire Rapids CPUJan 11, 2023 (Gmt+09:00)

2 Min read -

Korean Innovators at CES 2023With SmartThings Station, Samsung wants a more connected world

Korean Innovators at CES 2023With SmartThings Station, Samsung wants a more connected worldJan 05, 2023 (Gmt+09:00)

3 Min read -

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai Motor

The KED ViewNo holds barred: State support for Samsung, SK Hynix, Hyundai MotorJan 03, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsungŌĆÖs foundry revenue exceeds mainstay NAND chip sales

Korean chipmakersSamsungŌĆÖs foundry revenue exceeds mainstay NAND chip salesDec 13, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersShell-First: Samsung FoundryŌĆÖs custom-tailored new operation strategy

Korean chipmakersShell-First: Samsung FoundryŌĆÖs custom-tailored new operation strategyNov 30, 2022 (Gmt+09:00)

4 Min read