Korean chipmakers

Samsung’s foundry revenue exceeds mainstay NAND chip sales

The feat, Samsung's first since contract chipmaking became an independent business, also bodes well for its profitability

By Dec 13, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co., the world’s largest memory chipmaker, saw its foundry business revenue exceed that of its mainstay NAND flash chips for the first time – the latest indication that the South Korean tech giant is gaining traction in its bid to play a greater role in the contract chip manufacturing segment.

According to market research firm TrendForce and industry analysts, Samsung’s foundry sales reached $5.58 billion in the third quarter, far above its NAND chip sales of $4.3 billion.

The sales figures represent the first time that Samsung’s foundry business has outperformed its NAND business since the company separated the contract chipmaking division from its broader semiconductor business in 2017.

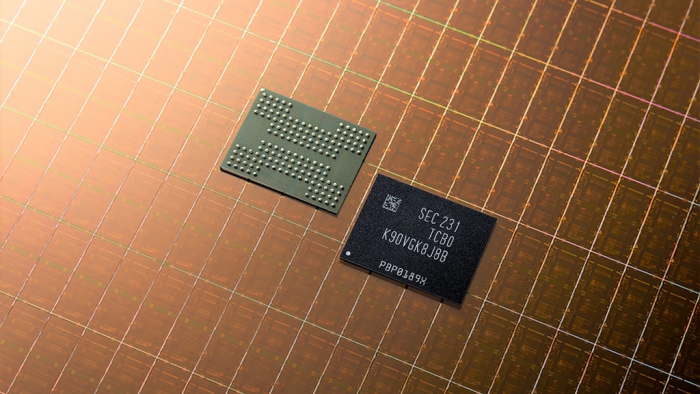

Samsung’s semiconductor business growth has largely been building on sales of its two memory chip products – DRAM, the type of memory commonly used in PCs and servers, and NAND, which are the flash memory chips used in smaller devices like smartphones and USB drives.

Samsung has been the dominant player in the global NAND market since the early 1990s. In the contract manufacturing business, however, it is a distant second with a low double-digit market share after Taiwan Semiconductor Manufacturing Co., which controls more than half of the global foundry market.

As of the third quarter, Samsung’s foundry market share stood at 15.5% after TSMC’s 56.1%.

With exponential growth in demand for sophisticated and user-specific semiconductors, foundry, or chip manufacturing for chip designers and fabless companies, has for years been one of the industry’s toughest battlegrounds.

LESS SUSCEPTIBLE TO INDUSTRY WHIMS

Analysts say Samsung’s growing foundry sales bode well for the company’s entire semiconductor business portfolio as the contract chipmaking is less susceptible to the industry’s cyclical whims.

The boom-and-bust cycle of the memory chip market has closely intertwined with global economic conditions, with chip prices plummeting during a downturn, hurting memory chipmakers’ profitability.

By contrast, the system chip business, including foundry, is relatively stable as contract chipmakers manufacture user-specific value-added chips for their fabless clients.

According to market tracker IC Insights, global foundry players are forecast to post combined sales of $132.1 billion this year, up 20% from last year.

With slowing demand for PCs and smartphones, the contract price of NAND chips hovered around $4.14 in November, down nearly 14% from $4.81 at the end of 2021.

NAND prices are widely expected to fall further into the first half of next year.

IMPROVING YIELDS

Industry officials said Samsung’s growing foundry business also comes with its improving production yield, which refers to how many chips remain on a wafer after processing.

During its third-quarter earnings call, Samsung announced record quarterly sales and net profit, which it attributed to its improved yield of advanced nodes.

The company is also widening its foundry client base, from traditional fabless companies, including Qualcomm Technologies and Nvidia, to tech companies such as Google, Microsoft and Tesla, which want to make their own chips.

Samsung leader Jay Y. Lee announced its Vision 2030 in April 2019, under which the company stressed the importance of its foundry business as one of the conglomerate's key growth drivers.

The company announced a 133 trillion won investment in R&D and production facilities for its Foundry and System LSI businesses through 2030.

In May 2021, the company unveiled further commitment by announcing a total investment of 171 trillion won, adding 38 trillion won to its previous commitment.

Given the difficulties of miniaturizing chip processing nodes, the importance of packaging is also growing.

Previously, chipmakers often consigned chip packaging to specialists such as Advanced Semiconductor Engineering Inc. (ASE) and Amkor Technology Inc. More recently, however, foundries are increasingly handling chip packaging in-house.

Last week, Samsung upgraded the organization in charge of advanced chip packaging from a task force to an independent team.

Samsung expects its foundry business to see double-digit growth in the fourth quarter from the previous quarter.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung Foundry: Driving force behind digital transformation

Korean chipmakersSamsung Foundry: Driving force behind digital transformationDec 01, 2022 (Gmt+09:00)

5 Min read -

Korean chipmakersShell-First: Samsung Foundry’s custom-tailored new operation strategy

Korean chipmakersShell-First: Samsung Foundry’s custom-tailored new operation strategyNov 30, 2022 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundry

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundryNov 29, 2022 (Gmt+09:00)

6 Min read -

Korean chipmakersSamsung mulls new foundry plant in Europe, to expand outsourcing

Korean chipmakersSamsung mulls new foundry plant in Europe, to expand outsourcingOct 19, 2022 (Gmt+09:00)

3 Min read -

The KED ViewCan Samsung Electronics ever catch up to foundry leader TSMC?

The KED ViewCan Samsung Electronics ever catch up to foundry leader TSMC?May 03, 2022 (Gmt+09:00)

4 Min read

Comment 0

LOG IN