The KED View

Can Samsung Electronics ever catch up to foundry leader TSMC?

The Korean people as well as the country’s chip industry pin high hopes on the incoming Yoon government

By May 03, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

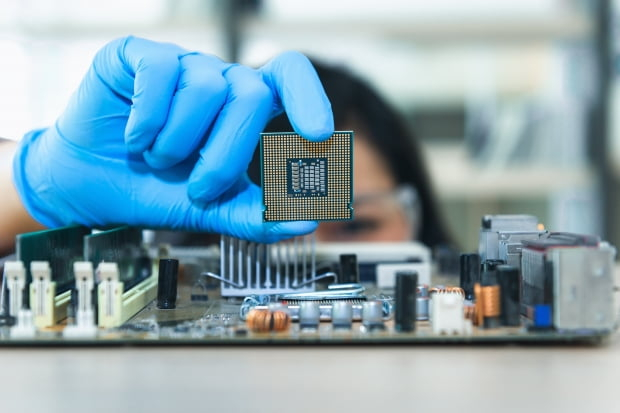

For years, Samsung Electronics Co. has been touted as the backbone of the South Korean economy, Asia’s fourth-largest, under the government’s push to foster the country’s chip industry as a global powerhouse.

However, the Korean tech giant is losing its share of the global foundry market, where Taiwan Semiconductor Manufacturing Co. (TSMC) is the dominant player.

Recently, Samsung came under increased pressure as TSMC forged a strategic partnership with Japanese companies to build chip plants in the archipelago to solidify its leadership, raising questions about whether its neighboring country can ever catch up to its bigger rival.

Samsung’s fate has been further clouded by the prolonged leadership vacuum at the top Korean conglomerate amid intensifying competition over the global semiconductor hegemony.

By contrast, TSMC has been upping the ante by announcing a grandiose plan that it would spend $100 billion over the next three years to build six foundry plants in the US – a move widely seen to hold Samsung, a fast-follower, in check as well as tighten a chip alliance with the Joe Biden administration.

Following its US plan, the Taiwanese company said in February it is building an $8.6 billion semiconductor line in the Kumamoto prefecture, Japan, with equity participation by Sony Group and auto parts maker Denso Corp.

Japanese companies are expected to benefit from the TSMC partnership, backed by the Japanese government, as they are strong in the areas of chip components, equipment and memory fabrication, but lag in the foundry market, where chipmakers make chips for fabless companies and chip design firms.

TSMC, in turn, can develop cutting-edge chip technology in cooperation with Japanese tech companies, further tightening its grip on the foundry business.

LOSING CLIENTS TO TSMC

TSMC’s latest move could threaten the status of Samsung, which is already struggling to retain its clients.

According to recent media reports, US chipmaker Nvidia Corp. won’t use Samsung’s parts in its next-generation graphic processing unit (GPU) this year and instead make TSMC its sole supplier.

Qualcomm Technologies Inc. is also reportedly switching from Samsung foundries to TSMC for the making of its Snapdragon 8 mobile application processor (AP) chips.

The reports come as Samsung is said to be installing its flagship mobile AP chip Exynos 2200 on its smartphones sold only in Europe for now, as the company has to improve production yields of the chip.

Given TSMC’s aggressive $44 billion foundry investment this year, Samsung is urged to redouble its efforts to work out massive chip investment plans and set out for M&As, which have been delayed due largely to the absence of Vice Chairman Lee Jae-yong, better known by his English name Jay Y. Lee, from management.

At the same time, government support is essential to ensuring that the country’s chipmakers are not walking in the shadow of their competitors.

While Samsung Electronics had to spend five years handling conflicts over installing power transmission lines at its Pyeongtaek plant, SK Hynix Inc.’s $101 billion project to build a semiconductor cluster in Yongin, south of Seoul, has been delayed again, stoking concerns that the world’s second-largest memory chip maker may lose competitiveness.

The government’s and lawmakers’ calls for fostering the nation’s chip industry seem to be ringing hollow as Korea’s Chips Act, passed the parliament in January, lacks key incentives for Korean chipmakers such as increased tax reliefs, a higher student quota for semiconductor-related departments at colleges and flexible operations of the mandatory 52-hour workweek system for R&D personnel.

HOPES FOR INCOMING GOVERNMENT

President Moon Jae-in, who ends his five-year term early next week, said at the K-Semiconductor Belt Strategy event held in May last year that “competition in the chip industry has now moved beyond the corporate level to the rivalry among countries. Therein lies the need for government support.”

However, the Moon administration’s announced chip investment between 2021 and 2029 amounts to 1.28 trillion won ($1 billion). That compares with the US government’s 57 trillion won for eight years from 2021, China’s 180 trillion won (2015-2025) and the EU’s 172 trillion won until 2030.

When Morris Chang, founder and former chairman of TSMC, belatedly held his 90th birthday in November last year, Taiwanese President Tsai Ing-wen joined the party herself – an indication that showed the government’s keen interest in the company as the backbone of its economy.

Last December, Tsai said her government plans to allow universities to recruit new students majoring in semiconductors twice a year to nurture the country’s chip talent.

Korean President-elect Yoon Suk-yeol, who takes office on May 10, has pledged during his presidential campaign that his government will significantly ease administrative red tape, enhance tax incentives and offer other supportive measures for the local chipmakers.

The public as well as the chip industry pin high hopes on the new leader.

Write to Keon-Ho Lee at leekh@hankyung.com

In-Soo Nam edited this column.

More to Read

-

EarningsSamsung’s stock underlines cloudy outlook despite record Q1

EarningsSamsung’s stock underlines cloudy outlook despite record Q1Apr 28, 2022 (Gmt+09:00)

4 Min read -

Samsung GroupJay Y. Lee absence raises risks for Samsung chip biz

Samsung GroupJay Y. Lee absence raises risks for Samsung chip bizApr 24, 2022 (Gmt+09:00)

6 Min read -

Korean chipmakersSamsung, TSMC in heated race for industry’s smallest 3 nm process node

Korean chipmakersSamsung, TSMC in heated race for industry’s smallest 3 nm process nodeAug 04, 2021 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung loses ground in foundry market as TSMC ties in with Japanese firms

Korean chipmakersSamsung loses ground in foundry market as TSMC ties in with Japanese firmsJun 01, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, TSMC up ante in US foundry competition

Korean chipmakersSamsung, TSMC up ante in US foundry competitionMay 24, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN