Foundry competition

Samsung, TSMC up ante in US foundry competition

Costly rivalry could incur huge losses if they don't secure enough clients

By May 24, 2021 (Gmt+09:00)

3

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Samsung Electronics' key M&A man returns; big deals in the offing

Money pours in for technology to reshape Korean restaurants

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

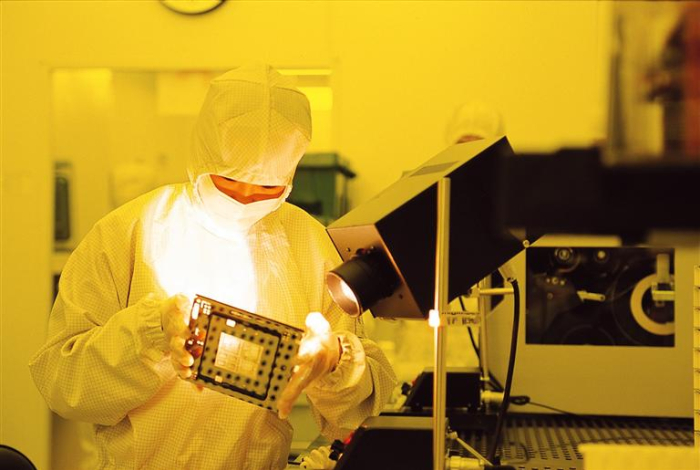

The worldŌĆÖs two largest foundry chipmakers, Taiwan Semiconductor Manufacturing Co. (TSMC) and Samsung Electronics Co., are upping the ante in their quest for global leadership by aggressively expanding facilities in the US.

In its latest offensive against its bigger rival, Samsung announced over the weekend a much-touted $17 billion investment plan to build a foundry factory in the US.

The investment, which comes in response to the Biden administrationŌĆÖs request that the company increase its presence in the US, also aims at countering TSMC, the worldŌĆÖs top foundry player, which last year disclosed plans for a $12 billion chip plant in Arizona expected to come online in 2024.

SamsungŌĆÖs plan, announced by its Vice Chairman Kim Ki-nam, during South Korean President Moon Jae-inŌĆÖs US visit, marks the companyŌĆÖs official acknowledgment of its expansion plans in one of the toughest foundry markets.

The Korean tech giant has been scouting sites for its new semiconductor factory in the US as it aims to close ranks with TSMC.

Samsung already has a semiconductor plant in Austin that makes 14-nanometer, 28 nm and 32 nm products for its US clients including Tesla Inc., Qualcomm Technologies Inc. and Nvidia Corp.

The new plant will likely be built close to its existing factory in Austin, Texas, as Samsung has publicly sought tax breaks of $805.5 million from the state government of Texas in return for the factory. But the company is keeping the US government hanging, saying it is also looking at alternative sites in the US, including Arizona and New York.

RIVALRY IN ADVANCED MACHINES

SamsungŌĆÖs second plant is widely expected to house extreme ultraviolet (EUV) lithography machines to manufacture chips below the 5-nanometer process. Some industry watchers say the new plant may have the ultra-micro lithography technology of the 3-nanometer process.

SamsungŌĆÖs plan comes amid reports that TSMC is considering building an advanced 3 nm plant in Arizona next to its first one. The Taiwanese company was initially looking at sites in Europe to build the advanced factory, estimated to cost as much as $25 billion.

Currently, Samsung is the worldŌĆÖs second-largest foundry player with its 2021 market share projected at 18%, lagging behind TSMCŌĆÖs estimated 54%.

Analysts said the fierce competition between the two players to expand facilities in the US will be costly and could lead to heavy losses if they fail to secure enough clients.

ŌĆ£Building foundry facilities is a very expensive process that takes three to 10 years. If their new plants run at a low operating rate, the chipmakers could incur huge losses,ŌĆØ said an industry official.

While TSMCŌĆÖs $37 billion US investment, including the latest reported one, accounts for four-fifths of its 2020 revenue of $45.4 billion, SamsungŌĆÖs $17 billion investment plan is above its estimated annual foundry revenue of about 15 trillion won ($13.3 billion).

TSMC counts Apple Inc. and Advanced Micro Devices Inc. (AMD) among its major customers.

INTELŌĆÖS FOUNDRY ENTRY TO COMPLICATE MATTERS

The rivalry between TSMC and Samsung comes as the US has been trying to boost its domestic chip production to counter ChinaŌĆÖs rising influence.

As part of such efforts, Intel Corp.┬Āin March announced a $20 billion investment plan┬Āto build two new chip manufacturing factories and jump into the foundry business.

Earlier this year, the US Congress passed the CHIPS for America Act, aimed at providing billions of dollars in incentives for semiconductor R&D and production in the US, as Washington takes other key steps to bolster its chip manufacturing and supply chains.

Steve Mollenkopf, chief executive of Qualcomm, said last week the company wants to expand its foundry business partnership with Samsung.

Last year, Samsung clinched a deal to manufacture QualcommŌĆÖs mobile application processor (AP) chips, known as the Snapdragon 888, as part of a series of high-profile deals for its foundry business.

Under SamsungŌĆÖs Vision 2030 announced in April 2019, the company plans to invest a total of 133 trillion won ($118 billion) to become the worldŌĆÖs top foundry player by then. The company is known to be spending 10 trillion won a year to develop chip foundry technology and purchase the necessary equipment to close in on bigger rival TSMC.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial plan

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial planMay 13, 2021 (Gmt+09:00)

3 Min read -

Semiconductor rivalryKorean chipmakers in rivalsŌĆÖ shadow, fall behind TSMC

Semiconductor rivalryKorean chipmakers in rivalsŌĆÖ shadow, fall behind TSMCMay 11, 2021 (Gmt+09:00)

4 Min read -

Foundry competitionIntelŌĆÖs jump into foundry sets off alarm bells for Samsung, TSMC

Foundry competitionIntelŌĆÖs jump into foundry sets off alarm bells for Samsung, TSMCMar 24, 2021 (Gmt+09:00)

3 Min read -

Foundry competitionSamsung to ramp up EUV scanners to take on foundry leader TSMC

Foundry competitionSamsung to ramp up EUV scanners to take on foundry leader TSMCMar 15, 2021 (Gmt+09:00)

3 Min read -

Foundry boomSamsung, other foundry players at full capacity as chip orders surge

Foundry boomSamsung, other foundry players at full capacity as chip orders surgeJan 06, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN