Samsung Group

Jay Y. Lee absence raises risks for Samsung chip biz

Without pardon, Samsung Elec. vice chairman may not return to management until 2027, boosting long-term strategy concerns

By Apr 24, 2022 (Gmt+09:00)

6

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co. is losing its hegemony in the global semiconductor market as a sustained leadership vacuum has kept the world’s top memory chipmaker from deciding on key future investment plans.

Its Vice Chairman Jay Y. Lee, the key decision-maker of the South Korean tech giant’s long-term strategy, has been on parole since August 2021 after serving 18 months of his 30-month prison term for a bribery and embezzlement conviction. But Lee’s parole, instead of a pardon, means he will be unable to return to Samsung management until the second half of 2027, given the country’s law governing special economic crimes.

Some domestic business lobby groups reportedly plan to ask President-elect Yoon Seok-yeol to pardon Lee, the de facto leader of the nation’s top conglomerate Samsung Group, for the sake of the local semiconductor industry.

“Large-scale issues such as chip investments and M&As need to be decided on by someone who is in charge of corporate management,” said Lee Chang-han, vice chairman of the Korea Semiconductor Industry Association. “Samsung’s decision-making power has weakened due to the absence of Vice Chairman Lee, the top decision-maker.”

Samsung’s lack of long-term strategy is expected to pose a risk to the entire South Korean semiconductor sector amid intensifying competition in the global market, industry sources said.

The concerns dampened Samsung’s share price. The stock of the country’s largest company by market capitalization lost ground, falling to as low as 66,100 won ($53.2) earlier this month, the weakest since November 2020, despite record sales in the first quarter.

LOWER INVESTMENT THAN COMPETITORS

Samsung’s semiconductor investment is also lagging its competitors' spending. Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s top foundry maker, announced it planned to spend $44 billion on capital expenditures this year alone. Intel Corp. decided to pour $20 billion each into factories in Arizona and Ohio, as well as earmarking 80 billion euros ($86.6 billion) for investment into Europe to boost chip capacity there over the next decade.

Meanwhile, Samsung aims to invest $17.1 billion in the chip business by 2030.

“Investors are concerned over Samsung’s uncertain future due to the lack of leadership,” said an analyst at a brokerage house in Seoul.

Samsung is feared to follow the decline of Japan’s semiconductor sector as the South Korean electronics behemoth has yet to unveil long-term visions and strategies, domestic industry sources said.

Until the 1970s, the global semiconductor industry was dominated by the US with Intel’s invention of DRAM in 1971. Japanese players took the throne in the 1980s with high-performance DRAMs required by mainframe computers for corporate servers.

Samsung aimed at the market of small and cheap products in the 1990s when personal computer makers became the main customers for DRAMs with the growing use of PCs. To cut costs, Samsung reportedly took a bold move of using European equipment that had been less competitive than Japanese machines. Such strategies allowed Samsung to beat its Japanese rivals.

Takashi Yunogami, a former semiconductor engineer at Hitachi Ltd., said Japanese chipmakers collapsed and surrendered market dominance to South Korean makers as they were excessively concerned with top technology and quality, failing to cope with the rapid changes in global trends.

Morris Chang, the founder of TSMC, paid close attention to the late Samsung Group Chairman Lee Kun-hee with his success of Samsung Electronics’ semiconductor business.

Samsung had Lee Kun-hee, the current vice chairman’s father, but Japanese rivals such as Hitachi, Toshiba Corp. and NEC Corp. did not have such a leader, Chang, a legendary figure in the global semiconductor industry, said in an interview with Taiwan’s Wealth Magazine in February.

But the current sustained leadership vacuum has ramped up risks for Samsung when competitors are boosting their muscle in the global market.

Samsung is far behind TSMC in the foundry market where product prices have jumped on the world’s semiconductor shortage. TSMC dominated the global foundry market with a 52.1% market share in the fourth quarter of last year, while Samsung accounted for just 18.3%, about a third of TSMC’s share, according to market tracker TrendForce. The Taiwan company is reportedly able to produce 3-nanometer chips ahead of Samsung.

In the US, chipmaker Micron Technology Inc. last year started commercial production of 176-layer NAND for the first time in the world.

LEADERSHIP VACUUM

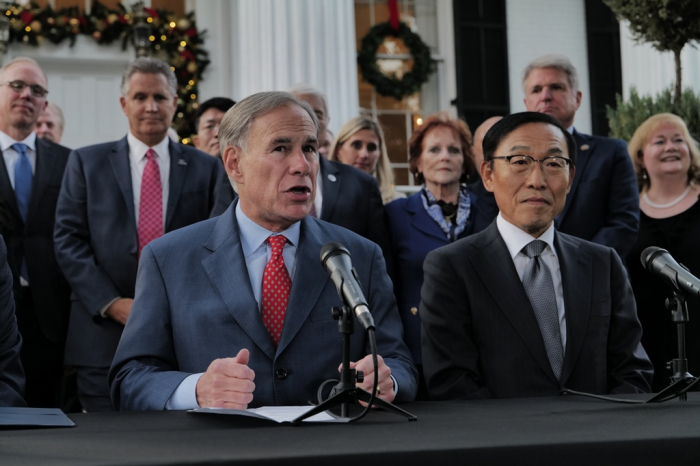

Samsung has unveiled few major investment plans, except for the one to build a $17 billion chipmaking plant in Taylor, Texas, announced in November of last year.

The company’s CEO reportedly has authority for spending of about 1 trillion won, while presidents are known to be able to approve investments of only 300 billion-400 billion won. That means Vice Chairman Lee is the only person in the company able to make decisions about chip plant investments in the billions of dollars.

“It is hard for a professional manager to make decisions on a large-scale investment as they cannot help focusing on short-term performance,” said a local semiconductor industry source.

Lee’s parole term ends on July 29, 2022 but he will still be restricted from employment given the law governing special economic crimes.

“Without a pardon, there will be no way to avoid the employment restriction,” said another industry source.

Lee is also facing difficulties in seeking acquisitions of other companies, a shortcut to securing future growth engines, under parole. Few global companies are willing to sign a deal with a leader if there are legal risks.

Governments around the world became stricter on mergers and acquisitions in the semiconductor industry amid the cut-throat hegemony competition. Germany disapproved of Taiwanese GlobalWafer Co.’s planned $5 billion takeover of German chip supplier Siltronic AG. US-based Nvidia Corp.’s attempt to acquire British chip designer Arm Ltd failed due to the opposition of countries such as the UK and China.

Samsung may disappear into history or lose major status globally without securing future growth engines in the near term, company officials feared. In 2011, global management consulting firm McKinsey said the average life expectancy of companies listed on the Standard and Poor’s 500 had shortened to 18 years in 2011 from 90 years in 1935, expecting 75% of the 500 companies on that list to disappear by 2027.

Write to Shin-Young Park at nyusos@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Samsung GroupSamsung Group hires governance expert for unprecedented reorganization

Samsung GroupSamsung Group hires governance expert for unprecedented reorganizationApr 11, 2022 (Gmt+09:00)

5 Min read -

EarningsSamsung sees record first-quarter sales; business outlook murky

EarningsSamsung sees record first-quarter sales; business outlook murkyApr 07, 2022 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMC

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMCNov 24, 2021 (Gmt+09:00)

4 Min read -

Fraud scandalsSamsung shares struggle as big strategic decisions still await Lee

Fraud scandalsSamsung shares struggle as big strategic decisions still await LeeAug 11, 2021 (Gmt+09:00)

3 Min read -

Tech, Media & TelecomSamsung's Lee to be released on parole on Aug. 13

Tech, Media & TelecomSamsung's Lee to be released on parole on Aug. 13Aug 09, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN