Earnings

Samsung sees record first-quarter sales; business outlook murky

The company needs to strengthen its foundry business to improve its top and bottom lines, analysts say

By Apr 07, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co. likely posted record revenue in the first quarter, driven by brisk sales of memory chips and smartphones. Its shares, however, fell to 52-week lows on growing uncertainty over its business outlook.

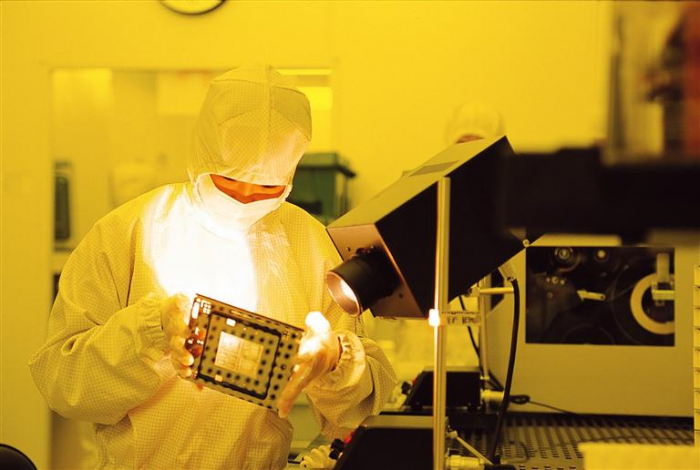

Analysts said the company needs to strengthen its chip foundry business if it wants to remain competitive against market leader Taiwan Semiconductor Manufacturing Co. (TSMC) at the leading edge of chip processing.

Samsung, the world’s largest memory and smartphone maker, said on Thursday it estimates its sales in the three months to March 31 reached 77 trillion won ($63 billion), an all-time high for the first-quarter period.

That’s up 17.8% from 65.4 trillion won in the same period a year earlier.

In its earnings guidance, Samsung said its first-quarter operating profit is estimated at 14.1 trillion won, up 50.3% from a year ago.

The preliminary quarterly results came above market expectations. The market consensus was 75.2 trillion won in sales and 13 trillion won in operating profit.

The company is due to release detailed results later this month.

Analysts said the South Korean tech giant’s strong revenue growth was supported by solid demand for memory chips from data center clients amid a persistent global chip shortage.

The chipmaker also likely benefited from the production disruption at rival NAND flash memory plants in Japan jointly owned by US Western Digital Corp. and Japanese Kioxia Holdings Corp. due to contamination of raw materials.

Although Samsung didn’t provide divisional performance, analysts said the company’s semiconductor business likely posted 8 trillion won in the first quarter, about 60% of its entire operating income. Chip business sales are estimated at 25 trillion won, they said.

ROBUST SMARTPHONE SALES

Robust sales of smartphones and high-end home appliances also likely boosted the company’s first-quarter earnings, analysts said.

In early February, the company announced new additions to its Galaxy S series models as the world’s top smartphone maker by volume faces growing competition from Apple Inc. and Chinese companies in both premium and low-end segments.

During its Galaxy Unpacked 2022 event, Samsung unveiled its latest smartphones, the Galaxy S22 series, including the much-awaited S22 Ultra with a built-in S Pen stylus, previously available only on Samsung’s Note family of smartphones.

Samsung expects the new products to help it strengthen its overall mobile phone market leadership and put it on an equal footing with Apple’s high-end line of iPhones.

Analysts said Samsung’s mobile and telecommunications equipment division likely posted an operating profit between 4.1 trillion won and 4.2 trillion won on sales of 33.3 trillion won.

SHARES AT FRESH 52-WEEK LOW

Despite the company’s strong quarterly performance, however, its stock fell to a fresh 52-week low on concerns that Samsung may be losing its competitiveness against rivals in the smartphone market as well as the chip sector.

On Thursday, the stock finished 0.7% lower at a fresh 52-week low of 68,000 won. The broader Kospi market closed down 1.4%.

The weak stock performance followed an overnight fall in tech shares in the US market amid a view that the US Fed and the central banks in other countries, including Korea, will accelerate their tightening monetary bias to keep inflation in check.

But analysts said investors also unloaded Samsung shares as they questioned Samsung’s future growth strategy.

In mid-March, Samsung said it is looking to the metaverse and robotics as keys to the tech company’s future. It said it is also seeking acquisitions in the artificial intelligence, 5G and automotive electronics sectors.

Some analysts said it may take years for Samsung to lead its rivals in the suggested new areas of growth.

While reporting spectacular 2021 earnings in January, Samsung skipped the routine capital expenditure plans for 2022, citing uncertainty.

STRUGGLING FOUNDRY SECTOR

In the chip foundry sector, the company faces an uphill battle against bigger rival TSMC.

According to recent media reports, US chipmaker Nvidia Corp. won’t use Samsung’s parts in its next-generation graphic processing unit (GPU) this year and instead make TSMC its sole supplier.

Qualcomm Technologies Inc. is also reportedly looking to switch from Samsung foundries to TSMC for the making of its flagship Snapdragon 8 mobile application processor (AP) chips.

Samsung is also struggling to compete with its rivals in the smartphone sector.

According to market researcher Counterpoint Research, Apple’s iPhone accounted for 60% of the global premium smartphone segment in 2021, when Samsung’s market share stood at 17%.

Some analysts expect Samsung’s revenue and profit to increase for the rest of the year with the rise of NAND chip prices from the second quarter and DRAM chip prices from the third quarter.

According to financial information provider FnGuide, Samsung is forecast to post a full-year operating profit of 60.5 trillion won in 2022, up 17.2% from the previous year.

(Updated to add closing share prices, full-year earnings outlook and other details)

Write to Shin-Young Park, Nam-Young Kim and Hyung-gyo Seo at nyusos@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Corporate strategySamsung looks to metaverse, robots for future growth

Corporate strategySamsung looks to metaverse, robots for future growthMar 16, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersMemory leader Samsung aims to strengthen system chips, foundry

Korean chipmakersMemory leader Samsung aims to strengthen system chips, foundryJun 08, 2021 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung loses ground in foundry market as TSMC ties in with Japanese firms

Korean chipmakersSamsung loses ground in foundry market as TSMC ties in with Japanese firmsJun 01, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, TSMC up ante in US foundry competition

Korean chipmakersSamsung, TSMC up ante in US foundry competitionMay 24, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN