Earnings

Samsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by half

The tech giant will also likely cut its investment plan to brace for the market downturn, analysts say

By Jan 06, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

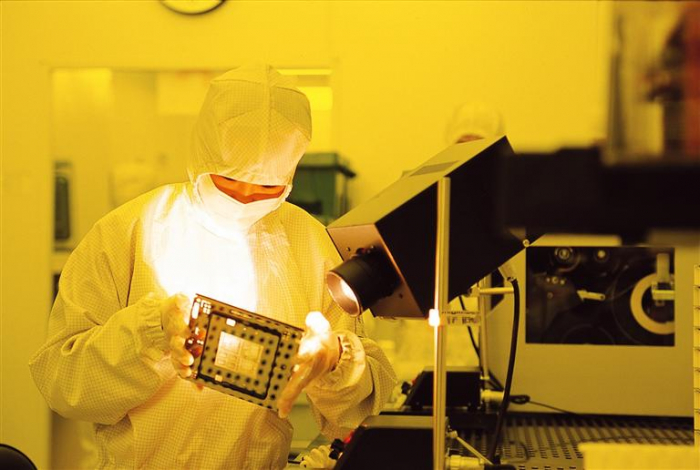

Samsung Electronics Co., the world’s largest memory chip and smartphone maker, posted its worst quarterly operating profit in eight years on Friday as a global economic slowdown dampened demand for semiconductors from electronics makers.

The South Korean tech giant also gave a dim outlook, slashing its 2023 chip profit forecast by half as major chipmakers and their clients are struggling to adjust their high inventory levels.

Samsung said its preliminary consolidated operating profit for last year’s October-December period stood at 4.3 trillion won ($3.39 billion), down 69% from 13.87 trillion won a year earlier.

Consolidated sales were estimated at 70 trillion won in the fourth quarter, down 8.6% from 76.57 trillion won in the year-earlier period.

"With external business environments set to remain uncertain, chip sales plummeted due to lower demand from server clients, data centers and handset makers," Samsung said in a statement.

The company didn’t provide a net profit estimate and other breakdown figures. It will release detailed fourth-quarter results later this month.

The estimated operating profit and revenue fell short of the market consensus of 6.93 trillion won in operating profit and 72.75 trillion won in sales.

If Samsung’s operating profit guidance is confirmed later this month, it will mark its worst quarterly profit since the third quarter of 2014.

For the whole of 2022, Samsung’s operating profit likely fell 16% to 43.37 trillion won from 51.63 trillion won the previous year.

But revenue likely rose 7.9% to a record 301.77 trillion won from 279.6 trillion won, driven by strong sales in the first half.

EXPECTS 2023 CHIP PROFIT CUT IN HALF

Samsung executives at its DS division, which is in charge of the semiconductor business, recently cut the division’s operating profit target for this year by half, people familiar with the matter said on Friday.

Analysts estimated the DS division’s 2022 operating profit at 25.45 trillion won.

“The global memory chip market will see a hard time at least until the first half of this year, hitting chipmaker’s profitability,” said an analyst with a local brokerage firm.

According to market data provider DRAMeXchange, the contract price of general-purpose DRAM products for PCs stood at $2.21 in December, down 22.5% from three months earlier. The NAND flash price fell 3.7% to $4.14 over the same period.

Taiwan-based chip research firm TrendForce forecasts DRAM prices will fall 15-20% in the first quarter of this year from the previous quarter.

On an annual basis, DRAM and NAND chip prices could decline by 35% and 11%, respectively, from last year, according to an Export-Import Bank of Korea projection.

With growing chip inventory levels at makers of smartphones, PCs and TVs, foundry players, including Samsung and Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), have lowered their factory operation rates to below 86% in the fourth quarter after running plants at full capacity in the year prior.

SAMSUNG LIKELY TO CUT INVESTMENT

Analysts said Samsung, which earlier vowed not to slash its chip production to maintain its market leadership, may adjust its stance while cutting its planned investment for this year.

Samsung executives said last October they would stick with the company’s production plans while advancing its chipmaking technologies to tide over the industry’s supply glut and widen its tech gap with rivals.

As the industrywide chip inventory buildup is at a worrisome level at a time when the global economy is fighting inflation and a potential recession, Samsung’s rivals such as SK Hynix Inc. and Micron Technology have reduced their output while curtailing capital spending.

In a recent research report, Citigroup Global Markets said the chances of Samsung adjusting its chip supply strategy by slashing investments are growing as sharper-than-expected memory chip price declines are threatening to push Samsung’s profitability below its breakeven points.

Write to Jeong-Soo Hwang and Sungsu Bae at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung unveils industry’s first 12 nm DRAM, compatible with AMD

Korean chipmakersSamsung unveils industry’s first 12 nm DRAM, compatible with AMDDec 21, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip sales

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip salesDec 13, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundry

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundryNov 29, 2022 (Gmt+09:00)

6 Min read -

EarningsSamsung reiterates no memory chip output cut despite weak Q3 results

EarningsSamsung reiterates no memory chip output cut despite weak Q3 resultsOct 27, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung says no memory output cut, to widen tech gap with rivals

Korean chipmakersSamsung says no memory output cut, to widen tech gap with rivalsOct 06, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN