Earnings

Samsung reiterates no memory chip output cut despite weak Q3 results

While geopolitical uncertainties are expected to persist through the first half, demand will recover late next year, it says

By Oct 27, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

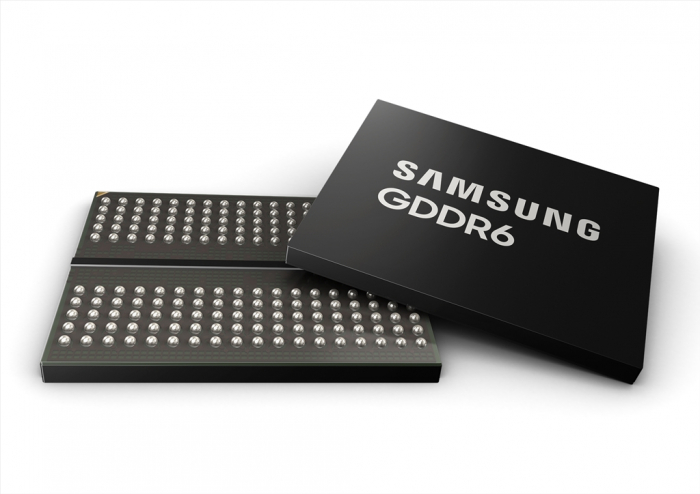

Samsung Electronics Co., the world’s largest memory chip and smartphone maker, said on Thursday it will not reduce its production despite dwindling demand as it expects a rebound in demand next year.

“We agree that current memory demand in the market is weak. But we need to see it from a strategic point of view. We need to be prepared for demand recovery from a mid- to long-term perspective,” Han Jin-man, executive vice president and head of Samsung’s memory global sales and marketing division, said during a third-quarter earnings conference call with analysts.

In a statement, Samsung said its memory business division expects “fundamental server demand” in the fourth quarter of this year owing to core infrastructure investments by companies.

For the system LSI business, new products from mobile customers are expected to drive growth in system-on-chip (SoC) revenue while in the foundry business, the earnings momentum is expected to continue on solid demand from global customers, it said.

Looking forward, Samsung said that while geopolitical uncertainties are likely to dampen demand to some degree in the first half of 2023, “demand may recover later next year, driven by resumed installations of data centers and the adoption of DDR5 for new CPUs.”

It maintained its 2022 capital expenditure estimate at 54 trillion won ($38 billion).

Earlier this month, Han said Samsung will stick with its current production plans while advancing its chipmaking technologies to tide over the industry’s supply glut and widen its tech gap with rivals.

The South Korean tech giant’s decision to maintain its production volume comes as rival chipmakers around the world are responding to the expected memory chip downcycle by slashing their planned investments.

Q3 RESULTS IN LINE WITH EARLIER GUIDANCE

Earlier on Thursday, Samsung released its finalized third-quarter earnings results, which came out largely in line with its guidance announced on Oct. 7.

The South Korean tech giant on Oct. 27 posted consolidated sales of 76.78 trillion won ($54.2 billion) for the three months to September, a record for the third quarter and a 3.8% increase from a year earlier.

Third-quarter operating profit fell 31.4% on year to 10.8 trillion won.

The results compare with its guidance for sales revenue of 76 trillion won and an operating profit of 10.8 trillion won.

Samsung said its semiconductor businesses posted 23 trillion won in consolidated revenue with 5.12 trillion won in operating profit in the third quarter.

Its foundry, or contract chip manufacturing, business posted record quarterly sales and operating profit on "improving yields in advanced nodes," it said. The company didn’t provide figures.

The strength in the US dollar against the Korean won benefited the company’s component businesses, resulting in about a 1 trillion won company-wide gain in operating profit in the third quarter, it said.

With record sales revenue in each of the three quarters so far this year, Samsung said it expects its annual revenue to reach a record high.

Write to Ji-Eun Jeong at jeong@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Leadership & ManagementJay Y. Lee inaugurated as chairman of Samsung Electronics

Leadership & ManagementJay Y. Lee inaugurated as chairman of Samsung ElectronicsOct 27, 2022 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung mulls new foundry plant in Europe, to expand outsourcing

Korean chipmakersSamsung mulls new foundry plant in Europe, to expand outsourcingOct 19, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, Qualcomm unveil industry’s fastest LPDDR5X DRAM chip

Korean chipmakersSamsung, Qualcomm unveil industry’s fastest LPDDR5X DRAM chipOct 18, 2022 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung says no memory output cut, to widen tech gap with rivals

Korean chipmakersSamsung says no memory output cut, to widen tech gap with rivalsOct 06, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung unveils 1.4-nano tech roadmap to challenge TSMC’s dominance

Korean chipmakersSamsung unveils 1.4-nano tech roadmap to challenge TSMC’s dominanceOct 04, 2022 (Gmt+09:00)

4 Min read

Comment 0

LOG IN