Korean chipmakers

Samsung says no memory output cut, to widen tech gap with rivals

Its ambitious investments and growing politicization of the chip business will be tailwinds, according to the WSJ

By Oct 06, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SILICON VALLEY – Samsung Electronics Co., the world’s top memory chipmaker, is not considering slashing its memory chip production despite dwindling demand amid concerns over a global economic slowdown.

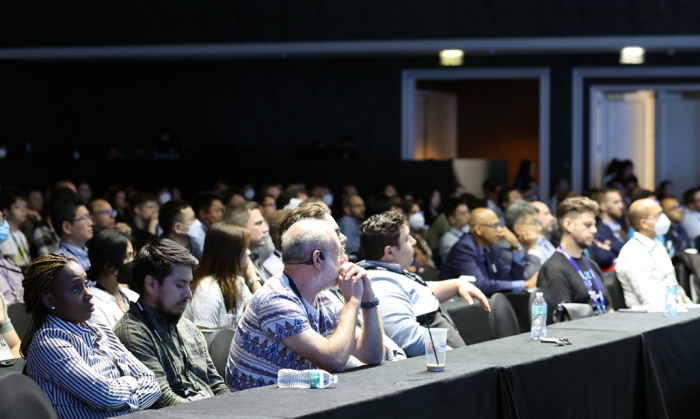

At Samsung Tech Day 2022 in San Jose, California, Samsung executives said the company will further advance its chipmaking technologies to tide over the industry’s supply glut and widen its tech gap with rivals.

“Even if the current situation is not good, we won’t change the course we have already charted,” said Han Jin-man, executive vice president and head of Samsung’s global memory sales and marketing division. “No one at Samsung is talking about cutting chip production for now.”

The South Korean tech giant’s decision to maintain its production volume comes as rival chipmakers around the world are responding to the expected memory chip downcycle by slashing their planned investments.

Sanjay Mehrotra, chief executive of the world’s No. 3 memory chipmaker Micron Technology Inc., recently said the current oversupply situation is “unprecedented.”

The Micron CEO said the company will reduce capital spending in fiscal 2023 by about $8 billion, or by more than 30%, with a 50% cut in spending on wafer-fab equipment.

Japan’s Kioxia Corp., a leading NAND player, has also said it will reduce its wafer input volume by 30% to counter slowing demand.

Last month, Samsung gave a cloudy industry outlook by saying that its semiconductor sales revenue in the second half will likely come in below its own forecast made in April.

MARKET LEADER FOR DECADES

Samsung has been the dominant player in the dynamic random access memory, or DRAM, segment – the type of memory commonly used in PCs and servers – and NAND chips, or flash memory chips used in smaller devices like smartphones and USB drives, since 1993.

According to market researcher Omdia, Samsung’s DRAM market share was 42.7% as of end-2021, followed by SK Hynix Inc.'s 28.6% and Micron’s 22.8%. In the NAND segment, Samsung controlled 33.9% of the market, followed by Western Digital Technologies Inc.’s 18.9% and SK Hynix’s 13.2%.

Samsung said it will keep its memory leadership amid growing competition, although it has some catching up to do in the system chip and foundry segments.

The company said on Thursday it will sharpen its technology in vertical or V-NAND flash memory chips to consolidate its flash leadership.

At the Tech Day event, Samsung showcased its fifth-generation 10-nanometer DRAM, which the company plans to mass produce from next year, as well as its eighth- and ninth-generation V NAND chips.

Most of Samsung's rivals are currently producing DRAM chips with a 14 nm process technology.

SAMSUNG EYES 1,000-LAYER CHIP

Regarding its V-NAND, Samsung said it now produces seventh-generation 176-layer chips and will move to the eighth-generation 230-layer NAND by year-end with an aim to make 1,000-year V NAND in large quantities by 2030.

In the global semiconductor industry, memory chips account for about 30% while the remaining 70% are taken up by non-memory chips such as system-on-chips, a market where Korean companies are distant followers.

Samsung has just a single-digit market share in the non-memory market.

In the contract chipmaking, or foundry, segment, Samsung is a distant No. 2, following market leader Taiwan Semiconductor Manufacturing Co.

Earlier this week, Samsung said it will adopt the industry’s most advanced 1.4-nanometer chip production technology by 2027 to take on bigger foundry rival TSMC.

Meanwhile, the Wall Street Journal recently reported that Samsung is going through a tough time, but its ambitious investments in its foundry business and the increasing politicization of the chip business will be tailwinds for the company over the long run.

Write to Ki-Yeol Seo at philos@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung cuts H2 chip sales outlook by a third, gripped by sense of crisis

Korean chipmakersSamsung cuts H2 chip sales outlook by a third, gripped by sense of crisisSep 30, 2022 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung unveils 1.4-nano tech roadmap to challenge TSMC’s dominance

Korean chipmakersSamsung unveils 1.4-nano tech roadmap to challenge TSMC’s dominanceOct 04, 2022 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flash

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flashSep 07, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chips

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chipsFeb 04, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersNAND competition heats up as SK Hynix unveils 176-layer flash memory

Korean chipmakersNAND competition heats up as SK Hynix unveils 176-layer flash memoryDec 07, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN