Korean chipmakers

Samsung cuts H2 chip sales outlook by a third, gripped by sense of crisis

Analysts say no light at the end of the tunnel until chipmakers significantly slash production volumes

By Sep 30, 2022 (Gmt+09:00)

4

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

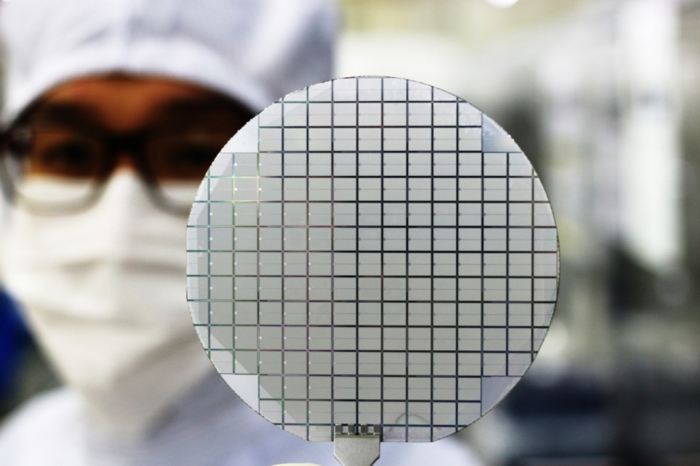

Samsung Electronics Co., the worldŌĆÖs largest memory chipmaker, has slashed its outlook for second-half semiconductor sales revenue by a third as chipmakers around the world are bracing for a slowdown.

Kyung Kye-hyun, Samsung's semiconductor business chief, said during a meeting with company employees on Monday that Samsung has lowered its chip sales guidance for the second half of this year by 32% compared with its forecast in April.

The company didnŌĆÖt provide exact figures, but the market consensus in April for SamsungŌĆÖs second-half chip sales was 67.03 trillion won ($46.9 billion). Based on the market consensus, SamsungŌĆÖs revised chip sales forecast would be around 45 trillion won.

The South Korean tech giantŌĆÖs conservative sales outlook comes as the chip industry is reeling from growing inventories and falling chip prices amid lackluster electronics demand.

According to market data provider DRAMeXchange, the contract price of general-purpose DRAM products for PCs stood at $2.85 in September, down 30.5% from $4.1 in July. The NAND flash price fell 10.6% to $4.3 from $4.81 over the same period.

The significant price drops were partly due to decreasing demand for PCs in the wake of the COVID-19 pandemic and weak sales of smartphones in China following the pandemic-related lockdown of major cities, industry officials said.

ŌĆ£Both DRAM and NAND flash suppliers and customers are groaning under growing chip inventories,ŌĆØ said a chip industry executive.

INVENTORY PILES UP

Industry watchers said the industrywide chip inventory buildup is at a worrisome level at a time when the global economy is fighting inflation and a potential recession.

Major chipmakers are reporting record-high levels of inventories of their chip products.

SamsungŌĆÖs DS division, which is in charge of the semiconductor business, said its product inventory reached 21.51 trillion won as of end-June, up 31% from 16.46 trillion won at the end of 2021.

Crosstown rival SK Hynix Inc., the worldŌĆÖs second-largest memory chipmaker, saw its chip inventory rise 33.2% to 11.88 trillion won from 8.92 trillion won over the same period.

ŌĆ£You canŌĆÖt keep piling up chips, waiting for a boom to come again. WeŌĆÖre trying to sell our chips at much lower prices, but thatŌĆÖs not easy,ŌĆØ said an official at a domestic chipmaker.

He said the company recently proposed a 20% discount for its mobile DRAM chip to a Chinese smartphone maker and a 30% PC DRAM chip price cut to a laptop computer manufacturer, but those offers were all rejected.

ŌĆ£Customers say their chip inventory is also rising. They have no reason to buy more when chip prices are forecast to fall further down the road,ŌĆØ he said.

CUTTING INVESTMENTS TO BRACE FOR A DOWNCYCLE

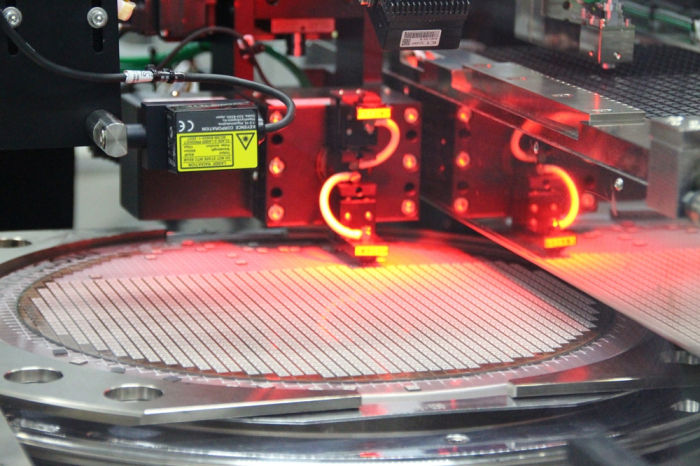

Chipmakers are responding to the expected memory chip downcycle by slashing their planned investments.

Sanjay Mehrotra, chief executive of the worldŌĆÖs No. 3 memory chipmaker Micron Technology Inc., said the current oversupply situation is ŌĆ£unprecedented.ŌĆØ

The Micron CEO said it will reduce capital spending in fiscal 2023 by about $8 billion, or by more than 30%, with a 50% cut in spending on wafer-fab equipment.

The company will continue to work closely with all end-market customers to cut inventory levels, he said.

Market researcher IDC expects global smartphone shipments to fall 6.5% this year compared to 2021 as consumers fear economic conditions would worsen. PC sales are projected to plunge by more than 10%.

Apple Inc. is also said to have given up its planned ramp-up of the iPhone 14 smartphone production.

ŌĆ£Korean chipmakers would also be forced to cut their chip production for a considerable period,ŌĆØ said Hwang Cheol-Seong, a professor at Seoul National UniversityŌĆÖs Department of Materials Science and Engineering, Hybrid Materials.

NO LIGHT AT END OF THE TUNNEL

Analysts said the chip industry will likely see a rebound in the second half of next year, when high levels of chip inventory are expected to ease alongside overall economic improvement.

Taiwan-based chip research firm TrendForce expects DRAM and NAND chip prices to fall 18% in the third quarter of this year from the previous quarter, and a further 20% on-quarter fall in the fourth quarter.

Micron said it expects to see a sales increase by the second half of 2023 following a DRAM price rebound from the early months of next year as chipmakers are reducing supplies.

SK Hynix is more cautious. The company said it expects the industry downcycle to continue throughout next year, with a slim chance of a meaningful rebound in the fourth quarter of 2023 at the earliest.

"The timing of Intel's new server CPU release and wider use of the DDR5 chip will determine when the memory chip industry will be able to stage a significant rebound,ŌĆØ said Park Jea-gun, a Hanyang University electronics engineering professor.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

The Deep DiveWhy Korean chipmakers struggle with talent shortages

The Deep DiveWhy Korean chipmakers struggle with talent shortagesJun 10, 2022 (Gmt+09:00)

6 Min read -

-

Korean chipmakersKorean chipmakers tumble, wipe out $13 billion in market capitalization

Korean chipmakersKorean chipmakers tumble, wipe out $13 billion in market capitalizationAug 12, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsungŌĆÖs new 5G multi-chip combines DRAM, NAND into one package

Korean chipmakersSamsungŌĆÖs new 5G multi-chip combines DRAM, NAND into one packageJun 15, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN