Korean chipmakers

Samsung’s $22 bn new chip plant up and running to make NAND flash

The move comes as chipmakers are again racing to ramp up facilities to stay ahead of rivals

By Sep 07, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

PYEONGTAEK – Samsung Electronics Co., the world’s largest memory chipmaker, said on Wednesday it has put its new 30 trillion won ($22 billion) semiconductor factory into full operation with an aim to turn it into one of the world’s most advanced facilities.

The South Korean company completed construction of the Pyeongtaek Campus Line 3 in July and has since put in wafers for pilot manufacturing.

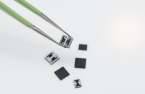

The latest plant will initially produce state-of-the-art NAND flash memory chips and later expand the facility to manufacture DRAM chips it developed or for other companies in a foundry mechanism, it said.

The new plant will be equipped with extreme ultraviolet (EUV) process technology for 5-nanometer or smaller-size chips.

“The Pyeongtaek Line 3 will play a key role in consolidating our market leadership,” said Chief Executive Kyung Kye-hyun.

Samsung’s Pyeongtaek complex is the world’s largest semiconductor production facility spanning 2.89 million square meters, equivalent to the size of 400 soccer fields.

Line 3, built on a 991,736 square-meter plot of land, is Samsung's key facility for next-generation chips.

RACE FOR FACILITY RAMP-UP

In late May, US President Joe Biden began his three-day trip to South Korea with a tour of Samsung’s Pyeongtaek campus, where he and Korean President Yoon Suk-yeol emphasized the two countries' iron-clad commitment to an economic security alliance.

Samsung is cranking up the Line 3 facility at a time when global chipmakers such as Micron Technology Inc. and Taiwan’s TSMC are again racing to ramp up capacity to remain ahead of rivals, although the industry is currently reeling from lackluster demand.

SK Hynix Inc., the world’s second-largest memory chipmaker, said on Tuesday it will break ground on a new fabrication plant, dubbed M15X, next month with an aim to complete construction in early 2025.

The company said it is building the 15 trillion won plant as it expects the memory business to recover steadily from 2024 and rebound in 2025.

Micron recently said it will invest $15 billion to build a memory plant in Boise, Idaho while Taiwan's TSMC said it will spend $40 billion-$44 billion on facility investment this year.

Last month, Samsung said it will spend about 100 trillion won to expand semiconductor production capacity in Korea to meet growing global demand over the long term.

Samsung has said it will operate six chip plants in Pyeongtaek by adding three more lines over the next few years.

“The specific date for the ground-breaking of Line 4 hasn’t been decided yet, but we are fully prepared. We can proceed at any time with just a press of the button,” said a Samsung official.

NO SIGN OF INDUSTRY UPTURN YET

Samsung CEO Kyung said on Wednesday there is no sign yet that business conditions will improve in the second half of this year or next year.

“Times are still tough. But we’re preparing for the next industry boom,” he said.

He said if Samsung’s chip technology is one generation ahead of its rivals, it can sell its chips at prices 10% higher.

“It is true that Micron and SK Hynix have narrowed the technology gap (with us) compared to five or ten years ago,” he said.

He said Samsung is also eyeing M&As for expansion in existing and new businesses. "We can't say our M&A targets now, but we're very positive about acquisitions," he said.

In mid-August, the company said it will also spend 20 trillion won by 2028 on an advanced semiconductor research and development complex to secure an edge in the increasingly competitive foundry market.

Samsung, the No. 2 foundry player, saw its market share gap with TSMC widen in recent years while other chipmakers are rapidly chasing the frontrunners.

Write to Ji-Eun Jeong at jeong@hankyung.com

In-Soo Nam edited this article.

More to Read

-

ElectronicsSamsung set for record Q3 profits on iPhone 14 series

ElectronicsSamsung set for record Q3 profits on iPhone 14 seriesSep 07, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix bets on 2025 memory upturn with $11 billion new plant

Korean chipmakersSK Hynix bets on 2025 memory upturn with $11 billion new plantSep 06, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersMicron’s entry into DDR5 market: A boon for Samsung, SK Hynix

Korean chipmakersMicron’s entry into DDR5 market: A boon for Samsung, SK HynixAug 30, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung to spend $74 bn on chip production lines in Korea

Korean chipmakersSamsung to spend $74 bn on chip production lines in KoreaAug 23, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung to invest $15 bn in semiconductor R&D complex

Korean chipmakersSamsung to invest $15 bn in semiconductor R&D complexAug 19, 2022 (Gmt+09:00)

5 Min read

Comment 0

LOG IN