Korean chipmakers

SK Hynix bets on 2025 memory upturn with $11 billion new plant

The new investment comes as a surprise as SK earlier held off on another chip plant, citing market uncertainty

By Sep 06, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Hynix Inc., the world’s second-largest memory chipmaker, will spend 15 trillion won ($11 billion) over the next five years to build a new memory plant, expecting an industry upturn by 2025.

The South Korean chipmaker said on Tuesday it will break ground on the fabrication plant, dubbed M15X, next month with an aim to complete construction in early 2025.

The plant, an extension of its M15 line, will be built on a 60,000 square-meter plot of land in the Cheongju Technopolis industrial complex, south of Seoul.

SK currently owns three NAND flash memory fabs – M11, M12 and M15 – and a packaging facility at the Cheongju industrial complex.

The company also runs DRAM production facilities in Icheon, Korea as well as memory chip plants in Wuxi, Chongqing and Dalian, China.

The company said the new fab will be a two-story building with a size similar to the M11 and M12 facilities combined. The construction of the new fab comes earlier than planned, it said.

The new plant will produce memory chips, but SK said it will decide later whether it will make DRAM or NAND chips there, depending on market conditions.

“Looking back on the past 10 years, SK Hynix was able to grow into a global company as it boldly carried out investment at times of crisis,” said Vice Chairman and Co-Chief Executive Park Jung-ho.

“As we look to prepare for the next 10 years now, I believe starting the M15X will be the first step to lay the foundation for solid future growth.”

SURPRISE MOVE

The decision to build a new memory plant comes as a surprise as the company earlier hinted at curtailing capital expenditure for this year and 2023, citing uncertain market conditions.

SK Hynix said in mid-July that it is holding off on a 4.3 trillion won plan to build a new NAND chip factory, M17, amid growing global uncertainty and falling chip prices.

Company executives had raised concerns over the rising inflation, which is putting a chill on demand for electronics goods, which widely use semiconductors.

The soaring value of the dollar and the weakening won are also pushing raw material prices higher, forcing the chipmaker to rethink the construction of the M17 plant at a time when NAND flash memory chip prices are on a slide.

However, SK Hynix said on Tuesday it expects the memory business to start to recover steadily from 2024 and rebound in 2025 as industry data in recent years showed the memory business cycle has become less volatile.

“With the M15X, we’re preparing for the next (industry) upturn expected to come in 2025,” the company said in a statement.

Company officials said SK may spend more in addition to the 15 trillion won investment to expand the M15X facility.

Regarding the restart of the construction of the M17 plant, it said it will decide after reviewing the market situation further.

SK’S NAND RANKING SLIPS TO THIRD

According to market tracker TrendForce, SK Hynix ranked third in the global NAND flash market with an 18% share, following market leader Samsung Electronics Co. (35.3%) and Japan’s Kioxia (18.9%) as of the first quarter.

In the fourth quarter of 2021, SK Hynix was the No. 2 player behind Samsung.

Industry watchers said SK Hynix’s market share gap with Kioxia will widen unless the Korean chipmaker expands its facilities and sells more NAND chips.

Japan's Ministry of Economy, Trade and Industry said in July that it will provide Kioxia with 92.9 billion yen in support of facilities under construction in Yokaichi, Shiga.

SK Hynix will also be competing with Samsung, which plans to add three more chip fabrication lines to its Pyeongtaek plant, which currently operates three fabs.

Back in 2012 when chipmakers were scaling back investments amid an industry downturn, SK Hynix increased its investment by more than 10% compared with the previous year, resulting in higher profits from the end of 2012.

In 2015, it built three plants, including the M14, amid growing market uncertainty. As chip demand rose, the company posted record earnings for two years from 2017.

Write to Ji-Eun Jeong at jeong@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersMicron’s entry into DDR5 market: A boon for Samsung, SK Hynix

Korean chipmakersMicron’s entry into DDR5 market: A boon for Samsung, SK HynixAug 30, 2022 (Gmt+09:00)

2 Min read -

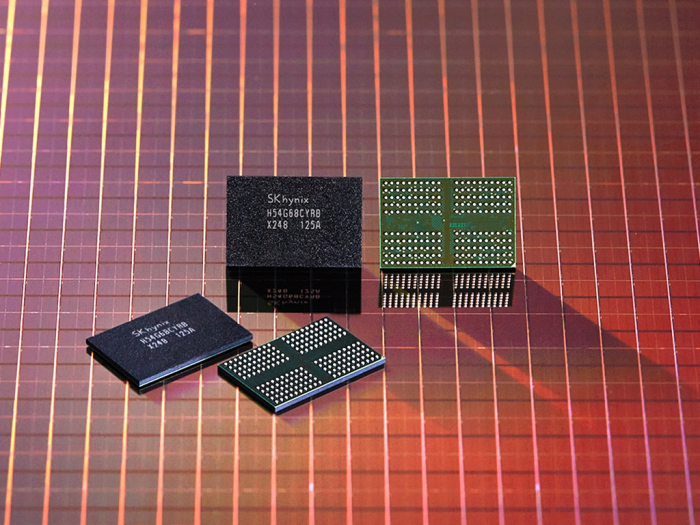

Korean chipmakersSK Hynix unveils world's first 238-layer NAND; Samsung SSD 20 times faster

Korean chipmakersSK Hynix unveils world's first 238-layer NAND; Samsung SSD 20 times fasterAug 03, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix puts $3.3 billion factory plan on hold amid global uncertainty

Korean chipmakersSK Hynix puts $3.3 billion factory plan on hold amid global uncertaintyJul 20, 2022 (Gmt+09:00)

2 Min read -

EarningsSK Hynix posts record Q1 sales buoyed by Solidigm, may build another fab

EarningsSK Hynix posts record Q1 sales buoyed by Solidigm, may build another fabApr 27, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chips

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chipsFeb 04, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN