SK Hynix puts $3.3 billion factory plan on hold amid global uncertainty

The decision follows LG Energy Solution’s move last month to reconsider its $1.3 billion US battery project

By Jul 20, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

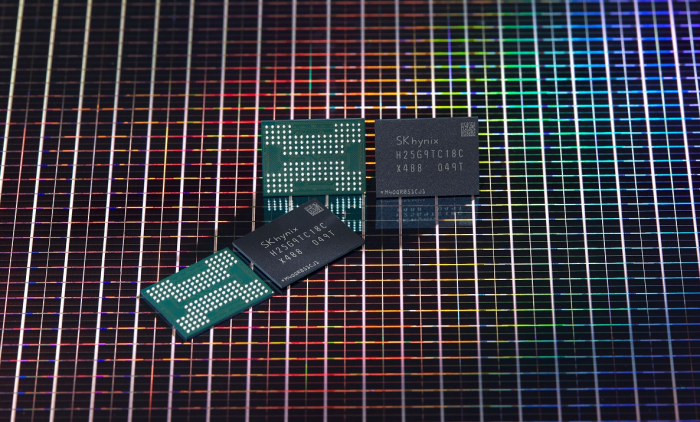

SK Hynix Inc., the world’s second-largest memory chipmaker, has decided to hold off on a 4.3 trillion won ($3.3 billion) plan to build a new NAND chip factory amid growing global uncertainty and falling chip prices.

The soaring value of the dollar and the weakening won are also pushing raw material prices higher, forcing the chipmaker to rethink the construction of the new plant at a time when NAND flash memory chip prices are on a slide, industry officials said.

SK Hynix earlier said it plans to expand capacity with a new NAND plant, dubbed M17, in Cheongju, North Chungcheong Province, some 140 km south of Seoul, with the construction work set to start next year for completion by 2025.

The company is also said to be slashing its capital spending plan for next year.

According to a recent Bloomberg News report, SK Hynix is reassessing projected chip demand and is considering reducing its 2023 capital expenditure by about a quarter to 16 trillion won in response to slower electronics demand than anticipated.

While largely sticking with its plan to spend about 21 trillion won this year building up DRAM and NAND capacity, the company is rethinking its expansion plans for next year due to rising uncertainty over dwindling demand for chips that go into everything from smartphones to servers, the report said.

NOT ALONE

Chipmakers around the world are moving to moderate supply growth, citing worsening economic conditions.

Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s top foundry chipmaker, recently decided to cut its spending plans despite strong second-quarter earnings, according to media reports.

US memory chipmaker Micron Technology Inc. is also taking action to cut its expenditures to adjust chip supplies.

BATTERY MAKERS ALSO DELAYING PROJECTS

Chipmakers’ decision to readjust their capital spending plans follows a similar move by battery manufacturers.

LG Energy Solution Ltd., one of the world’s largest electric-vehicle battery makers, said last month it is reassessing its 1.7 trillion won project to build a battery factory in the US state of Arizona, citing increasing costs.

The company said in March it will build an 11-gigawatt-hour production facility for cylindrical batteries in Queen Creek, Arizona.

The initial plan was to start construction in the second quarter of this year and begin mass production by the latter half of 2024.

According to the Financial Supervisory Service, Korean companies reported a total of 8.3 trillion won in facility investment and tangible asset acquisitions in the first half, down 35.2% from 12. 81 trillion won in the year-earlier period.

Write to Shin-young Park and Ik-hwan Kim at nyusos@hankyung.com

In-Soo Nam edited this article.

-

BatteriesLG Energy to supply $765 million batteries to Japan’s Isuzu Motors

BatteriesLG Energy to supply $765 million batteries to Japan’s Isuzu MotorsJul 05, 2022 (Gmt+09:00)

3 Min read -

BatteriesLG Energy considers billion-dollar battery plant in Arizona

BatteriesLG Energy considers billion-dollar battery plant in ArizonaMar 22, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix to supply industry’s best-performing DRAM to Nvidia

Korean chipmakersSK Hynix to supply industry’s best-performing DRAM to NvidiaJun 09, 2022 (Gmt+09:00)

1 Min read -

EarningsSK Hynix posts record Q1 sales buoyed by Solidigm, may build another fab

EarningsSK Hynix posts record Q1 sales buoyed by Solidigm, may build another fabApr 27, 2022 (Gmt+09:00)

2 Min read -

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in Canada

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in CanadaMar 24, 2022 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix develops memory chip with computing capabilities

Korean chipmakersSK Hynix develops memory chip with computing capabilitiesFeb 16, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chips

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chipsFeb 04, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsSK Hynix wins China’s approval for $9 billion Intel NAND acquisition

Mergers & AcquisitionsSK Hynix wins China’s approval for $9 billion Intel NAND acquisitionDec 23, 2021 (Gmt+09:00)

4 Min read