M&As

SK Hynix wins China’s approval for $9 billion Intel NAND acquisition

The deal places Hynix ahead of Kioxia as the world’s No. 2 NAND player and narrows gap with market leader Samsung

By Dec 23, 2021 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Hynix Inc. has received approval from China’s antitrust regulator for its $9 billion deal to acquire Intel Corp.’s NAND memory chip business, clearing the last hurdle to the South Korean chipmaker’s largest-ever acquisition.

With the green light from China’s State Administration for Market Regulation, SK Hynix has received all required merger clearances from competition authorities in eight jurisdictions around the world, the company said on Wednesday.

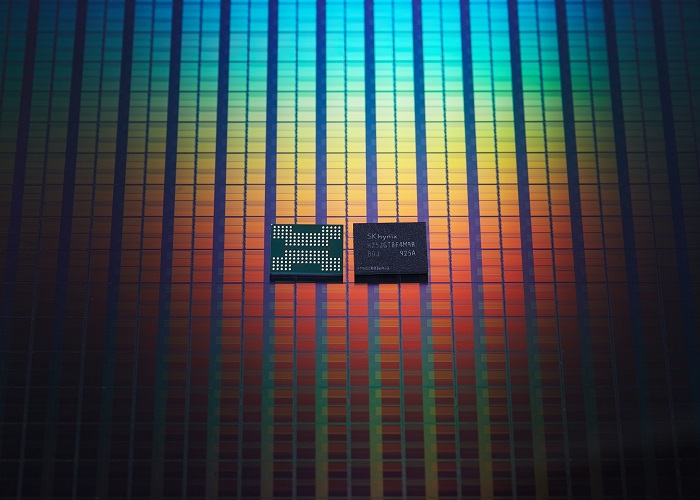

The deal, once completed, will place SK Hynix ahead of Japan’s Kioxia Holdings Corp. as the world’s second-largest NAND memory maker and narrow its gap with market leader Samsung Electronics Co.

Combined with Intel’s NAND business, SK Hynix’s market share stands at 19.4% as of the third quarter, still far behind Samsung’s 34.5%, according to market tracker TrendForce.

“We will enhance our competitiveness in the NAND flash and SSD (solid-state drive) business by continuing the remaining post-merger integration process,” SK Hynix said in a statement.

In October of 2020, SK Hynix signed a 10.3 trillion won ($9 billion) all-cash deal to buy Intel’s NAND memory chip and SSD operations to shore up its position in the booming memory market.

The acquisition is the largest ever by a Korean company, far higher than Samsung’s $8 billion deal in 2016 to acquire Harman International Industries Inc.

The deal also includes an Intel factory in Dalian, China. SK Hynix said the main part of the transaction, involving a payment of $7 billion, will close by the end of this year. The remaining $2 billion payment is expected to be made by March 2025.

To foot the bill, SK Hynix said on Wednesday it has raised about 8 trillion won via a rights offering to its affiliated corporations in the US and China.

The chipmaker, whose customers include Apple Inc. and Huawei Technologies Co., has said it aims to more than triple its NAND flash memory revenue over five years through the acquisition.

US-CHINA TENSIONS

There has been speculation in the market that China’s approval could be delayed significantly amid rising tensions between China and the US, which is striving to reduce the powerful Asian nation’s influence in the technology sector.

Last month, Washington’s top trade official Katherine Tai said SK Hynix’s capital spending plans, including factory expansion, in China, could pose a threat to the US’s national security.

SK Hynix had planned to bring some of the new extreme ultraviolet lithography (EUV) machines made by Dutch firm ASML Holding N.V., to its factory in Wuxi, China, to renovate its plant and improve the efficiency of memory chip production. But the US opposed the idea, citing potential use for military purposes.

SK Hynix later said it does not have an immediate plan to install the equipment in its Wuxi factory.

MUTUALLY BENEFICIAL

Industry officials said China’s approval of the SK Hynix deal would be mutually beneficial as China has also secured a stable procurement of chips, which have been in short supply in recent months, disrupting other industries such as automobiles and electronics around the globe.

In return for its regulatory approval, China said SK Hynix agreed to several commitments with regard to its future sales to Chinese customers such as a further expansion of its facility in China and limits on price hikes.

For SK Hynix, the acquisition of Intel’s NAND and SSD businesses will considerably enhance its presence in the rapidly growing market.

The corporate solid-state drive market is expected to grow to $30.7 billion globally by 2024 from $10.5 billion in 2019, according to an industry forecast.

Intel is already the world’s second-largest corporate SSD player with a 29.6% market share, and if combined with SK Hynix, the merged entity will control more than a third of the market, overtaking the current leader Samsung at 34.1%.

Most of SK Hynix’s revenue comes from its DRAM business, where the chipmaker is the world's second-largest supplier after Samsung.

To catch up with Samsung, SK Hynix said last week it has further advanced its DRAM technology and shipped samples of 24 Gigabit (Gb) double data rate 5 (DDR5) DRAM, the industry’s highest density for a single chip.

SK Hynix said it expects the new product will also ease the market's DRAM supply glut by moving faster to the next-generation chips.

Write to Shin-young Park at nyusos@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SK Hynix to set up US NAND firm led by Intel’s senior vice president

SK Hynix to set up US NAND firm led by Intel’s senior vice presidentAug 06, 2021 (Gmt+09:00)

2 Min read -

SemiconductorsSamsung overtakes Intel as foundry looms as next battlefield

SemiconductorsSamsung overtakes Intel as foundry looms as next battlefieldAug 02, 2021 (Gmt+09:00)

3 Min read -

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMC

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMCMar 24, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN