Semiconductors

Samsung overtakes Intel as foundry looms as next battlefield

Sandwiched between bigger rival TSMC and fast-follower Intel, Samsung should boost foundry investment, analysts say

By Aug 02, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. overtook Intel Corp. as the world’s top chipmaker by revenue in the second quarter, but the South Korean technology giant faces a bigger showdown with the US rival in the foundry business.

Last week, Samsung said it racked up 22.74 trillion won ($19.7 billion) in semiconductor revenue in the three months to June, beating out Intel, which posted $19.6 billion in total revenue.

Excluding the contribution of a business unit that Intel has agreed to sell, the Santa Clara-based company’s sales stood at $18.5 billion in the second quarter.

Intel has held the No. 1 sales spot for much of the past three decades, ceding it to Samsung, the world’s top memory chipmaker, in 2017 and 2018 when memory chip sales boomed.

Given divergent outlooks for their core businesses, the position is likely to stay that way in the near future, the Wall Street Journal reported on Monday, citing industry analysts.

While reporting a 54% on-year jump in its overall operating profit in the second quarter, Samsung, which is also the world’s top maker of smartphones, attributed its decent chip performance to higher-than-expected prices of DRAM and NAND chips amid pent-up demand in the pandemic.

According to market data provider DRAMeXchange, the July contract price of DDR4 8Gb for PCs, one of the most common DRAM products, has risen 7.89% to $4.1 from the previous month. The July figure is the highest since April 2019.

The July contract price of 128Gb NAND flash used in memory cards and USBs was $4.81, up 5.48% from the previous month. The latest reading is the highest since September 2018.

NEXT BATTLEGROUND

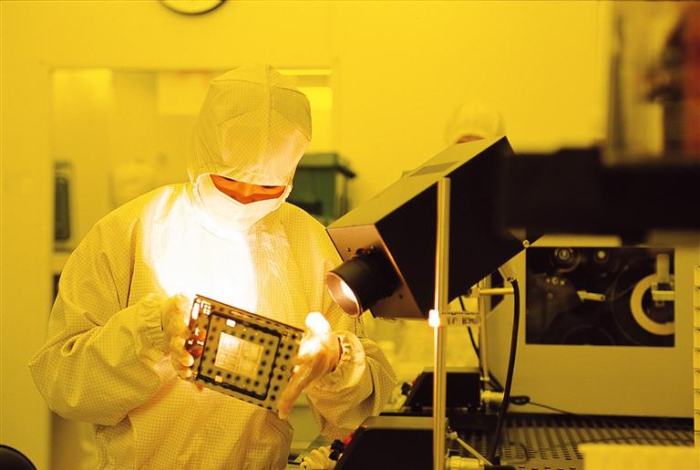

Despite Samsung’s ascension to the top post as the highest-grossing chipmaker, however, analysts say the Korean company faces an uphill battle against Intel as the US company is aggressive with its ambitious project to become a leader in the foundry business that manufactures cutting-edge chips for fabless firms, including chip designers.

Intel Chief Executive Pat Gelsinger said last week it aims to become the world’s top foundry player by 2025 by investing heavily in that business.

The CEO said Intel, the largest US manufacturer of microprocessors, has already secured Qualcomm Inc. and other semiconductor companies as its clients. Those firms have so far outsourced chipmaking to Taiwan Semiconductor Manufacturing Co. (TSMC) and Samsung that have dominated the foundry sector for years.

The Intel CEO’s announcement came just a few months after the company in March unveiled a $20 billion spending plan to build two new chip factories in Arizona to jump into the foundry field.

TSMC is currently the biggest foundry player, controlling 55% of the global market, followed by Samsung with a 17% market share, according to market researcher TrendForce.

“Samsung’s chip business revenue is volatile, fluctuating in accordance with memory chip prices in the market. The company needs to expand its investment in the foundry business to compete with bigger rival TSMC and deal with growing threats from Intel,” said a local industry official.

SAMSUNG’S VISION 2030

Under its Vision 2030, Samsung plans to invest a total of 133 trillion won ($116 billion) to become the world’s top foundry player by then. The company is known to be spending 10 trillion won a year to develop chip foundry technology and purchase the necessary equipment.

During a second-quarter earnings call with analysts last Thursday, Samsung’s foundry operation chief said the company is targeting 20% annual sales growth for its foundry business this year.

Write to Shin-Young Park at nyusos@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SemiconductorsChip supercycle view revives with DRAM, NAND prices at multi-year highs

SemiconductorsChip supercycle view revives with DRAM, NAND prices at multi-year highsJul 30, 2021 (Gmt+09:00)

2 Min read -

EarningsSamsung works on industry’s first 200-layer NAND as its Q2 profit jumps

EarningsSamsung works on industry’s first 200-layer NAND as its Q2 profit jumpsJul 29, 2021 (Gmt+09:00)

3 Min read -

-

Semiconductor rivalrySamsung loses ground in foundry market as TSMC ties in with Japanese firms

Semiconductor rivalrySamsung loses ground in foundry market as TSMC ties in with Japanese firmsJun 01, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN