Samsung considers chip output cut as first-quarter loss looms large

The move would mark a turnaround from its earlier stance to stick with its production plans and advance tech to tide over the crisis

By Jan 27, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

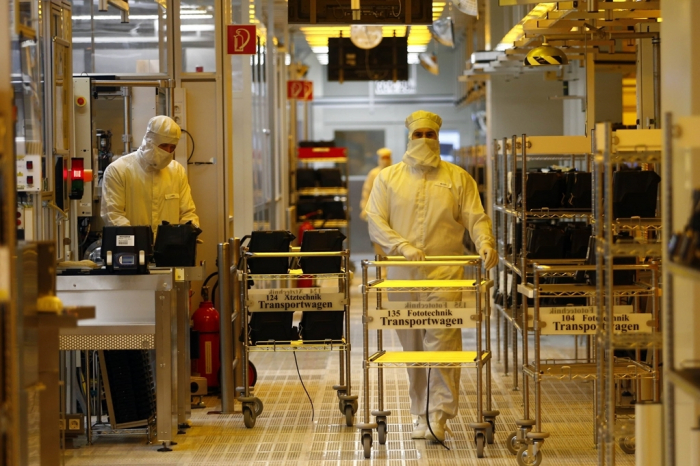

Samsung Electronics Co., the world’s largest memory chipmaker, is considering slashing its semiconductor production as the company is heading for a massive operating loss in the first quarter.

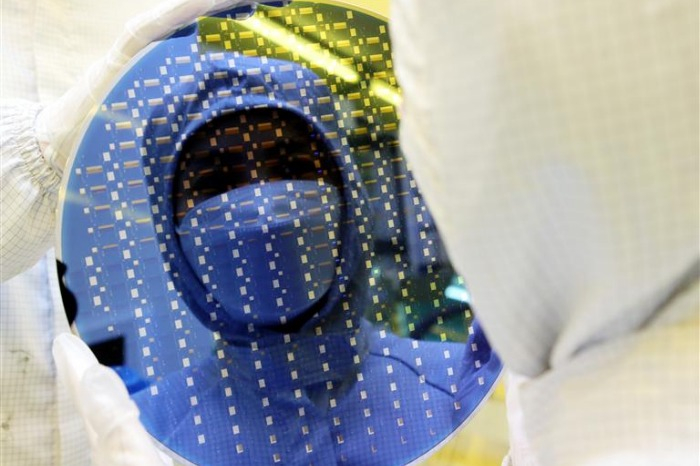

The South Korean tech giant is now serious about cutting wafer input to produce much fewer DRAM and NAND chips, people familiar with the matter said on Friday.

The move would mark a turnaround from Samsung’s consistent stance that it would stick with its production plans while advancing its chipmaking technologies to tide over rising inventories and slowing demand.

With analysts forecasting a deeper-than-expected industry slowdown, however, Samsung is now mulling moves to follow its rivals in reducing capital expenditures and chip production volumes to buttress falling prices and ease a supply glut, sources said.

Chipmakers such as SK Hynix Inc., Micron Technologies Inc. and Japan’s Kioxia Corp. have been implementing production cuts since October.

In a recent research report, Citigroup Global Markets said the chances of Samsung adjusting its chip supply strategy by slashing investments are growing as sharper-than-expected memory chip price declines are threatening to push Samsung’s profitability below its breakeven point.

The bearish outlook underscores the depth of a sharp slowdown in a global technology sector grappling with worsening consumer demand brought about by decades-high inflation rates, rising interest rates and the economic downturn.

CHANCE OF SAMSUNG POSTING LOSSES LOOMS LARGE

Earlier this month, the South Korean tech giant posted its worst quarterly operating profit in eight years as the global economic slowdown dampened demand for semiconductors from electronics makers.

The company also gave a dim near-term outlook, slashing its 2023 chip profit forecast by half as major chipmakers and their clients struggle to adjust their high inventory levels.

Samsung’s memory chip business may have already been bleeding, boding ill for its performance throughout this year.

Industry watchers said Samsung will likely post an operating loss to the tune of 1 trillion won ($811 million) from its semiconductor business in the first quarter, compared with an estimated loss of 500 billion won in the fourth quarter of last year.

The semiconductor loss could widen to 1.5 trillion won in the second quarter if the adverse market conditions continue, they said.

FURTHER TROUBLE AHEAD UNLESS MORE CUTS

Intel Corp. said on Thursday its fourth-quarter sales fell 32% year-on-year to $14 billion, the lowest in six years. It also posted an operating loss of $1.13 billion and a net loss of $661 million.

Company executives said they expect to lose money in the current quarter, surprising investors with a bleaker-than-expected outlook for both the PC market and slowing growth in its key data center division.

“We expect some of the largest inventory corrections literally that we've ever seen in the industry,” Chief Executive Pat Gelsinger told investors on a conference call.

Analysts said the semiconductor market would see more trouble ahead unless major chipmakers engage in further production cuts.

“However, if majors such as SK Hynix and Micron additionally cut their output, the DRAM market could stage a meaningful rebound as early as the second half,” said an industry official.

(Updated with Samsung’s 2023 business outlook and the possibility of further output cuts by industry peers)

Write to Jeong-Soo Hwang, Ji-Eun Jeong and Sungsu Bae at hjs@hankyung.com

In-Soo Nam edited this article.

-

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by half

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by halfJan 06, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung may cut spending as foundry players brace for downturn

Korean chipmakersSamsung may cut spending as foundry players brace for downturnJan 13, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsKorea proposes bigger tax breaks for chipmakers, key industries

Business & PoliticsKorea proposes bigger tax breaks for chipmakers, key industriesJan 03, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip sales

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip salesDec 13, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to make 3 nm chips for Nvidia, Qualcomm, IBM, Baidu

Korean chipmakersSamsung to make 3 nm chips for Nvidia, Qualcomm, IBM, BaiduNov 22, 2022 (Gmt+09:00)

3 Min read -

EarningsSamsung reiterates no memory chip output cut despite weak Q3 results

EarningsSamsung reiterates no memory chip output cut despite weak Q3 resultsOct 27, 2022 (Gmt+09:00)

2 Min read