Samsung foundry ‘relief pitcher’ Han Jin-man vows to improve 2-nm yields

Samsung will pursue a 'two-track' strategy to narrow the tech gap with TSMC and fend off fast follower SMIC

By Dec 09, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co.'s new contract chipmaking business chief said on Monday he will go all-in to improve the company’s advanced 2-nanometer chip processing technology and secure more clients to take on foundry rival Taiwan Semiconductor Manufacturing Co.

In his inaugural message to Samsung employees as head of its foundry business, Han Jin-man said he will pursue a “two-track strategy” to narrow Samsung's technology gap with TSMC and fend off competition with fast followers, including China’s Semiconductor Manufacturing International Corp., better known as SMIC.

Samsung, the world’s No. 1 memory chipmaker, last month promoted Han, executive vice president of its US semiconductor business, to president and named him to lead its foundry business, which has been incurring sizable losses for years.

Han previously worked in design teams for DRAM and flash memory and led solid-state drive development and strategic marketing.

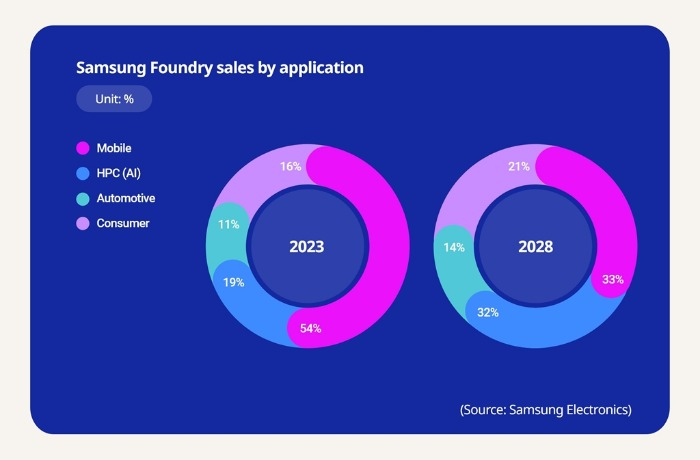

The new Samsung foundry leader will be tasked with securing large companies such as Qualcomm, AMD and Nvidia as its clients.

‘RELIEF PITCHER’

The South Korean tech giant last month reshuffled its top brass in a sweeping move as it faces an uphill battle against memory rival SK Hynix Inc. and foundry rival TSMC.

Samsung also created the chief technology officer (CTO) position for its foundry business to bolster its contract chipmaking business.

Nam Seok-woo, the new foundry CTO, was previously president and head of FAB Engineering & Operations. Samsung said he is an expert in semiconductor process development and manufacturing with extensive experience in memory process and foundry manufacturing technology.

Nam and Han, Samsung’s two foundry chiefs, will be charged with closing Samsung’s gap with foundry leader TSMC.

RAMP-UP OF 2-NANOMETER PROCESS NODE PRODUCTION

On Monday, Han said he will focus on improving the yield of its cutting-edge 2-nm process and expanding clients for mature processes.

He also stressed the importance of a “rapid ramp-up" of foundry production using the 2-nm process.

"Although we were the first to transition to the gate-all-around (GAA) process, we still have significant shortcomings in commercialization,” he said.

In June 2022, Samsung became the first chipmaker to mass-produce 3-nm chips using its GAA technology.

In the foundry market, however, Samsung is struggling to catch up with TSMC, whose clients include Nvidia, Google and Apple.

According to market research firm TrendForce, TSMC's foundry market share rose to 64.9% in the third quarter from 62.3% in the second quarter of this year.

TSMC is reported to be starting mass production of 2-nm products next year, further solidifying its lead.

CHASED BY FAST FOLLOWERS

While fighting an uphill battle against TSMC, Samsung is also witnessing the emergence of fast followers.

Industry observers said Samsung faces growing competition from Chinese players like SMIC, whose market share gap with Samsung has narrowed to 3.3 percentage points in the third quarter from 5.8 percentage points in the previous quarter.

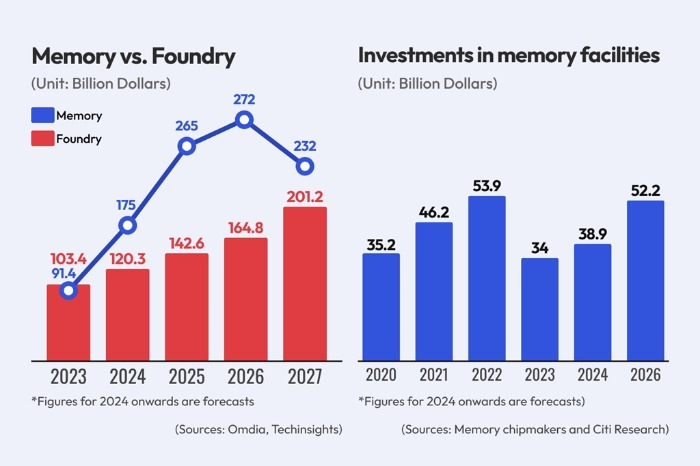

To improve the profitability of its foundry business, which has been posting quarterly losses of more than 1 trillion won ($700 million), Samsung plans to expand its client base for mature processes of 10 nm and above.

As part of such efforts, Samsung revamped its foundry organization, replacing executives in its design platform development team to hold them accountable for the low production yields of its mobile processor, Exynos 2500.

Earlier, Samsung planned to equip its Galaxy S25 smartphone due out next year with Qualcomm Inc.’s Snapdragon 8 and Samsung’s Exynos 2500. But it changed its plan and decided to rely solely on the Snapdragon 8 Series for the Galaxy S25.

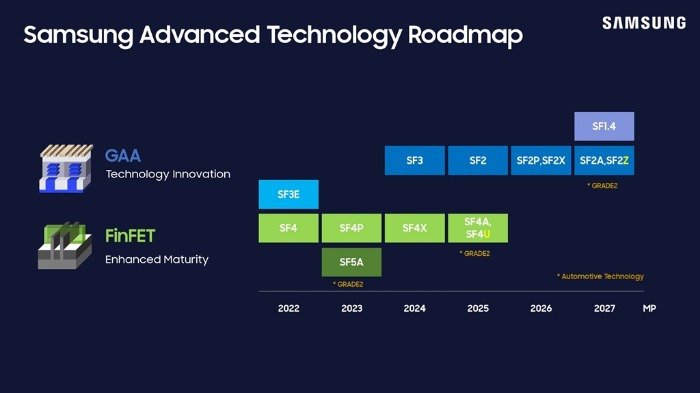

Last year, Samsung said it aims to move to more advanced 1.4-nm chip processing technology by 2027.

Chipmaking processes carry a numerical label that loosely denotes the size of the transistors that can be packed on a chip. The number refers to the thickness of the circuitry that can be drawn on the transistor. The lower the number, the more advanced the technology.

With demand for high-performance chips rising, competition for technology advancement is also fierce, particularly between TSMC and Samsung.

While Samsung’s production tech is based on GAA transistor architecture for its microfabrication process, TSMC mainly uses a different technology in the fin field-effect transistor (FinFET) structure.

Write to Chae-Yeon Kim at why29@hankyung.com

In-Soo Nam edited this article.

-

Executive reshufflesSamsung reshuffles top brass; Co-CEO to control memory business

Executive reshufflesSamsung reshuffles top brass; Co-CEO to control memory businessNov 27, 2024 (Gmt+09:00)

3 Min read -

Executive reshufflesSamsung to replace chiefs of 3 key posts: Memory, foundry, system LSI

Executive reshufflesSamsung to replace chiefs of 3 key posts: Memory, foundry, system LSINov 26, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip development

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip developmentSep 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung unveils new foundry tech; AI chip sales to rise ninefold

Korean chipmakersSamsung unveils new foundry tech; AI chip sales to rise ninefoldJun 13, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung on smooth track to 1.4 nm foundry tech to take on TSMC

Korean chipmakersSamsung on smooth track to 1.4 nm foundry tech to take on TSMCJun 28, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundry

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundryNov 29, 2022 (Gmt+09:00)

6 Min read -

Korean chipmakersSamsung to make 2-nanometer GAA chips by 2025 to overtake TSMC

Korean chipmakersSamsung to make 2-nanometer GAA chips by 2025 to overtake TSMCOct 07, 2021 (Gmt+09:00)

3 Min read