Samsung to replace chiefs of 3 key posts: Memory, foundry, system LSI

The overarching theme of Samsung’s year-end leadership reshuffle is seeking change amid stability

By Nov 26, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

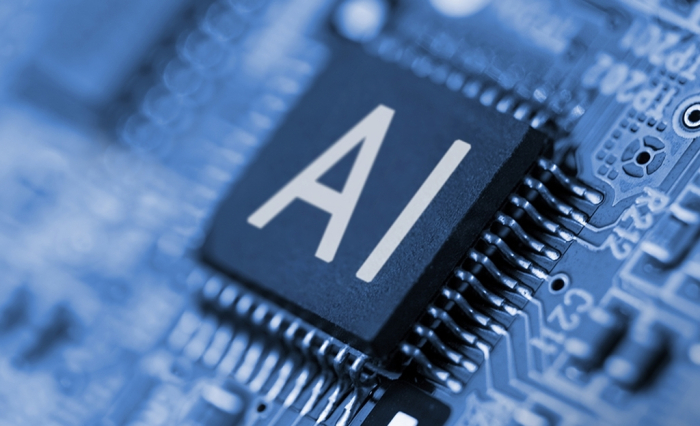

Samsung Electronics Co. plans to replace the three key posts of its semiconductor business — memory, foundry and system LSI — as the South Korean tech giant struggles to compete with its rivals, particularly in the booming AI chip arena.

Samsung, the world’s No. 1 memory chipmaker, will announce its major year-end executive reshuffles as early as Wednesday, people familiar with the matter said.

Jun Young-hyun, vice chairman and chief executive of Samsung’s Device Solutions (DS) division, which oversees its semiconductor business, will retain his post, sources said.

Han Jin-man, executive vice president of Samsung's US semiconductor business, will likely be tapped as the new memory business head, to lead Samsung’s high-bandwidth memory (HBM) chip business.

Nam Seok-woo, the DS division’s manufacturing & technology president, is expected to serve as the new foundry business head tasked with closing Samsung’s widening gap with foundry leader Taiwan Semiconductor Manufacturing Co.

Choi Jin-hyuk, head of the Memory Research Center under Samsung’s Americas Operations, will be named as the new System LSI Business head, overseeing the development of the Exynos application processors and image sensors, sources said.

SMARTPHONE, HOME APPLIANCE CHIEF HAN JONG-HEE TO STAY

Sources said Han Jong-hee, vice chairman and head of the Device eXperience (DX) division, which oversees Samsung’s smartphones and consumer electronics business, will remain as the business' CEO.

But he is expected to transfer control of the digital appliances (DA) business to Moon Jong-seung, current vice president and head of the DA Development Team.

Roh Tae-moon (TM Roh), head of the Mobile eXperience (MX) division, and Yong Seok-woo, president and head of the Visual Display (VD) division, will likely keep their roles, sources said.

Significant changes are expected for other key positions, however, such as the heads of global marketing and North American operations.

Jeong Hyeon-ho, vice chairman of Samsung’s Business Support Task Force, will likely retain his position.

Choi Joo-sun, CEO of Samsung Display Co., and Jang Deok-hyun, CEO of Samsung Electro-Mechanics Co., are also expected to retain their posts, sources said.

CHANGE AMID STABILITY

Analysts said the overarching theme of Samsung’s year-end leadership reshuffle is "seeking change amid stability."

Samsung faces growing business uncertainties with the return of Donald Trump to the White House as well as the ongoing legal risks surrounding Chairman Lee Jae-yong, who also goes by the name Jay Y. Lee.

While vice-chair-level leaders of the DS, DX, and Business Support TF divisions will retain their posts to mitigate external risk, the company plans to replace five or six president-level leaders in key business areas to instill a sense of crisis among its employees.

SAMSUNG’S COMPETITIVENESS PLUMMETS

Over the past several months, Samsung’s top executives have flagged imminent executive reshuffles and a business overhaul.

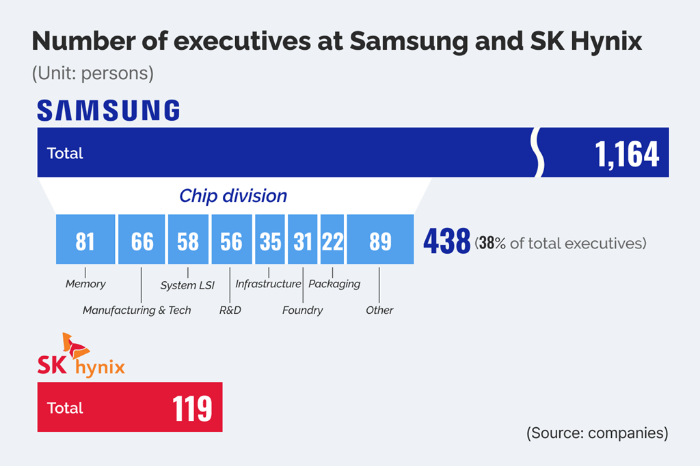

In October, Vice Chairman Jun Young-hyun said the company plans to drastically cut its chip executive ranks and restructure semiconductor-related operations as it struggles against rivals such as SK Hynix Inc. and Micron Technology Inc. in the advanced memory segment amid the AI boom.

As of the second quarter, Samsung’s DS division had 438 executives, accounting for 38% of the company's 1,164 executives. Samsung has more than double the number of chip executives as its crosstown competitor SK Hynix, which counts 199.

In a rare public apology for the weak third-quarter business performance, Jun said: "The management leading the (memory) business is fully responsible, and we will take the lead in overcoming this crisis and making the third quarter’s weak earnings a turning point for the company."

Through the drastic organizational revamp and executive job cuts, Samsung aims to uncover the reasons for the weakening competitiveness of its semiconductor business, particularly in HBM chips.

Among the semiconductor Big Three — Samsung, SK Hynix and Micron — Samsung is the only one that doesn’t supply the latest AI chip, HBM3E, to Nvidia Corp., the world’s top AI chip designer.

Samsung is supplying fourth-generation 8-layer HBM3 chips in small quantities to Nvidia.

SK Hynix, the world’s No. 2 memory chipmaker and the HBM chip leader, has been supplying 8-layer HBM3 chips in large quantities since March and plans to supply a more advanced 12-layer version starting in the fourth quarter.

Write to Jeong-Soo Hwang, Chae-Yeon Kim and Eui-Myung Park at hjs@hankyung.com

In-Soo Nam edited this article.

-

Corporate restructuringSamsung to cut chip executive jobs, restructure in battle versus SK Hynix

Corporate restructuringSamsung to cut chip executive jobs, restructure in battle versus SK HynixOct 10, 2024 (Gmt+09:00)

4 Min read -

ElectronicsSamsung Galaxy solidifies dominance in Indian smartphone market

ElectronicsSamsung Galaxy solidifies dominance in Indian smartphone marketNov 04, 2024 (Gmt+09:00)

2 Min read -

EarningsSK Hynix’s Q3 profit soars to record high, beats Samsung’s memory profit

EarningsSK Hynix’s Q3 profit soars to record high, beats Samsung’s memory profitOct 24, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soars

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soarsOct 23, 2024 (Gmt+09:00)

3 Min read -

EarningsSamsung chip head vows drastic revamp after flagging weak Q3 earnings

EarningsSamsung chip head vows drastic revamp after flagging weak Q3 earningsOct 08, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip development

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip developmentSep 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boom

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boomSep 04, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talent

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talentJul 08, 2024 (Gmt+09:00)

4 Min read