HBM chip war intensifies as SK Hynix hunts for Samsung talent

Competition for AI chip supremacy is heating up between the two rivals, particularly in the HBM4 chip segment

By Jul 08, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean chipmaker SK Hynix Inc., just like its global peers, has largely designed and produced semiconductors in-house, including high-bandwidth memory (HBM), an AI chip, whose demand is growing explosively.

For the next-generation AI chip, HBM4, however, the company plans to outsource chip manufacturing to a foundry or contract chipmaker, most likely Taiwan Semiconductor Manufacturing Co. (TSMC).

Going one step further, the Korean chipmaker is aggressively looking for top talent to advance its own HBM technology and oversee tech outsourcing. The main target for its manhunt? Its crosstown rival Samsung Electronics Co.

SK Hynix, the world’s No. 2 memory chipmaker after industry leader Samsung, recently posted a global recruitment notice seeking experienced workers for 48 HBM-related positions.

Interested professionals are required to submit their applications to SK Hynix by July 15.

In its notice, SK said it is looking for chip experts with more than four years of work experience to enhance HBM logic die yields through foundry process improvements and logic die testing.

Required competencies include the ability to thoroughly analyze the latest foundry technology and develop foundry devices, according to the recruitment notice.

The company is particularly seeking to hire nine chip engineers in a foundry process called FinFET, a technology that can increase the power efficiency of semiconductors. Interested people must have more than 10 years of work experience.

SAMSUNG ON HIGH ALERT

Industry watchers said SK Hynix’s planned hiring raises concerns among rival chipmakers over talent outflow as they struggle to retain experienced workers.

Samsung Electronics, in particular, is on high alert as it faces its first-ever labor strikes aimed at higher wages and better working conditions.

SK Hynix’s move is part of an industry-wide hiring war to recruit highly skilled workers to capitalize on the AI boom, which is guzzling up AI chips such as HBM.

Although Samsung is the world’s top memory chipmaker, it lags far behind SK Hynix in the HBM segment.

Last week, Samsung officially launched dedicated HBM and advanced chip packaging teams as part of its efforts to catch up to SK Hynix.

Samsung, which vows to triple its HBM output this year, is eager to pass quality testing currently underway by Nvidia Corp., the world’s No. 1 AI chip designer.

SAMSUNG, SK HYNIX VIE FOR TOP SPOT IN HBM4 CHIPS

Industry sources said SK Hynix needs to hire top-notch engineers for the sixth-generation HBM4, of which it is slated to begin mass production next year, as well as for the development and advancement of the next-generation 3D DRAM chip and the processing-in-memory (PIM) chip.

In April, SK said it was partnering with TSMC to jointly develop next-generation AI chips.

SK Hynix dominates the production of HBM, critical for generative AI computing, while the Taiwanese foundry player’s advanced packaging technology helps HBM chips and graphic processing units (GPUs) work together efficiently.

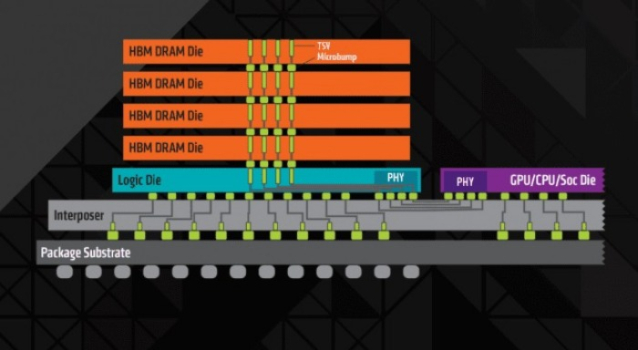

SK Hynix said the two companies will initially focus on improving the performance of the base die at the very bottom of the HBM package.

HBM is made by stacking a core DRAM die on top of a base die through processing technology called Through Silicon Via (TSV). The base die is connected to the GPU, which controls HBM chips.

SK Hynix said it has used proprietary technology to make base dies up to HBM3E, the fourth-generation DRAM memory, but plans to adopt TSMC’s advanced logic process for HBM4’s base die so additional functionality can be packed into limited space.

The two companies will also collaborate to optimize the integration of SK Hynix's HBM and TSMC's 2.5D packaging process, called CoWoS technology while cooperating in responding to common customer requests related to HBM.

SAMSUNG TO COUNTER WITH FULL-SERVICE

Samsung, for its part, has added 300 engineers to its newly established HBM team to develop HBM4 chips.

The world’s No. 2 foundry player after TSMC, Samsung can handle all processes related to HBM4, including logic die design, packaging and production.

Vice Chairman Jun Young-hyun, who in May took the helm of Samsung’s Device Solutions (DS) division, which oversees the company’s chip business, vowed to overtake HBM sector leader SK Hynix within the next few years.

“Competition for AI chip supremacy is heating up between Samsung and SK Hynix, particularly for the HBM4 chip. The first challenge for Samsung is to get its HBM chips approved by Nvidia,” said an industry official.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teams

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teamsJul 05, 2024 (Gmt+09:00)

3 Min read -

EarningsSamsung’s Q2 profit soars on AI chips; second-half outlook rosy

EarningsSamsung’s Q2 profit soars on AI chips; second-half outlook rosyJul 05, 2024 (Gmt+09:00)

3 Min read -

Corporate investmentSK Group, led by SK Hynix, to invest $77 billion in AI, chips

Corporate investmentSK Group, led by SK Hynix, to invest $77 billion in AI, chipsJul 01, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung unveils new foundry tech; AI chip sales to rise ninefold

Korean chipmakersSamsung unveils new foundry tech; AI chip sales to rise ninefoldJun 13, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025May 30, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growth

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growthMay 07, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEO

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEOMay 02, 2024 (Gmt+09:00)

5 Min read -

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacy

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacyApr 19, 2024 (Gmt+09:00)

4 Min read