Samsung Electronics, TSMC tie up for HBM4 AI chip development

Through the collaboration, Samsung hopes to keep SK Hynix, the dominant HBM player, in check

By Sep 05, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

TAIPEI – South Korea’s Samsung Electronics Co., the world’s largest memory chipmaker, is partnering with its foundry rival Taiwan Semiconductor Manufacturing Co. (TSMC) to jointly develop a next-generation artificial intelligence chip, HBM4, in a push to strengthen their positions in the fast-growing AI chip market.

Dan Kochpatcharin, head of Ecosystem and Alliance Management at TSMC, said during a Semicon Taiwan 2024 forum on Thursday that the two companies are co-developing a bufferless HBM4 chip.

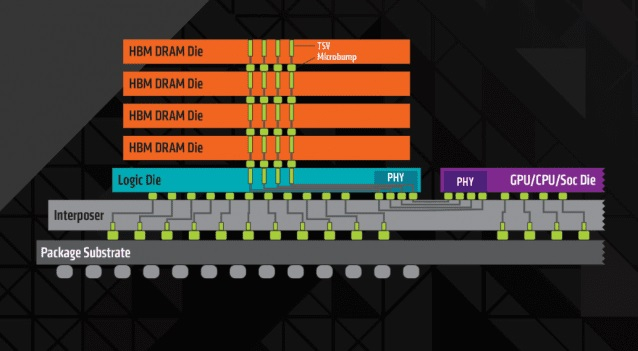

HBM, short for high-bandwidth memory, is an advanced DRAM chip critical to the AI boom as it provides much-needed faster processing speed compared with traditional memory chips.

HBM4 is the sixth-generation HBM chip, which major memory makers such as Samsung, SK Hynix Inc. and Micron Technology Inc. plan to mass-produce for AI chip designers, including Nvidia Corp, as early as next year.

Analysts said if Samsung and TSMC collaborate on the development of bufferless HBM4 chips, it would mark their first partnership in the AI chip segment.

In foundry or contract chipmaking, Samsung is the No. 2 player, fiercely competing with bigger rival TSMC.

Semicon Taiwan 2024, organized by the chip industry association SEMI, is an annual international gathering of chip professionals. With over 1,100 chip-related enterprises participating, this year’s event is being held through Friday at the Taipei Nangang Exhibition Center.

Industry officials said the bufferless HBM4 will have 40% higher power efficiency and 10% lower latency than existing models.

As the memory manufacturing process gets more and more complex, cooperation with partners “has become more important than ever,” said Kochpatcharin.

SAMSUNG TO MASS-PRODUCE HBM4 IN 2025

Sources said Samsung’s collaboration with TSMC will start with the cutting-edge sixth-generation HBM4 chip, of which the Korean company plans to begin mass production in the second half of next year.

Through the partnership, Samsung aims to deliver “customized chips and services” requested by clients like Nvidia and Google.

While Samsung is capable of providing comprehensive HBM4 services, including memory production, foundry and advanced packaging, it hopes to leverage TSMC’s technology to secure more clients, sources said.

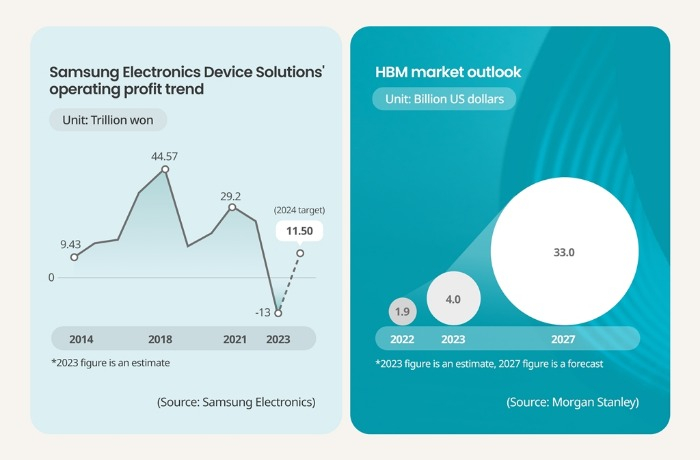

The move comes as Samsung is striving to overtake its crosstown rival SK Hynix, the dominant HBM player with a 53% share of the AI chip market.

Samsung commands 35% of the market, according to market research firm TrendForce.

To solidify its HBM leadership, SK Hynix, which is not engaged in the foundry business, joined hands with TSMC in April to jointly produce HBM4 chips. SK plans mass production of HBM4 in 2026.

SAMSUNG SEEKS OUT PARTNERSHIP

On Wednesday, Lee Jung-bae, corporate president and head of Samsung’s memory business, said during a keynote speech at Semicon Taiwan 2024 that “to maximize the performance of AI chips, customized HBM is the best choice. We are working with other foundry players to offer more than 20 customized solutions.”

At the forum’s CEO Summit, he said while Samsung’s System LSI and Memory divisions handle chip design and production, the company will leverage other foundry player’s manufacturing capabilities to maximize HBM performance.

"There are limits to improving HBM performance using traditional memory processes alone,” he said.

STRATEGIC MOVE

The manufacturing process for HBM4 is different from previous generations, as the logic die, which acts as the brain of an HBM chip, will be produced by foundry companies rather than memory manufacturers.

Samsung plans to provide a turnkey service – from DRAM production to logic die production and advanced packaging. However, it is also considering using TSMC’s technology as there are customers who prefer TSMC-produced logic dies, sources said.

“To become a leader in the HBM segment, Samsung must take bold measures that go beyond developing new technologies,” said an industry official.

SK Hynix is currently the top supplier of HBM3 AI chips to Nvidia, which controls 80% of the AI chip market.

Samsung, which has passed Nvidia’s qualification tests for its HBM3 chips, is striving to gain the US AI chip designer’s approval for its HBM3E chips.

Write to Chae-Yeon Kim and Jeong-Soo Hwang at Why29@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boom

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boomSep 04, 2024 (Gmt+09:00)

3 Min read -

EarningsSK Hynix to supply 12-layer HBM3E to Nvidia in Q4; profit soars in Q2

EarningsSK Hynix to supply 12-layer HBM3E to Nvidia in Q4; profit soars in Q2Jul 25, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to mass-produce HBM4 on 4 nm foundry process

Korean chipmakersSamsung to mass-produce HBM4 on 4 nm foundry processJul 15, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talent

Korean chipmakersHBM chip war intensifies as SK Hynix hunts for Samsung talentJul 08, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teams

Korean chipmakersSamsung launches dedicated HBM, advanced chip packaging teamsJul 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025May 30, 2024 (Gmt+09:00)

3 Min read -

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisis

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisisMay 21, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growth

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growthMay 07, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacy

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacyApr 19, 2024 (Gmt+09:00)

4 Min read