SK Hynix seeks to raise $373 million as chip recovery looms large

The company may raise its capital spending plan for this year if necessary, analysts say

By May 17, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Hynix Inc., the world’s second-largest memory chipmaker, is seeking to raise as much as 500 billion won ($373 million) in bank loans to secure funds for investment amid growing signs that the semiconductor market is bottoming out.

The South Korean company plans to borrow 300 billion won from Hana Bank to finance its planned investment. The company is also working to borrow an additional 200 billion won from other financial institutions.

“We want to secure money to prepare for a market upturn, which we expect as early as the third quarter,” said a company official.

While leading memory chipmakers posted dismal operating losses in recent quarters, underscoring the severity of the chip industry downturn, most companies have expressed views that a much-awaited market recovery is possible in the latter part of this year.

The rosy outlook follows an industrywide move to cut wafer input and chip production since the fourth quarter of last year to counter growing inventories and falling chip prices.

Analysts said the “last piece” of recovery expectations came from memory market leader Samsung Electronics Co., which last month announced that it would also join its peers’ moves to curtail output by adjusting its wafer input.

While Samsung did not disclose the exact level it would cut, Citigroup analysts said the chipmaker is expected to cut DRAM levels by 20% and NAND levels by 15%.

SK DENIES TALK OF FINANCIAL CRUNCH

SK Hynix has denied persistent market speculation that the company is suffering from a financial squeeze and is tapping the money market to raise operating funds.

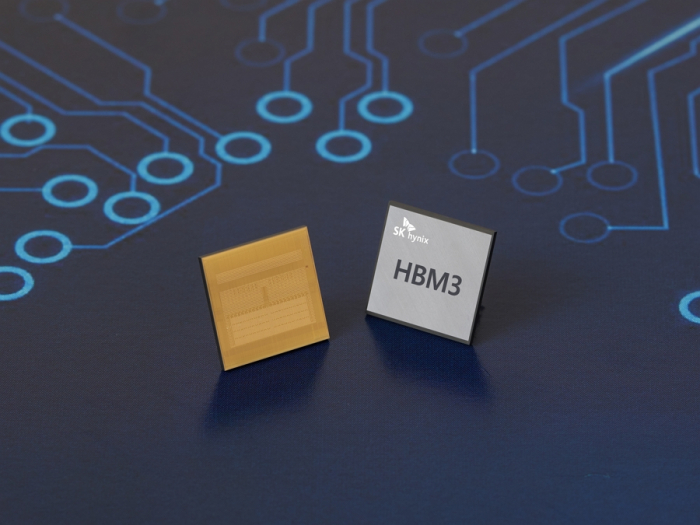

After posting a record quarterly loss in the first three months of the year, SK said it will maintain its investment in high-end memory products such as AI chips even as it is cutting overall capital expenditures.

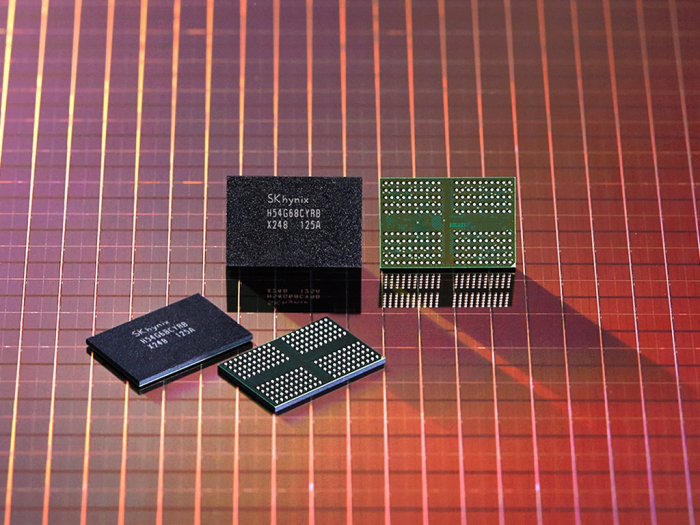

SK Hynix makes most of its profits from selling memory chips such as DRAM and NAND.

The company plans to spend about 9 trillion won in facility investment this year, half of its 2022 spending.

SK’s first-quarter capital expenditures reached 1.75 trillion won and if the trend continues, it may raise its full-year spending above the planned 9 trillion won, analysts said.

Last month, SK said it is securing $1.5 billion by issuing exchangeable bonds in a preemptive move to raise funds before market liquidity dries up.

The company has been experiencing a cashflow squeeze after incurring 600 billion won in one-off charges related to the worsened NAND business at its two overseas invested firms – Japan’s Kioxia and San Jose-based Solidigm.

As of the end of the first quarter, SK Hynix had 6.13 trillion won in cash and cash equivalents.

RECOVERY SIGNALS

In a recent note to clients, Citi said the brokerage is still defensive on the chip sector but there are several positive signs, including the stabilization of PC sales, AI-driven growth and a gradual recovery in the handset market.

Taiwan-based Supreme Electronics Co., the world’s largest distributor of memory parts and components, saw its sales increase for three consecutive months, with its April sales rising 33% from the previous month to NT$12.5 billion.

Supreme buys DRAM and NAND chips from companies like Samsung and SK Hynix and sells them in China and Hong Kong.

“Supreme’s improving sales could mean increasing memory demand in China,” said an industry official.

Market sentiment is also improving.

According to market tracker TrendForce, spot prices of DDR5 and other major DRAM chips are rising, with SK Hynix’s DDR4 and DDR3 chips in particular demand.

Spot prices are often a leading indicator for long-term contract prices.

Industry data showed memory chip prices began staging a rebound for the first time in more than a year in April, boosting hopes for a sooner-than-expected market recovery.

Critics, however, cautioned against hasty optimism, saying that the industry’s chip inventory remains at an elevated level.

While reiterating its buy ratings on most memory chipmakers, Citi said it is neutral on companies like Intel and Advanced Micro Devices (AMD) after April notebook data showed shipments fell 24% month on month.

Data from market researcher IDC showed that global PC shipments in the first quarter fell 29% from the year-earlier period.

Samsung and SK Hynix’s chip inventories at the end of the first quarter were estimated at 31.95 trillion won and 17.18 trillion won, up from 29.06 trillion won and 15.66 trillion won, respectively, in the previous quarter.

Write to Jeong-Soo Hwang, Ik-Hwan Kim and Nan-Sae Bin at hjs@hankyung.com

In-Soo Nam edited this article.

-

EarningsSamsung bets on H2 recovery with heavy spending after record chip losses

EarningsSamsung bets on H2 recovery with heavy spending after record chip lossesApr 27, 2023 (Gmt+09:00)

4 Min read -

EarningsSK Hynix expects second-half market recovery after record Q1 loss

EarningsSK Hynix expects second-half market recovery after record Q1 lossApr 26, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyed

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyedApr 12, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix to raise $1.5 bn in exchangeable bonds

Korean chipmakersSK Hynix to raise $1.5 bn in exchangeable bondsApr 03, 2023 (Gmt+09:00)

1 Min read -

Corporate bondsSK Hynix set for largest-ever corporate bond issue at bargain prices

Corporate bondsSK Hynix set for largest-ever corporate bond issue at bargain pricesFeb 08, 2023 (Gmt+09:00)

1 Min read -

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

4 Min read