Earnings

Samsung’s chip output cut: Boon for industry, price rebound

Its shares surged as investors bet on an earlier-than-expected industry recovery, as soon as the second half

By Apr 07, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co., the world’s largest memory chipmaker, said on Friday it is curtailing chip production after its semiconductor business posted its first quarterly loss in more than a decade. Its shares rose 4.7% as investors bet on an earlier-than-expected industry recovery.

“We’re adjusting memory output downwardly to a meaningful level, especially that of products with supply secured,” the South Korean tech giant said in a regulatory filing.

But the company said it will continue to invest in infrastructure buildup and expand R&D spending to solidify its market leadership over the long term.

The company didn’t provide details such as the size of reduction volumes or the type of products affected, but industry officials said Samsung would be slashing production of DDR4 DRAM chips by about 20-30%.

Investors welcomed the move – an about-face of its earlier stance that there would be no “forced” output reduction.

While rivals such as Micron Technology, Kioxia and SK Hynix Inc. have slashed their investment and cut production, Samsung has been holding out, using the current market downturn as an opportunity to expand its market share lead so it can take advantage of an eventual rebound in demand.

On Seoul’s main stock bourse, shares of Samsung rose as much as 4.7% to 65,200 won in early trade. The stock closed up 4.3% at 65,000 won, outperforming the benchmark Kospi index’s 1.3% gain.

WORST RESULTS SINCE GLOBAL FINANCIAL CRISIS

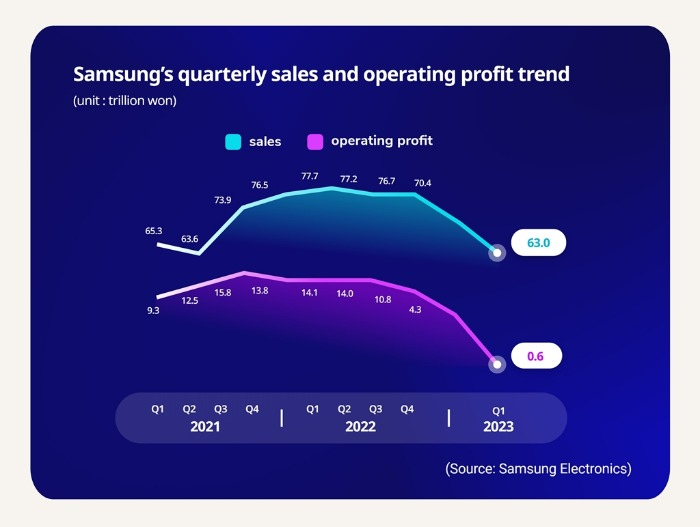

Earlier in the day, Samsung said it estimates its consolidated operating profit plunged 96% to 600 billion won ($456 million) in the first quarter from 14.12 trillion won in the year-earlier period.

The estimate, which came in much worse than market expectations of around 1.1 trillion won, would mark the company’s worst quarterly profit since the global financial crisis in 2009 if confirmed later this month.

First-quarter sales likely fell 19% from a year earlier to 63 trillion won.

“Memory demand dropped sharply due to the macroeconomic situation and slowing customer purchasing sentiment as many customers continue to adjust their inventories for financial purposes,” Samsung said in a statement.

The company is due to release detailed results, including a divisional breakdown and net profit, later this month.

Although Samsung didn’t provide divisional performance, analysts said the company’s semiconductor business likely swung to a loss as an industry chip glut worsened and buyers slowed purchases amid a global economic slowdown.

Samsung’s Device Solutions division, which oversees its chip business, likely posted a loss of around 4 trillion won, its first shortfall in 14 years, analysts said.

FASTER-THAN-EXPECTED RECOVERY

Samsung’s official announcement that it is lowering memory production volumes bodes well for the entire chip industry – a move that could lead to a rebound as early as the second half of this year.

Earlier this year, SK Hynix said it would more than halve its capital spending for this year after posting its first quarterly operating loss in a decade.

Micron also said it would cut its fiscal 2023 investment plans by more than 30% to hasten the rebound of memory chip prices.

Prices of DRAM memory chips, widely used in smartphones, PCs and servers plunged about 20% during the first quarter, while prices for NAND flash chips used in data storage fell about 10-15%, according to market tracker TrendForce.

Memory chip prices will continue to remain subdued in the second quarter, TrendForce said.

GALAXY S23 SERIES SUPPORTS MOBILE PROFITS

While demand for smartphones is sluggish overall, Samsung’s mobile business likely performed relatively well, boosted by its premium models, including the Galaxy S23 series launched during the quarter.

The latest Galaxy series have beaten their predecessor Galaxy S22 smartphones in sales volume, less than two months after the newest smartphones came on the market.

Samsung, also the world’s largest smartphone manufacturer by volume, expects the new products to strengthen its overall mobile phone market leadership and put it on an equal footing with Apple’s high-end line of iPhones.

Samsung’s mobile devices business likely posted 3.5 trillion won in first-quarter operating profit, while its display business and home appliance business likely earned 800 billion won and 300 billion won, respectively, in the first three months of the year, analysts said.

(Updated with Samsung’s business outlook for the rest of the year and analysts’ estimates for the company’s other business divisions)

Write to Ik-Hwan Kim and Jeong-Soo Hwang at lovepen@hankyung.com

In-Soo Nam edited this article.

More to Read

-

-

AutomobilesHyundai Motor to emerge as Korea’s highest earner, beating Samsung

AutomobilesHyundai Motor to emerge as Korea’s highest earner, beating SamsungApr 03, 2023 (Gmt+09:00)

3 Min read -

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

4 Min read -

EarningsSamsung vows no chip output cut, eyes second-half demand recovery

EarningsSamsung vows no chip output cut, eyes second-half demand recoveryJan 31, 2023 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung considers chip output cut as first-quarter loss looms large

Korean chipmakersSamsung considers chip output cut as first-quarter loss looms largeJan 27, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN