Earnings

SK Hynix expects second-half market recovery after record Q1 loss

The chipmaker said it will focus on high-end products such as DDR5, LPDDR5 and HBM3 to tide over the current crisis

By Apr 26, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Hynix Inc., the world’s second-largest memory chipmaker, said on Wednesday it expects the global semiconductor market to rebound in the second half after it posted a record quarterly loss due to a continued supply glut.

The South Korean chipmaker said the memory industry will start improving as early as this quarter, offering one of the industry’s most optimistic views on the expected market recovery yet.

“Memory industry levels at customers declined throughout the first quarter while inventories across the memory industry are expected to improve from the second quarter with production cuts by suppliers,” the company said in a statement.

“We forecast an improvement in market conditions from the second half.”

SK Hynix and its global peers such as Micron Technology and Kioxia have been cutting wafer input since the fourth quarter of last year to counter growing inventories and falling chip prices.

Samsung Electronics Co., the world’s largest memory chipmaker, which previously was reluctant to slash production, said earlier this month it is also joining the industrywide move to curtail output by adjusting its wafer input.

RECORD QUARTERLY LOSS

Earlier in the day, SK Hynix said it logged losses for the second consecutive quarter in the first three months of the year as the weak global economy put a chill on demand for semiconductors used in PCs and other digital gadgets.

The company posted a record operating loss of 3.4 trillion won ($2.5 billion) in the first quarter, turning from a profit of 2.86 trillion won in the year-earlier period.

The first-quarter loss is wider than its 1.7 trillion won shortfall in the previous quarter – the company’s first quarterly loss in a decade.

Its net loss came in at 2.59 trillion won in the first quarter, also a turnaround from a net profit of 1.98 trillion won a year earlier.

Sales fell 58.1% on year to 5.08 trillion won.

“As the memory chip downturn continued through the first quarter, we posted a sequential drop in revenue and a wider operating loss on sluggish demand and falling product prices,” the company said.

“But we expect our revenue to rebound in the second quarter after bottoming out in the first, driven by a gradual increase in sales volume.”

SK Hynix makes most of its profits from selling memory chips such as DRAM and NAND.

BETS ON HIGH-PERFORMANCE CHIPS

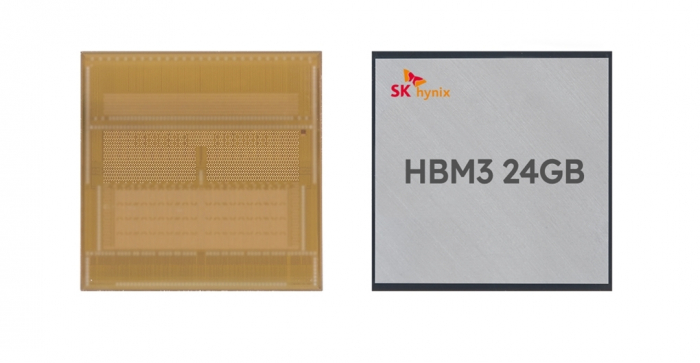

The company said it will focus on high-performance DRAM products, including server DDR5 and HBM as well as advanced NAND chips such as 176-layer SSDs and uMCPs to improve its profitability and increase sales.

It said it will also maintain its investment in high-end memory products such as AI chips even as it is cutting overall capital expenditures.

The company said it will heavily spend to prepare for mass production of 1b nanometer DRAM – a fifth generation 10-nanometer technology – and 238-layer NAND to support a quick business turnaround.

It said it expects the growing high-performance server market for artificial intelligence, including ChatGPT, and wider adoption of high-capacity memory products by customers to have a positive impact on the memory market.

“With advanced products such as DDR5, LPDDR5 and HBM3, we will solidify our leadership in the premium market,” Chief Financial Officer Kim Woo-hyun said.

“The memory market is still under tough conditions but it seems to be bottoming out.”

Write to Ye-Rin Choi at rambutan@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSK Hynix unveils industry’s slimmest 12-layer, 24 GB HBM3 chip

Korean chipmakersSK Hynix unveils industry’s slimmest 12-layer, 24 GB HBM3 chipApr 20, 2023 (Gmt+09:00)

2 Min read -

EarningsSamsung’s chip output cut: Boon for industry, price rebound

EarningsSamsung’s chip output cut: Boon for industry, price reboundApr 07, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS ActMar 28, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stunted

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stuntedMar 22, 2023 (Gmt+09:00)

3 Min read -

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN