Samsung, SK Hynix look to China exit plans as growth stunted

While Korea plans to build a massive chip cluster, its chipmakers are seeking ways to work around the US curbs

By Mar 22, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co. and SK Hynix Inc., the world’s two largest memory chipmakers, are in quandary over their growth strategies in China following the announcement of US guardrails on semiconductor manufacturers' subsidies for their US operations.

The two South Korean companies may seek ways to drastically reduce their Chinese business as the Joe Biden administration’s latest move looks to stunt growth for chipmakers that wish to continue business transactions in China, analysts said.

“The guardrail provisions are essentially asking chipmakers to maintain their status quo for now and eventually pull out of China,” said an official at a Korean chip company.

According to the US Commerce Department’s follow-up announcement to the CHIPS and Science Act on Tuesday, companies winning US grants cannot meaningfully expand advanced production capacity in “countries of concern” such as China and Russia.

The new rules ban firms from spending more than $100,000 over a decade when adding capacity for advanced chips such as 128-layer or more NAND flash and DRAM with a circuit width of 18 or narrower nanometers.

They also cannot add more than 5% to the existing capacity, via wafer inputs, of any single plant making these semiconductors in China. For legacy chip processes, the increase in wafer input volume will be limited to 10% over a decade.

Grant recipients, however, can still make technology upgrades to existing facilities if they receive approval from the US Commerce Department.

TECH ADVANCEMENT COULD OFFSET WAFER INPUT LIMIT

Industry watchers said the US restrictions are less stringent than feared as advancement in processing technology could minimize any negative impact of the wafer input ceilings.

“Even if the amount of wafer input is maintained, the volume of chips produced will increase under ultra-fine process technology,” said an industry official.

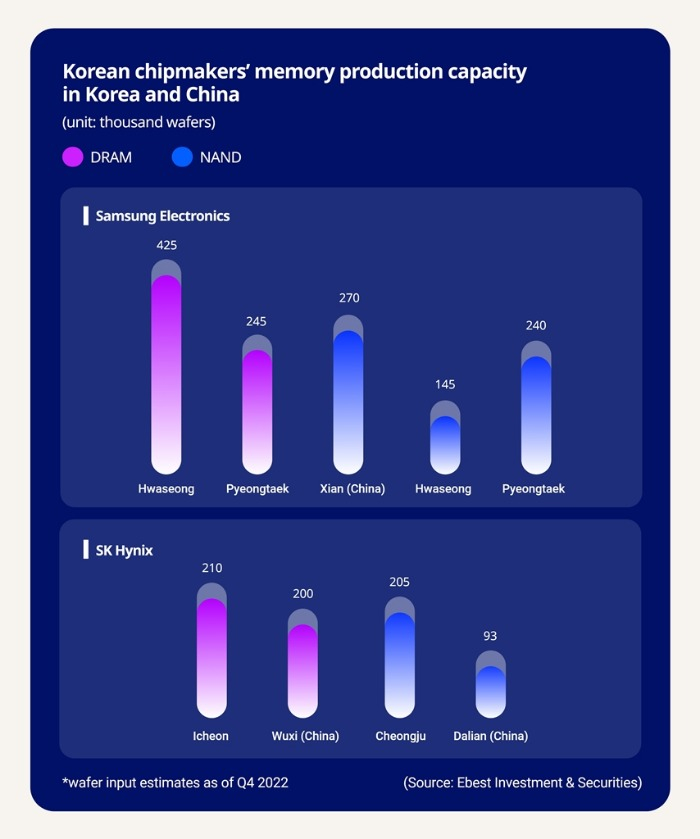

In China, Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing.

Samsung’s Xian plant accounts for nearly 40% of the company’s entire NAND production globally while SK Hynix’s Wuxi plant produces about 48% of its global DRAM output.

Last October, the US government granted Samsung and SK Hynix a one-year waiver, allowing them to continue to take chips and chipmaking equipment to their factories in China.

While the one-year reprieve would give Korean chipmakers temporary breathing room, Samsung and SK Hynix will eventually seek to reduce their operations in China and increase chip production in Korea or the US, analysts said.

Samsung and SK Hynix said they will determine their next steps after closely reviewing the US announcement.

Under pressure, however, Samsung reportedly is considering building a memory chip plant at its new US factory currently under construction in Taylor, Texas.

SK Hynix is also considering diversifying its global production facilities away from China. The company has already announced that it will build a chip packaging plant and a research center in the US.

Last week, the Korean government said it will create the world’s largest semiconductor cluster near Seoul by attracting 340 trillion won ($261 billion) in private investment from Samsung and other domestic companies.

Korean President Yoon Suk Yeol is traveling to the US next month for a summit meeting with his counterpart Joe Biden over tricky issues involving the CHIPS Act and the Inflation Reduction Act, which are increasingly causing headaches for Korean companies.

Write to Jeong-Soo Hwang, In-Seol Jeong and So-Hyeon Kim at hjs@hankyung.com

In-Soo Nam edited this article.

-

Business & PoliticsKorean Chips Act set to pass parliament in March; coverage expanded

Business & PoliticsKorean Chips Act set to pass parliament in March; coverage expandedMar 17, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsSouth Korea eyes $261 billion chip cluster; Samsung takes lead

Business & PoliticsSouth Korea eyes $261 billion chip cluster; Samsung takes leadMar 15, 2023 (Gmt+09:00)

4 Min read -

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issues

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractive

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractiveMar 06, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read