Earnings

Samsung bets on H2 recovery with heavy spending after record chip losses

With hefty R&D and facility expansion spending, the top memory chipmaker hopes to widen its market lead

By Apr 27, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. on Thursday reported its worst quarterly loss for its semiconductor business, but echoed the widely held industry view that the chip market will rebound in the latter part of this year.

The world’s largest manufacturer of memory chips and smartphones by volume said its Device Solutions division, which oversees its chip business, posted a record loss of 4.58 trillion won ($3.42 billion), its first shortfall in 14 years. The division’s sales reached 13.73 trillion won.

The significant loss comes a day after its crosstown rival SK Hynix Inc., which is the world’s No. 2 memory chipmaker, said it logged losses for the second consecutive quarter with 3.4 trillion won in chip losses for the first three months of the year.

“The memory business’s performance fell significantly … with ongoing inventory adjustments leading to a decrease in overall demand amid an economic slowdown and weakened customer spending,” Samsung said in a statement.

While its DRAM sales were sluggish due to inventory adjustments by server customers, its NAND sales performed relatively well as the company actively responded to a trend shift toward high-density storage devices, it said.

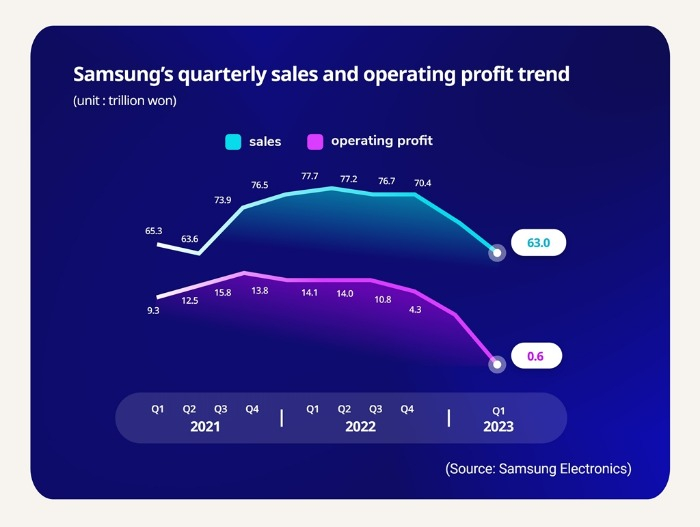

Overall, Samsung’s first-quarter operating profit on a consolidated basis plunged 95.5% to 640.2 billion won from 14.12 trillion won in the year-earlier period. That’s the company's worst quarterly operating profit since the first quarter of 2009 when the entire industry was hit by the global financial crisis.

Its net profit declined 86.1% on year to 1.57 trillion won. First-quarter sales fell 18% to 63.74 trillion won.

Thursday's first-quarter results came in line with Samsung’s preliminary estimates earlier this month.

LIMITED RECOVERY IN Q2

While the two leading memory chipmakers’ dismal losses underscore the severity of the semiconductor industry downturn, most leading chipmakers have expressed similar views on the timing of the expected market recovery.

“Looking ahead to the second quarter, we expect a limited demand recovery. In the second half, demand is expected to gradually recover as customer inventory levels will have declined due to inventory adjustments occurring since the second half of last year,” Samsung said.

Major chipmakers such as SK Hynix, Micron Technology and Kioxia have been cutting wafer input since the fourth quarter of last year to counter growing inventories and falling chip prices.

Samsung, which previously was reluctant to slash production, earlier this month said it is also joining the industrywide move to curtail output by adjusting its wafer input.

During an earnings conference call with analysts on Thursday, Kim Jae-joon, executive vice president of Samsung’s DS division, said its output cut would focus on legacy DRAM products, which have relatively weak demand.

To tide over the current crisis, Samsung said it will focus on boosting technological competitiveness, including the gate-all-around (GAA) based 2-nanometer process, while meeting the demand for DDR5, LPDDR5x and other high-end products.

The company also plans to begin mass production of high bandwidth memory or HBM3 chips in the second half.

HEFTY CAPITAL EXPENDITURES

As of the end of the first quarter, Samsung's inventory assets, including semiconductors, stood at 54.42 trillion won, up 4.3% or an increase of 2.23 trillion won from the end of 2022.

While its rivals have slashed their investment, Samsung said it will continue to spend heavily to use the current market downturn as an opportunity to expand its market share lead so it can take advantage of an eventual rebound in demand.

Samsung’s total capital expenditures in the first quarter stood at 10.7 trillion won, including 9.8 trillion won for semiconductors and 300 billion won for displays. That’s a record quarterly spending and marks a 36% increase from the year-earlier period.

The company said it will continue to expand its R&D spending to solidify its market leadership over the long term.

FOUNDRY DEMAND SHRINKS

Samsung said its foundry, or contract chipmaking business, saw demand decline in the first quarter due to higher inventory levels at clients.

In the second half, however, the market is expected to recover, it said.

The company’s first-quarter foundry investment focused on fabs in Taylor, Texas and Pyeongtaek, Korea to address the demand for advanced nodes.

Samsung is the world’s second-largest foundry player after market leader Taiwan Semiconductor Manufacturing Co.

Samsung’s mobile business performed well, boosted by its premium models, including the Galaxy S23 series launched during the quarter.

The company expects its premium products, including new foldable phones, to strengthen its overall mobile phone market leadership and put it on an equal footing with Apple’s high-end line of iPhones.

Samsung said an expected second-half recovery in the global smartphone and display markets will be led by improving market conditions in China.

(Updated with a Samsung executive's comments from the conference call on the type of chips for output reduction and those for increased production)

Write to Jeong-Soo Hwang and Ik-Hwan Kim at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EarningsSK Hynix expects second-half market recovery after record Q1 loss

EarningsSK Hynix expects second-half market recovery after record Q1 lossApr 26, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyed

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyedApr 12, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung’s chip output cut: Boon for industry, price rebound

EarningsSamsung’s chip output cut: Boon for industry, price reboundApr 07, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chips

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chipsApr 06, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN