Samsung to more than double chip investment in Texas

With the bold spending plan, Samsung will be eligible for over $6 bn in US chip subsidies, Wall Street Journal reports

By Apr 07, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

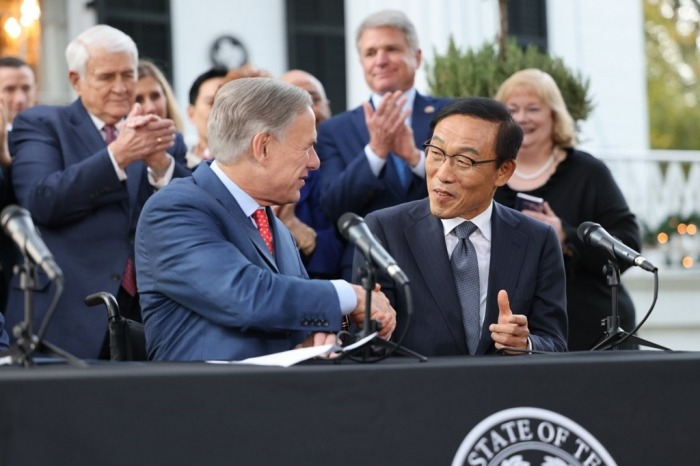

Samsung Electronics Co. plans to more than double its total semiconductor investment in Texas to about $44 billion to add an advanced semiconductor factory and a packaging facility near its foundry plant under construction, the Wall Street Journal reported on Friday.

The spending plan is more than double the $17 billion it pledged in 2021 to build a foundry plant in Taylor, Texas, near its existing operations in Austin, by the end of this year. At the time, that marked Samsung’s largest-ever investment in the US.

The additions of a semiconductor factory and a packaging plant are estimated to cost $20 billion and $4 billion, respectively, according to the report.

The world’s largest memory chipmaker is scheduled to announce the new investment plan on April 15, the newspaper reported, citing unnamed sources.

Once the $44 billion investment is completed, its semiconductor complex in Texas will be fully equipped to provide one-stop service from foundry to packaging to US-based fabless companies, or chip designers such as Nvidia Corp. and AMD Inc.

“One-stop service is the greatest strength that Samsung Electronics can provide to its customers as a comprehensive semiconductor company,” said a semiconductor industry official.

The increased spending will also be used to build an R&D facility at the Samsung semiconductor hub in Texas, which is expected to collaborate with the University of Texas at Austin, a top engineering school in the US.

The semiconductor market is mainly divided into foundry and packaging services.

Foundry companies assemble customized semiconductor chips for chip designers. Samsung trails Taiwan's TSMC Co., which controls over half of the foundry market.

Packaging is one of the final steps in semiconductor manufacturing. In the process, graphic processing units (GPU) are combined with high-performance DRAMs such as high bandwidth memory (HBM) to operate as a single chip.

US SUBSIDIES

If Samsung ramps up its investment in Texas to $44 billion, it is expected to qualify for over $6 billion in subsidies from the US government under the US Semiconductor Support Act, according to the Wall Street Journal report.

Last month, Bloomberg News reported that Samsung is expected to receive more than $6 billion in US chip subsidies -- more than expected -- on the condition that it commits to extra US investments beyond the ongoing project in Texas.

Its aggressive investment is expected to gain momentum from stronger-than-expected first-quarter results, with the semiconductor market showing signs of recovery after a one-and-half-a-year slump.

On Friday, Samsung said its operating profit in the January-March quarter is estimated at 6.6 trillion won ($4.9 billion), almost a tenfold jump from the year prior, thanks to strong demand for HBM, optimized for AI chipsets.

Last month, a senior Samsung executive said the company expected to nearly triple its HBM chip production volume this year, compared to last year.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

Korean chipmakersSamsung establishes HBM team to up AI chip production yields

Korean chipmakersSamsung establishes HBM team to up AI chip production yieldsMar 29, 2024 (Gmt+09:00)

2 Min read -

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demand

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demandApr 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bn

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bnApr 04, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to supply $752 million in Mach-1 AI chips to Naver, replace Nvidia

Korean chipmakersSamsung to supply $752 million in Mach-1 AI chips to Naver, replace NvidiaMar 22, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung to receive over $6 bn in US chip subsidies, eyes extra investment

Korean chipmakersSamsung to receive over $6 bn in US chip subsidies, eyes extra investmentMar 15, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung to build $281 million chip packaging R&D center in Yokohama

Korean chipmakersSamsung to build $281 million chip packaging R&D center in YokohamaDec 22, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung set to supply HBM3, packaging services to AMD

Korean chipmakersSamsung set to supply HBM3, packaging services to AMDAug 22, 2023 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung Elec to provide HBM3, packaging service to Nvidia

Korean chipmakersSamsung Elec to provide HBM3, packaging service to NvidiaAug 01, 2023 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMC

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMCNov 24, 2021 (Gmt+09:00)

4 Min read