Earnings

Samsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demand

Its NAND business also likely turned to a quarterly profit as the firm is set to see gains from quake-hit TSMC

By Apr 05, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co., the world’s largest memory chipmaker, said on Friday its first-quarter operating profit likely rose more than tenfold from a year earlier, boosted by a rebound in chip demand.

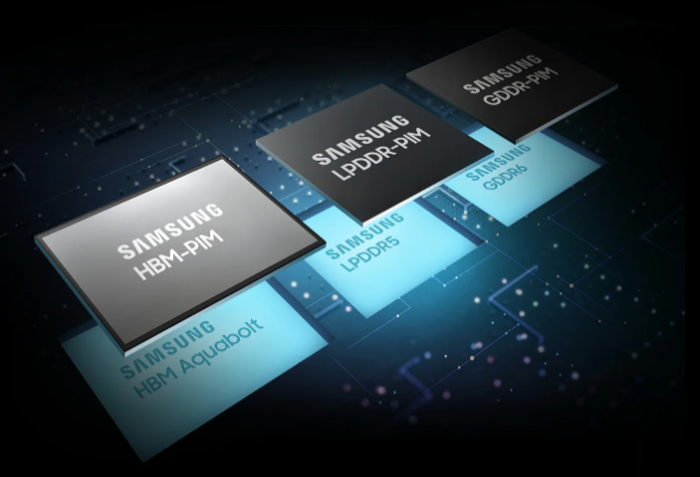

Analysts expect a continued tailwind for the Suwon, South Korea-based tech giant in the coming quarters on robust demand for advanced semiconductors such as high-bandwidth memory (HBM) used in artificial intelligence chipsets.

Samsung is also set to benefit from the recent earthquake in Taiwan, home to the world’s largest contract chipmaking or foundry company Taiwan Semiconductor Manufacturing Co. (TSMC), analysts said.

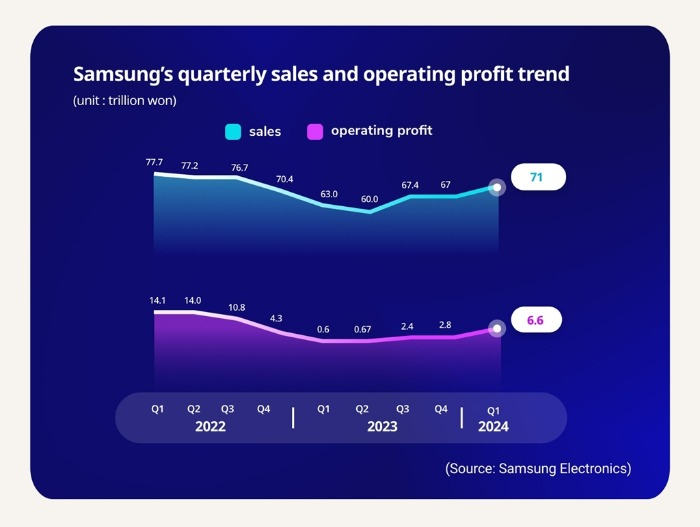

Samsung said in a regulatory filing that its operating profit in the January-March period is estimated at 6.6 trillion won ($4.9 billion), up 931% from 640 billion won in the year-earlier period on a consolidated basis.

The preliminary operating profit figures exceed market consensus forecasts of 5.48 trillion won. The first-quarter profit estimate also surpasses Samsung’s 2023 full-year operating profit of 6.57 trillion won.

First-quarter sales likely rose 11.4% from the same period a year earlier to 71 trillion won, it said.

Its sales estimate was slightly below market expectations of 71.95 trillion won.

Samsung plans to announce detailed quarterly results, including net profit and divisional performance, later this month.

If Samsung’s first-quarter sales are confirmed, it would mark the first time Samsung has posted quarterly sales in the 70 trillion won range since the fourth quarter of 2020 when it recorded 70.46 trillion won in revenue.

CHIP BUSINESS SWINGS TO PROFIT

Although Samsung didn’t provide a breakdown of its divisional performance, its Device Solutions (DS) division, which oversees its chip business, likely swung to a profit for the first time in five quarters.

Analysts said they expect Samsung’s chip business to post a first-quarter operating profit of 700 billion won to 1 trillion won, a turnaround from 2.2 trillion won in losses in the fourth quarter of last year.

If confirmed, Samsung would have posted its first quarterly chip profit since the fourth quarter of 2022 when it posted an operating profit of 270 billion won.

Samsung’s NAND flash memory business also likely turned to a profit in the first quarter, analysts said.

“Our chip business entered positive territory from January,” Kyung Kye-hyun, head of Samsung’s chip business, said during Samsung’s annual general meeting last month.

Memory chip prices have rebounded from a deep trough beginning in mid-2022 due to weak post-pandemic demand for gadgets that use the chips.

During the first quarter, memory chip prices jumped by about 20% versus the previous quarter for DRAM chips used in tech devices and 23-28% for NAND flash chips used for data storage, according to market tracker TrendForce.

The bullish outlook for memory chip demand, including exploding appetite for chips such as HBM used in AI chipsets, has driven a 29% rise in Samsung shares over the past 12 months.

On Friday, Samsung’s shares closed 0.9% lower at 84,500 won in line with the broader benchmark Kospi index’s 1% fall.

SET TO BENEFIT FROM TAIWAN QUAKE

Analysts said Samsung, a distant runner-up in the chip foundry segment, is expected to gain from the recent earthquake in Taiwan, which industry officials said would disrupt supply chain, particularly supplies from TSMC.

The 7.2-magnitude quake that struck Taiwan’s eastern coast on Wednesday morning killed nine people and injured more than 1,000. It was Taiwan’s largest earthquake in at least 25 years.

Taiwan plays an outsized role in the global chip supply chain as it is home to TSMC, which supplies chips to Apple Inc., Nvidia Corp. and other AI chip manufacturers.

Taiwanese contract chipmakers said they shut down some facilities for inspections, although major disruptions are unlikely.

Analysts said TSMC, whose facilities in Hsinchu, Tainan and Taichung have experienced varying degrees of disruption, may have to delay some shipments and increase wafer input to compensate for the shutdowns.

(Updated with Samsung’s NAND business turning to a Q1 profit and impacts from the recent earthquake in Taiwan and disruptions at TSMC)

Write to Chae-Yeon Kim, Eui-Myung Park and Jeong-Soo Hwang at why29@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung to unveil 3D DRAM in 2025 to lead AI chip market

Korean chipmakersSamsung to unveil 3D DRAM in 2025 to lead AI chip marketApr 02, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to supply $752 million in Mach-1 AI chips to Naver, replace Nvidia

Korean chipmakersSamsung to supply $752 million in Mach-1 AI chips to Naver, replace NvidiaMar 22, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadership

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadershipMar 20, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to receive over $6 bn in US chip subsidies, eyes extra investment

Korean chipmakersSamsung to receive over $6 bn in US chip subsidies, eyes extra investmentMar 15, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung flexes NAND muscle with high-capacity microSD cards

Korean chipmakersSamsung flexes NAND muscle with high-capacity microSD cardsFeb 28, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN