Samsung offers upbeat 2024 outlook on chip recovery

Samsung aims to raise profitability by focusing on high-end chips, smartphones as demand is expected to gradually recover

By Jan 31, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co., the world’s top memory chipmaker, on Wednesday offered an upbeat outlook for the semiconductor industry on recovering demand amid the booming generative artificial intelligence (AI) sector as its chip business reported a narrower quarterly loss thanks to a turnaround in its mainstay DRAM segment.

The Suwon, South Korea-based tech giant plans to actively meet demand for premium products to increase profitability.

“The memory market and demand for IT are expected to continue recovering in 2024, though macroeconomic uncertainties remain to be seen,” Samsung said in a detailed earnings statement for the fourth quarter of 2023.

“The company will meet demand for semiconductors for AI applications and expand into AI-enabled consumer product markets,” it said. “The company will strengthen its leadership in premium products and competitiveness in advanced-node semiconductors.”

Samsung also said the recovery is likely to accelerate in the second half, while its earnings are expected to improve only moderately in the first half as ongoing macroeconomic uncertainties are predicted to weigh on the near-term business environment.

SMALLEST PROFIT SINCE GLOBAL FINANCIAL CRISIS

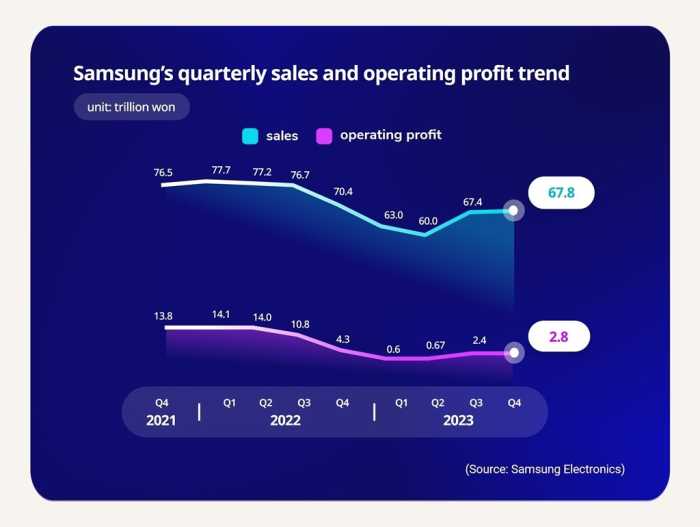

Ballooned chip inventory and weak demand amid sluggish economic growth pushed down Samsung’s operating profit last year by 84.9% to 6.6 trillion won ($4.9 billion) on a consolidated basis with sales down 14.3% to 258.9 trillion won.

The profit was the lowest since 2008 when the global financial crisis rattled the world’s economy.

In the fourth quarter of 2023, the company’s operating profit fell 34.4% to 2.8 trillion won on a consolidated basis in the fourth quarter from a year earlier as sales dipped 3.8% to 67.8 trillion won.

The latest profit and revenue were 16.1% and 0.6% higher, respectively, than those in the July-September 2023 period, however.

“Fourth quarter revenue and operating profit increased from the third quarter based on improved performance in memory due to higher prices, and continued strength in sales of premium display products,” Samsung said.

Its net profit was 6.3 trillion won during the quarter, down 73.4% on-year but up 8.6% on-quarter.

The company invested 7.6 trillion won in research and development for future growth in the last three months of 2023, the largest quarterly spending on R&D.

SEMICONDUCTOR RECOVERY

Samsung’s Device Solutions (DS) division, which oversees its chip business, logged an operating loss of 2.2 trillion won in the October-December period, a 41.9% smaller loss than the 3.8 trillion won deficit in the previous quarter. The division reported an operating profit of 270 billion won in the fourth quarter of 2022.

The DS division’s sales jumped 32% to 21.7 trillion won in the fourth quarter of 2023 from the previous three months with memory revenue up 49% to 15.7 trillion won.

“For the memory business, the overall market showed a recovery compared to the previous quarter, with content-per-box continuing to increase for PC and mobile. Server demand showed signs of recovery as investments in generative AI expanded across the IT industry,” Samsung said in a statement, referring to artificial intelligence.

“The DRAM business posted a profit on the back of higher prices,” said the company as it focused on sales of high-end products amid the accelerating depletion of DRAM and NAND flash memory inventory.

The DS division has been reducing its operating losses every quarter from 4.6 trillion won in the first to 4.4 trillion won in the second and 3.8 trillion won in the third.

TO CONCENTRATE ON PREMIUM SEMICONDUCTOR MODELS

Samsung aims to focus on high-end products and improve profitability as it expects semiconductor demand to keep gradually recovering from the current quarter.

“Looking to the first quarter of 2024, PC and mobile demand recovery is expected to continue, while server and storage demand will show signs of recovery, though market conditions need close monitoring,” the company said.

“In terms of industry supply, bit growth of cutting-edge products is anticipated to face constraints across the market while consumer demand for advanced-node products is predicted to stay strong.”

The company is set to enhance its leadership in the high-density double data rate 5 (DDR5) market and solidify competitiveness in high bandwidth memory (HBM) by ramping up the volume of next-generation HBM3E in a timely manner. For NAND, it will meet the demand for high-density storage by being the first in the industry to enter the mobile quad-level cell (QLC) market and by leading the Gen5 SSD market for generative AI applications.

Its foundry business, which suffered weaker earnings in the fourth quarter, is actively developing 3 nanometers (nm) and 2 nm gate-all-around (GAA) technology and plans to expand into newly emerging application segments using advanced process technologies.

TO BOOST MOBILE PHONE BUSINESS WITH 'AI SMARTPHONES'

Samsung’s Device eXperience (DX) division, which oversees mobile phones and home appliances, reported an operating profit of 2.6 trillion won in the fourth quarter, up 60% on-year but down 30% on-quarter.

The division logged sales of 39.6 trillion won in October-December, down 7% and 10% from a year earlier and the previous three months, respectively.

Its Mobile eXperience (MX) and network business under the division saw an operating profit of 2.7 trillion won, 60.6% higher than a year earlier but 17.3% lower than the prior quarter. Sales of the business totaled 25 trillion won, down 7% and 17% on-year and on-quarter, respectively.

“The MX Business reported a decline in sales and profit quarter-on-quarter due to lower smartphone sales, including the fading of new-product effects from flagship models launched in the third quarter.”

Samsung expected the global smartphone market to rebound this year despite a decline in the first quarter due to seasonality.

The world’s No .2 smartphone maker aims to leverage the recently launched Galaxy S24 series, which brings advanced AI capabilities and enhanced product competitiveness, to expand sales of flagship products.

The latest premium phones, called “AI phones,” are enjoying record-breaking demand even before hitting the shelves not only in South Korea but also in India, the world’s second-largest smartphone market.

(Updated with Samsung’s outlooks, plans for semiconductor and smartphone businesses, comments, details and background)

Write to Ye-Rin Choi at rambutan@hankyung.com

Jongwoo Cheon edited this article.

-

Korean chipmakersNo annual bonuses for Samsung chip unit due to loss

Korean chipmakersNo annual bonuses for Samsung chip unit due to lossJan 30, 2024 (Gmt+09:00)

2 Min read -

ElectronicsBaidu’s AI Ernie to power Samsung Galaxy S24 in China

ElectronicsBaidu’s AI Ernie to power Samsung Galaxy S24 in ChinaJan 29, 2024 (Gmt+09:00)

1 Min read -

ElectronicsSamsung Galaxy S24: A success story even before hitting the shelves

ElectronicsSamsung Galaxy S24: A success story even before hitting the shelvesJan 26, 2024 (Gmt+09:00)

2 Min read -

ElectronicsSamsung Galaxy S24 sees record Indian pre-orders in three days

ElectronicsSamsung Galaxy S24 sees record Indian pre-orders in three daysJan 23, 2024 (Gmt+09:00)

1 Min read -

ElectronicsSamsung Galaxy S24 heralds dawning of AI smartphone era

ElectronicsSamsung Galaxy S24 heralds dawning of AI smartphone eraJan 18, 2024 (Gmt+09:00)

3 Min read -

EarningsSamsung’s narrowed Q4 chip losses fuel bullish 2024 outlook

EarningsSamsung’s narrowed Q4 chip losses fuel bullish 2024 outlookJan 09, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung Electronics to up AI chip foundry sales to 50% by 2028

Korean chipmakersSamsung Electronics to up AI chip foundry sales to 50% by 2028Nov 20, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slow

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slowNov 09, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chips

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chipsOct 21, 2023 (Gmt+09:00)

3 Min read