Earnings

Samsung’s narrowed Q4 chip losses fuel bullish 2024 outlook

Sources say the chipmaker already saw a DRAM turnaround in Q4 and is set to post a decent profit this year

By Jan 09, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co., the world’s largest maker of memory chips, smartphones and TVs, said on Tuesday its chip business losses significantly shrank in the fourth quarter of last year – the latest industry indication that the much-awaited memory rebound is just around the corner.

The Suwon, South Korea-based tech giant, already swung to a profit in its mainstay DRAM segment while a turnaround in the NAND flash memory business is also imminent, sources said.

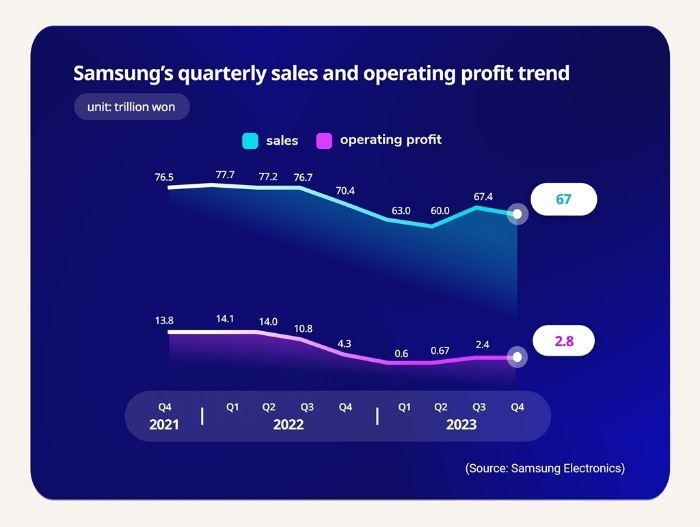

The company said it estimates its operating profit in the October-December quarter to be 2.8 trillion won ($2.1 billion) on a consolidated basis, down 35% from 4.3 trillion won in the year-earlier period.

Fourth-quarter sales fell 4.8% to 67 trillion won from 70.4 trillion won, Samsung said in a short preliminary earnings statement.

Samsung is due to release detailed results, including a divisional breakdown and net profit, later this month.

The fourth-quarter profit estimate came in far below the market consensus of 3.96 trillion won. Shares of Samsung finished Tuesday 2.4% lower at 74,700 won, underperforming the benchmark Kospi index’s 0.3% decline.

SAMSUNG SET TO REVERSE CHIP LOSSES

Although Samsung didn’t provide divisional performance details, analysts said the company’s reduced chip business losses in the final quarter of 2023 contributed to its steady earnings improvement.

The company’s Device Solutions (DS) division, which oversees its chip business, posted a combined loss of about 12 trillion won in the first nine months of last year.

On a quarterly basis, the DS division saw its operating losses dwindle from 4.58 trillion won in the first quarter to 4.36 trillion won in the second quarter and 3.75 trillion won in the third quarter.

Analysts said Samsung likely posted a chip business operating loss to the tune of 1 trillion-2 trillion won in the fourth quarter, buoyed by a rebound in memory chip prices.

SAMSUNG DRAM BUSINESS LIKELY SWUNG TO PROFIT

Since the second half of 2023, a combination of production cuts by chip giants such as Samsung, SK Hynix Inc. and Micron Technology Inc. and the gradual depletion of excess inventory, has fueled a price rebound.

After climbing 13-18% in the fourth quarter, DRAM’s average selling prices are expected to rise by another 13-18% in the current quarter, according to Taiwan-based market research firm TrendForce.

Mobile DRAM, used in smartphones and other smart devices, will see the sharpest spike, potentially rising 18-23%, while PC, server and graphics DRAM chips are expected to climb 10-15%, and consumer DRAM 8-15%, it said.

Samsung, the memory market leader, likely saw its DRAM business swing to a profit in the fourth quarter of last year, people familiar with the matter said.

The company has focused on more profitable, high-end chips such as high bandwidth memory (HBM) chips used in artificial intelligence devices to offset the lower prices of general-purpose commodity memory chips.

Analysts expect Samsung’s chip business recovery to gain traction in the current quarter, with the market consensus for its overall first-quarter operating profit reaching 5.62 trillion won.

For the entire 2024, Samsung’s DS division, including the chip business, is expected to post an operating profit of 14 trillion-15 trillion won, they said.

LAST YEAR’S PROFIT AT 15-YEAR LOW

Samsung said earlier Tuesday it likely posted the smallest overall operating profit in 15 years last year, weighed by heavy losses from its chip business.

The company said it estimates its 2023 operating profit at 6.54 trillion won on a consolidated basis, down 85% from the year prior.

Last year’s operating profit, if confirmed later this month, would mark the lowest since the onset of the global financial crisis in 2008 when Samsung posted a 6.03 trillion won profit.

Sales likely declined 14.6% to 258.16 trillion won in 2023, the company said.

Losses incurred by Samsung’s chip business are expected to be offset by strong performance in its mobile and display divisions.

Industry officials said Samsung’s Device eXperience (DX) division, which covers mobile phones and home appliances, likely posted about 2 trillion won in operating profit in the fourth quarter.

Its display business likely saw a fourth-quarter operating profit of 2 trillion.

(Updated with Samsung’s fourth-quarter results in the lead, industry sources’ comments on its DRAM turnaround, and the industry outlook for this year)

Write to Ye-Rin Choi, Chae-Yeon Kim and Jeong-Soo Hwang at rambutan@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Tech, Media & TelecomSamsung ramps up on-device NPU chip R&D; LG Electronics joins race

Tech, Media & TelecomSamsung ramps up on-device NPU chip R&D; LG Electronics joins raceJan 07, 2024 (Gmt+09:00)

3 Min read -

Korean innovators at CES 2024Samsung dubs upcoming Galaxy S24 AI phone as on-device AI race rages on

Korean innovators at CES 2024Samsung dubs upcoming Galaxy S24 AI phone as on-device AI race rages onJan 04, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to build $281 million chip packaging R&D center in Yokohama

Korean chipmakersSamsung to build $281 million chip packaging R&D center in YokohamaDec 22, 2023 (Gmt+09:00)

3 Min read -

Tech, Media & TelecomNew Samsung, LG laptops drive industry shift toward on-device AI

Tech, Media & TelecomNew Samsung, LG laptops drive industry shift toward on-device AIDec 17, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slow

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slowNov 09, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN