Korean chipmakers

Samsung, SK Hynix expect high 2024 profits as memory market returns

The two largest memory chipmakers are expected to earn over $15 billion combined, driven by AI chips

By Nov 30, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

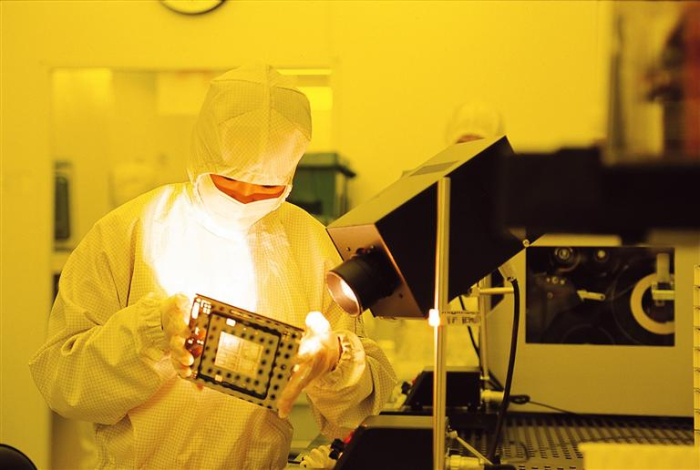

Samsung Electronics Co. and SK Hynix Inc., the world’s two largest memory chipmakers, expect to post decent chip profits next year as DRAM prices rise and the overall memory market expands rapidly.

The two South Korean chipmakers, which have seen their semiconductor business losses snowball for most of this year, will likely post more than 20 trillion won ($15.4 billion) in combined operating profit for 2024, analysts said.

According to the World Semiconductor Trade Statistics (WSTS), the global memory market is forecast to rise to $129.8 billion next year, up 45% from $89.6 billion this year. That would mark the memory industry’s first growth in three years.

The overall semiconductor market, including memory chips, is expected to grow 13.1% year on year to $588.4 billion in 2024, the WSTS said.

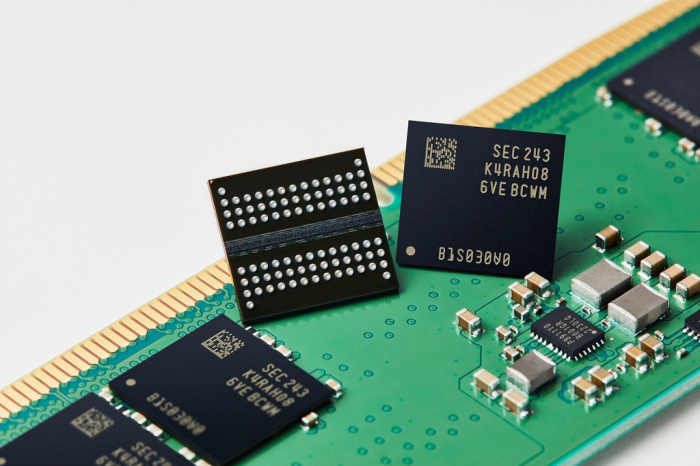

Rising DRAM chip prices are driving the rosy industry outlook.

Samsung, the top memory chipmaker by revenue, is known to have increased the prices of its mobile DRAM chips supplied to its smartphone clients by 25-28% in the fourth quarter from its earlier contract prices.

Samsung’s contract mobile DRAM prices were higher than the 13-18% increase compiled by market tracker TrendForce for the fourth quarter.

Data from DRAMeXchange show the November contract price of DDR4 8Gb for PCs, one of the most common DRAM products, stood at $1.55, up 3.3% from the previous month. In October, the price of such chips gained 15.4% on-month, marking a significant price hike for the first time since July 2021.

OUTPUT CUT BY BIG 3 BEARS FRUIT

The rise in DRAM prices was thanks to production cuts by industry leaders, particularly by the Big Three – Samsung, SK Hynix and Micron Technology Inc. – from the fourth quarter of last year.

Market leader Samsung, which previously was holding out on no production cuts, joined its industry peers in April, providing relief to the market and fanning hopes that Samsung’s move will facilitate an early recovery.

Since April, Samsung has been curtailing its chip production by slashing wafer input for legacy chips such as DDR4 DRAM and 128-layer NAND flash.

Earlier this month, the company said it will continue its DRAM chip production cuts at least until the end of this year as it cautiously gauges the right time to increase its supplies.

AI CHIPS: NAME OF THE GAME

While maintaining its current output cut for DRAM chips, Samsung is widely expected to increase its production volume and investment in advanced chips such as high bandwidth memory (HBM) DRAM, up to 10 times as expensive as commoditized DRAM chips.

Samsung’s crosstown rival SK Hynix is also aggressively ramping up its investment in the HBM series of DRAM chips to retain its leadership in the HBM category.

SK has earmarked 10 trillion won in facility investment for next year, up 43-67% from this year’s estimated capital expenditures of 6 trillion-7 trillion won, people familiar with the matter said.

The HBM series of DRAM is in growing demand as such chips power generative AI devices that operate on high-performance computing systems.

While posting a fourth straight quarterly loss in the July-September period, SK Hynix executives said they expect an imminent DRAM turnaround, driven by AI chips.

SET TO SWING TO 2024 PROFIT

HBM and other graphic DRAMs accounted for a fifth of SK Hynix’s third-quarter sales of 9 trillion won.

According to TrendForce, the global HBM market is forecast to grow to $8.9 billion by 2027 from $3.9 billion this year.

With the overall DRAM price upturn of late, SK Hynix is expected to swing to profit next year.

The market consensus for SK Hynix’s 2024 operating profit is 8.46 trillion won, compared with an estimated operating loss of 8.38 trillion won this year.

Samsung Electronics, which makes other tech devices such as smartphones and home appliances, saw its chip business loss narrow to around 3.9 trillion won from a loss of 4.36 trillion won in the second quarter and a shortfall of 4.6 trillion won in the first quarter.

Samsung’s Device Solution (DS) division, which oversees its semiconductor business, is expected to post an operating profit of 14 trillion-15 trillion won in 2024, a turnaround from an estimated loss of 13 trillion-15 trillion won this year, according to market consensus.

Write to Ik-Hwan Kim at lovepen@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung launches next-generation chip process development unit

Korean chipmakersSamsung launches next-generation chip process development unitNov 29, 2023 (Gmt+09:00)

4 Min read -

Executive reshufflesSamsung sets up future business planning unit, keeps co-CEO system

Executive reshufflesSamsung sets up future business planning unit, keeps co-CEO systemNov 27, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focusNov 09, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung to unveil 3D AI chip packaging tech SAINT to rival TSMC

Korean chipmakersSamsung to unveil 3D AI chip packaging tech SAINT to rival TSMCNov 12, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slow

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slowNov 09, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix pins high hopes on specialty DRAM for AI use: CEO

Korean chipmakersSK Hynix pins high hopes on specialty DRAM for AI use: CEOOct 10, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN