Korean chipmakers

Samsung to continue DRAM output cut until year-end; NAND recovery slow

A meaningful rise in DRAM chip supplies is expected to come in the second half of next year, analysts say

By Nov 09, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

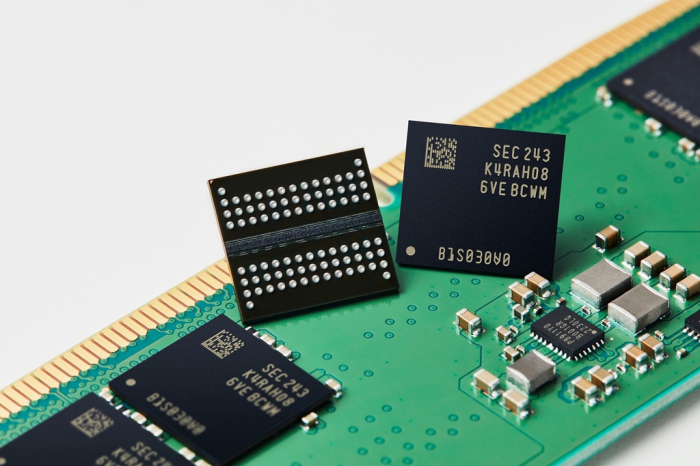

Samsung Electronics Co., the world’s largest memory chipmaker, will continue its ongoing DRAM chip production cut at least until the end of this year as it cautiously gauges the right time to increase its supplies.

Contract DRAM chip prices rebounded for the first time in nearly two and a half years in October, however, it is still too early to churn out memory chips, industry sources quoted Samsung executives as saying.

Samsung made the remarks during its recent non-deal roadshow with investors and analysts, one person familiar with the matter said.

The Suwon, South Korea-based chipmaker will make its decision on when and by how much to increase its memory chip production after closely monitoring market trends early next year, sources said.

In October, contract DRAM prices rose for the first time in 27 months, aided by Samsung and other global chipmakers’ production cuts, which started in the fourth quarter of last year.

SK Hynix Inc., the world’s No. 2 memory chipmaker, and its peers such as Micron Technology and Kioxia, began slashing their chip investment and production in late 2022 as the industry was reeling from an oversupply amid a global economic slowdown.

Market leader Samsung, which previously was holding out, joined them in April, providing relief to the market and fanning hopes that Samsung’s move will facilitate an early recovery.

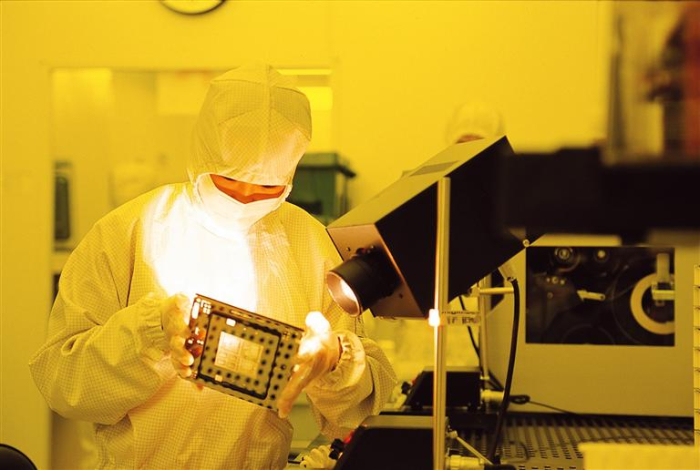

Since April, Samsung has been curtailing its chip production by slashing wafer input for legacy chips such as DDR4 DRAM and 128-layer NAND flash. However, the company said it will continue to invest in infrastructure buildup for advanced DRAM chips and expand R&D spending to solidify its market leadership over the long term.

SUPPLY TO NORMALIZE IN Q2

Industry officials said the chip industry will see increased DRAM supplies in the second quarter of next year at the earliest as it takes three to four months for wafer input increases to lead to an actual rise in chip production volumes.

A meaningful rise in DRAM chip supplies from major chipmakers will come in the second half of 2024, industry watchers said.

Most chipmakers agree that a recovery in NAND flash chips will come later than DRAM chips, given higher NAND chip inventory levels at their clients.

While maintaining its current output cut for DRAM chips, Samsung is widely expected to increase its production volume and investment for advanced chips such as high bandwidth memory (HBM).

Earlier this month, Samsung purchased buildings and facilities from affiliate Samsung Display Co. for 10.5 billion won ($8 million) to expand its HBM chip production.

Samsung’s crosstown rival SK Hynix is also aggressively ramping up its investment in the HBM series of DRAM chips to retain its leadership in the HBM category.

The company has earmarked 10 trillion won in facility investment for next year, up 43-67% from this year’s estimated capital expenditures of 6 trillion-7 trillion won, people familiar with the matter said on Thursday.

The lion’s share of the increased 2024 spending will go to building facilities for advanced DRAM chips such as HBM3, DDR5 and LPDDR5, sources said.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focusNov 09, 2023 (Gmt+09:00)

4 Min read -

Artificial intelligenceSamsung unveils generative AI Gauss, to be integrated in Galaxy S24

Artificial intelligenceSamsung unveils generative AI Gauss, to be integrated in Galaxy S24Nov 08, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyed

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyedApr 12, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung’s chip output cut: Boon for industry, price rebound

EarningsSamsung’s chip output cut: Boon for industry, price reboundApr 07, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN