Samsung Electronics to up AI chip foundry sales to 50% by 2028

With advancements in nanometer process technology, the S.Korean chip giant plans to woo more AI chip-designing companies

By Nov 20, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. plans to up artificial intelligence chip foundry sales to about 50% of its total foundry sales in five years with its advanced nanometer silicon process technology as more and more tech companies opt for self-designed AI chips.

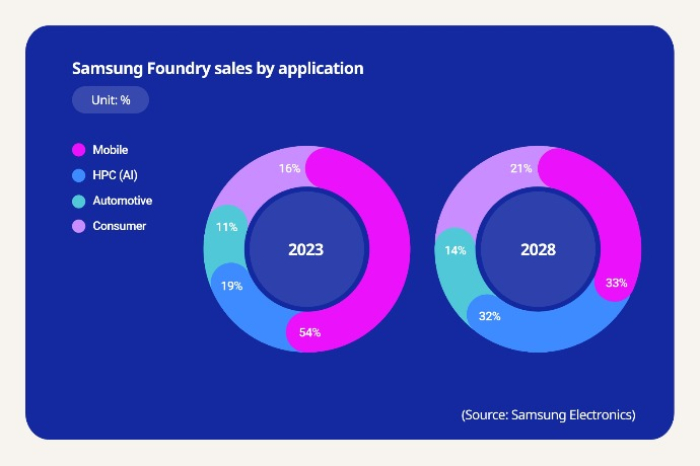

Samsung Foundry, the semiconductor foundry business at Samsung Electronics, has recently set a goal to beef up foundry sales from high-performance computing (HPC) chip orders to 32% in 2028 from 19% in 2023 and automotive chip orders to 14% from 11% in the same period.

Over the same period, it will reduce mobile chip foundry sales to the low 30 percent range from this year’s estimated 54%.

With diversification of its chip foundry orders, the Korean chip giant is expected to improve profitability with high-value-added chip production.

Both HPC and automotive chips are considered AI chips.

For foundry order diversification, the company plans to double the number of non-Samsung customers over the same period.

With mobile chip foundry orders making up more than half of its total foundry sales, Samsung Electronics relies heavily on its in-house chip developers and affiliates, such as Samsung System LSI, which develops Samsung’s application processor Exynos and image sensor ISOCELL for smartphones.

MORE TECH FIRMS OPTING FOR OWN AI CHIPS

Samsung Electronics is confident about its foundry business as it has recently seen a rise in AI chip foundry orders, such as graphics processing units (GPU) and central processing units (CPU) for AI servers and data centers.

There are rumors that the Korean chip giant has already secured a global HPC major as a new foundry customer.

According to foreign media, CPU major Advanced Micro Devices Inc. (AMD) is reportedly reviewing commissioning Samsung to produce its next-generation chips with its 4-nanometer class node.

As Samsung and AMD in April extended their strategic partnership in developing next-generation AP chips, the Korean chip maker could win the order, some analysts forecast.

Samsung, which still lags far behind global leader Taiwan Semiconductor Manufacturing Company (TSMC) Ltd. in foundry orders, is also said to have advanced the production yield of its 4 nm chips to the level of TSMC.

The Korean company is also expected to benefit from Google, Microsoft Corp. and Amazon.com Inc. rushing to develop their own AI chips. As they are fabless, they have to contract out their chip production to foundry companies, like Samsung and TSMC.

TSMC currently produces Microsoft’s AI chips, using its 5 nm node. Still, Samsung could win foundry orders from the US tech giant later, considering that fabless chip companies should have the upper hand in price negotiations with multiple foundry players.

“(Samsung’s) reputation and capability are improving (in foundry),” Jeong Ki-bong, vice president of Foundry Business at Samsung Electronics, said during the company’s third-quarter earnings conference call on Oct. 31, expecting “strong annual growth.”

Samsung’s foundry business recorded its highest-ever quarterly orders last quarter thanks to a flood of orders from AI chip customers.

BEYOND 4NM PROCESS TECHNOLOGY

The key to the steady growth in Samsung’s foundry orders is its nanometer chip processing technology, which is a must to produce high-performance, low-power and high-efficiency AI chips.

Samsung plans to advance its 3 and smaller nanometer process technologies to woo more AI chip customers.

It pins high hopes on its next-generation gate-all-around (GAA) architecture, which is expected to improve chip performance and energy efficiency significantly.

“The GAA has gained great attention from the HPC industry, and we will plan its production depending on demand,” said Jeong.

It also plans to produce automotive and HPC chips, using the 2 nm process node starting in 2026 and unveil the 1.4 nm node, considered a dream technology, in 2027.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Sookyung Seo edited this article.

-

Korean chipmakersSamsung Electronics bags AI chiplet foundry order from Tenstorrent

Korean chipmakersSamsung Electronics bags AI chiplet foundry order from TenstorrentOct 04, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung narrows gap with TSMC in foundry market share

Korean chipmakersSamsung narrows gap with TSMC in foundry market shareSep 06, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung set to supply HBM3, packaging services to AMD

Korean chipmakersSamsung set to supply HBM3, packaging services to AMDAug 22, 2023 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung's new US chip fab wins first foundry order from Groq

Korean chipmakersSamsung's new US chip fab wins first foundry order from GroqAug 16, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung improves 4 nm foundry yields, on par with TSMC: analyst

Korean chipmakersSamsung improves 4 nm foundry yields, on par with TSMC: analystJul 11, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung Electronics to aid foundry clients with state-of-the-art tech

Korean chipmakersSamsung Electronics to aid foundry clients with state-of-the-art techJul 05, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chips

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chipsApr 06, 2023 (Gmt+09:00)

3 Min read