Samsung to receive over $6 bn in US chip subsidies, eyes extra investment

Heavy investments by TSMC, Samsung and Intel to expand facilities could lead to a supply glut, analysts warn

By Mar 15, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

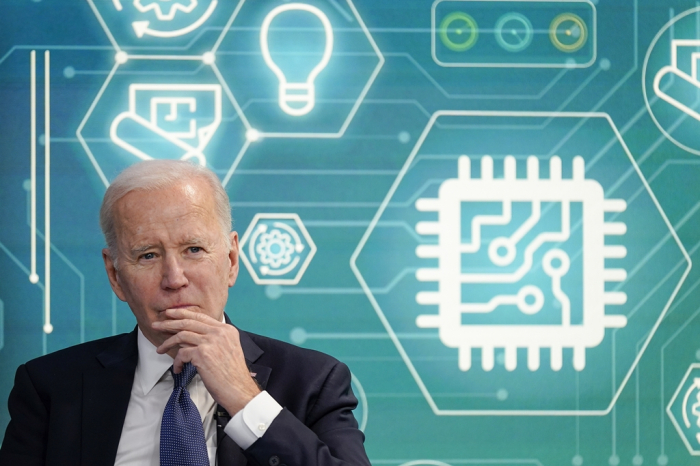

South Korean tech giant Samsung Electronics Co. is expected to receive more than $6 billion in US chip subsidies as the Joe Biden administration is wooing its allies amid an intensifying tech rivalry with China.

The larger-than-expected subsidies from the 2022 CHIPS and Science Act will likely come with the condition that Samsung, the world’s largest memory chipmaker, commit to extra US investments beyond its ongoing project in Texas.

The subsidies for Samsung are among several awards that the US Commerce Department is expected to announce in the coming weeks, including a grant of more than $5 billion to Taiwan Semiconductor Manufacturing Co. (TSMC), Samsung’s archrival, according to a Bloomberg News report on Thursday.

The pending announcement represents a preliminary agreement that could still be altered and no final decision has been made, the media outlet reported, citing unidentified industry sources.

Samsung declined to comment on the report.

However, Yonhap News Agency reported on Friday that Seoul’s Trade Minister Cheong In-gyo, who is in Washington, D.C., said Samsung is certain to receive significant US subsidies, although the amount has yet to be decided.

The US is Samsung’s largest overseas market.

LARGER SUBSIDIES THAN GRANTS TO TSMC

Samsung, like other chipmakers, has been awaiting chip grants from the US government, aimed at ramping up chip production on American soil.

In 2021, the Korean chipmaker announced a $17 billion project in Taylor, Texas, near its existing semiconductor manufacturing plant in Austin.

Samsung previously said its Taylor site was slated to begin mass production this year, but that has been delayed to 2025, partially due to the protracted negotiations over the size of US chip grants.

With the US grants, Samsung could start an advanced 4-nanometer line at the Taylor plant by the end of this year with mass production likely next year, industry officials said.

It is not yet clear where Samsung’s additional investment would be located, Bloomberg sad.

Samsung earlier said it had secured enough space in Taylor to build 10 chip manufacturing factories.

TSMC, the world’s largest contract chipmaker, is said to be receiving more than $5 billion in federal grants to set up a chipmaking plant in Arizona, according to several media reports.

TSMC, which makes chips used in Apple Inc.’s iPhones, has said it would invest about $40 billion in its Arizona plant, among the largest foreign investments in US history.

US-CHINA RIVALRY OVER CHIP SUPREMACY

The CHIPS Act set aside $39 billion in direct grants and $13.2 billion in R&D subsidies to persuade the world’s top semiconductor companies to make chips in the US.

Of $39 billion, the Commerce Department said $28 billion is earmarked for advanced projects by makers of cutting-edge chips that will fuel the artificial intelligence boom.

Last month, Commerce Secretary Gina Raimondo said at a CSIS discussion that more than 600 letters of intent were submitted to receive US subsidies and requests by leading chipmakers for their advanced projects reached over $70 billion.

Samsung and its crosstown rival SK Hynix Inc., the world’s No. 2 memory player, have been jittery about the Biden administration’s Chips for America program, which comes with tough conditions for foreign recipients.

Home to the world’s two largest memory chipmakers, Korea has been torn between its traditional ally, the US, and its largest trading partner China, in an escalating fight for semiconductor supremacy.

In 2022, SK Group, which owns SK Hynix, pledged to invest $22 billion in semiconductor R&D and facilities for advanced packaging in the US.

The US government has said it would cap the technology levels of chips made by Samsung and SK Hynix at their Chinese plants if they receive US grants.

GREATER SUBSIDIES FOR INTEL

Meanwhile, industry officials said Intel Corp., the main US competitor to Samsung and TSMC – has been in talks for a CHIPS Act package of more than $10 billion spanning both grants and loans.

Intel’s incentive deal will reportedly be announced as early as next week.

Samsung faces an uphill battle in contract chipmaking, also known as foundry.

TSMC, which counts Apple and AMD among its major customers, controls over half of the global foundry market. Samsung is a distant second.

In 2021, Intel announced a $20 billion investment plan to build two new chip manufacturing factories in Arizona and jump into the foundry business.

Intel said it would overtake Samsung as the No. 2 foundry player by 2030.

Analysts said while the foundry industry is expected to continue to grow in the coming years driven by the AI boom, the intensifying competition among major players could lead to a supply glut given heavy investments to expand production capacities in the US.

Write to Jeong-Soo Hwang and Chae-Yeon Kim at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung wins first 2 nm AI chip order from Japan’s PFN; a snub to TSMC

Korean chipmakersSamsung wins first 2 nm AI chip order from Japan’s PFN; a snub to TSMCFeb 16, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS ActMar 28, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractive

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractiveMar 06, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMC

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMCNov 24, 2021 (Gmt+09:00)

4 Min read -

Korean chipmakersIntel’s jump into foundry sets off alarm bells for Samsung, TSMC

Korean chipmakersIntel’s jump into foundry sets off alarm bells for Samsung, TSMCMar 24, 2021 (Gmt+09:00)

3 Min read