Korean chipmakers

Samsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakers, irked by excessive subsidy eligibility requirements, say US investment is becoming less appealing

By Mar 28, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

WASHINGTON, D.C. – South Korean chipmakers on Tuesday expressed deep concerns about the detailed guidelines of the US CHIPS and Science Act, saying that they are being forced to bite off more than they can chew to receive US chip subsidies and incentives.

Excessive requests to disclose sensitive information, considered business secrets, to the US government could significantly reduce the appeal of receiving state funds to build new facilities in the country, they said.

Under the latest guidelines unveiled by the US Commerce Department on Monday, semiconductor firms hoping to access CHIPS Act funding are required to provide detailed revenue and profit projections for their new chipmaking plants, with which the US government plans to evaluate their applications.

The department provided an Excel-based tool that applicants can use to submit a pre-application to start a dialogue with US officials before completing a full application.

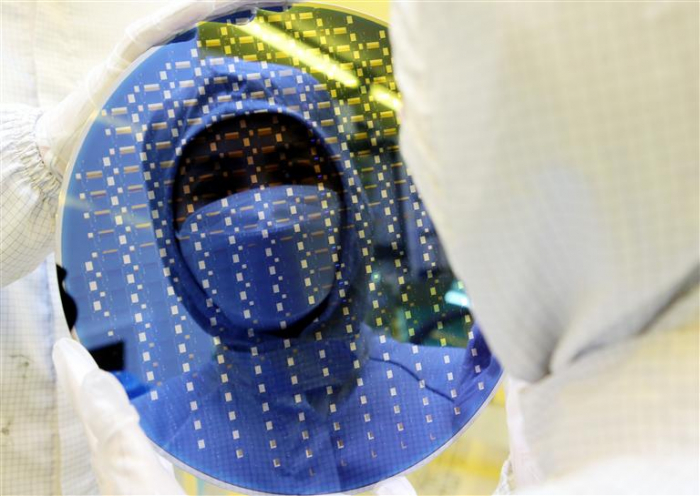

Data required to submit include the number of wafers, operation rates, production volumes, yield rates, the expected price for chips sold and the estimated annual price changes.

Companies will also be asked to disclose data on semiconductor materials such as silicon, nitrogen, oxygen, sulfur, and relevant consumables and labor costs – information that is classified as confidential and not disclosed in their financial reports.

INCREASINGLY FRUSTRATED

South Korea, home to the world’s two largest memory chipmakers, Samsung Electronics Co. and SK Hynix Inc., are increasingly frustrated by the detailed guidelines of the US CHIPS Act.

“Some of the requirements are hardly acceptable. US companies like Intel will also find it hard to accept,” said an executive at a Korean chipmaking company. “Now that we’re asked to expose ourselves to high business risks, we’re unsure what we can get in return.”

Korea’s government officials have already said the requirements under the $53 billion US chip subsidy program are “unconventional” and come with “unusual conditions that are completely different from the subsidies generally provided for foreign investment.”

Seoul’s Industry and Trade Minister Lee Chang-yang said earlier this month that “given the high investment costs, investing in the United States is becoming less appealing.”

Washington said the financial statements and information on semiconductor production to be submitted by the applicants would be a “critical part” of the CHIPS program evaluation.

In the US, Samsung is building a $17 billion foundry or contract chipmaking factory to produce cutting-edge semiconductors in Taylor, Texas.

Last year, SK Group, which owns SK Hynix, pledged to invest $22 billion in semiconductor research and development and facilities for advanced packaging in the US.

Other companies expected to apply for CHIPS Act funding include Intel Corp. and Taiwan Semiconductor Manufacturing Company Ltd., better known as TSMC.

Companies that accept the subsidies must also share with the US government a portion of their profits that exceed initial projections by an agreed-upon threshold.

“The profit-sharing clause is essentially taking away what they give,” said an industry official.

MICROSCOPIC SCRUTINY

The Commerce Department has assigned a number of semiconductor and financial experts to the CHIPS for America team, who will review chipmakers' applications.

The team is led by Todd Fisher, a veteran of private equity firm KKR & Co. A new addition to the team is Kevin Quinn, a former top technology investment banker at Goldman Sachs & Co.

Among notable figures from the tech industries are Dan Kim, former SK Hynix vice president who also worked for the US International Trade Commission (USITC), and Mike O'Brien from Synopsys, the world's No. 1 semiconductor design tool company.

Industry watchers said Korean chipmakers are looking to government officials for help as the officials are set to discuss details with their US counterparts on how to apply CHIPS Act guidelines to the applicants.

Korean President Yoon Suk Yeol, accompanied by an economic delegation that includes the chipmakers' chief executives, is heading to the US next month for a summit meeting with Joe Biden on April 26 to discuss tricky issues related to the CHIPS Act and the Inflation Reduction Act.

Write to In-Seol Jeong and Jeong-Soo Hwang at surisuri@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issues

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractive

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractiveMar 06, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMC

Korean chipmakersSamsung’s $17 billion new chip plant in Taylor aims to rein in TSMCNov 24, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN