Business & Politics

South Korea officially asks US to ease chip rules on China expansion

It’s unclear whether Washington will accept Seoul’s requests, but the US ally hopes to discuss the matter further

By May 24, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

WASHINGTON, D.C. – South Korea has officially requested the US government to review details of the guardrail provisions in the CHIPS and Science Act to ease the rules limiting Korean chipmakers’ production capacity in China.

According to the US Federal Register on Tuesday, the Korean government submitted its official request to the US Commerce Department, asking Washington to clarify some aspects of the guardrail provisions deemed critical for chipmakers in dealing with their Chinese partners.

"The Republic of Korea believes the guardrail provisions should not be implemented in a manner that imposes an unreasonable burden on companies investing in the United States," the Korean government said in comments on the proposed rule regarding the terms of CHIPS Act funding.

“In this vein, the ROK requests the US government to review the proposed rule’s current definitions of ‘material expansion,’ ‘legacy semiconductor,’ and other key terms,” it said.

While the filing provided no further details, sources said Seoul asked Washington to allow companies receiving US chip subsidies to expand their advanced chip output by 10% of the existing capacity over the next 10 years.

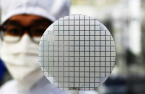

According to the detailed guidelines of the US CHIPS Act announced in March, chipmakers that win US grants will be barred from expanding output in China and “foreign countries of concern” by more than 5% for advanced chips and 10% for older technology, or legacy chips.

Legacy chips, as defined by the US, are logic chips produced with 28-nanometer or larger technology; DRAM chips manufactured with an 18 nm or higher process node; and 128-layer or thinner NAND flash memory chips.

The so-called guardrails are part of Washington’s efforts to thwart Beijing’s chip supremacy ambitions while securing the supply of the components that underpin advanced technologies, including artificial intelligence and supercomputers as well as everyday electronics.

The restrictions tied to the CHIPS Act aim to impose onerous limitations on chipmakers such as Korea’s Samsung Electronics Co. and SK Hynix Inc. – the world’s two largest memory chipmakers – and Taiwan’s TSMC, the world’s No. 1 foundry or contract chipmaker.

US CHIP ASSOCIATION ALSO CALLS FOR LIMIT HIKES

In their comments on the US guardrail rules, the international chip equipment and materials association, SEMI, stated that it is desirable to raise the limit on advanced chips’ “material expansion” to 10% from 5%.

The US Semiconductor Industry Association (SIA) has also asked the US government to hike the ceiling to 10%, or not to consider upgrades and replacements of foreign chipmakers’ existing chip equipment in China as material expansion.

The CHIPS Act provides up to $52.7 billion in subsidies to chipmakers that invest in new production facilities in the US but allows Washington to take back incentives from the recipients if they violate guardrail provisions.

In this regard, Seoul asked Washington to “further clarify the scope of restricted activities under the Technology Clawback.”

Samsung is building a $17 billion foundry factory in Taylor, about 25 km from Austin, where its current contract-manufacturing operations are located.

While requesting the US government to actively consider its requests when finalizing the rules on the guardrail provisions, Korea said it desires to continue communicating and cooperating closely with the US in regard to the CHIPS Act and other chip-related issues.

The US Commerce Department, after reviewing comments submitted by related parties, plans to announce the final rules by the end of the year.

SAMSUNG, SK’S CHINA OPERATIONS

In China, Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing.

Samsung’s Xian plant accounts for nearly 40% of the company’s global NAND production while SK Hynix’s Wuxi plant produces 48% of its global DRAM output.

Last October, the US government unveiled sweeping chip-related export controls on China, while granting Korean companies a one-year reprieve to allow them to upgrade their facilities there.

Samsung and SK have since halted new investments in China while awaiting Washington’s next move given the approaching end of the one-year grace period.

Earlier this month, industry sources said the US Commerce Department is in talks with Korean officials to work out separate equipment import standards to enhance non-Chinese chipmakers’ business predictability and minimize global supply chain disruptions.

Write to In-Seol Jeong at surisuri@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung, SK Hynix face collateral damage from Micron chip ban

Korean chipmakersSamsung, SK Hynix face collateral damage from Micron chip banMay 22, 2023 (Gmt+09:00)

4 Min read -

Business & PoliticsUS eyes new rules for Samsung, SK to bring chip machines to China

Business & PoliticsUS eyes new rules for Samsung, SK to bring chip machines to ChinaMay 10, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investments

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investmentsMar 14, 2023 (Gmt+09:00)

4 Min read -

The KED ViewJury still out on Korean chipmakers’ tech upgrades in China

The KED ViewJury still out on Korean chipmakers’ tech upgrades in ChinaMar 24, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stunted

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stuntedMar 22, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN