Business & Politics

US eyes new rules for Samsung, SK to bring chip machines to China

Separate standards, if established, would provide relief to Korean firms, which count China as a key growth market

By May 10, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

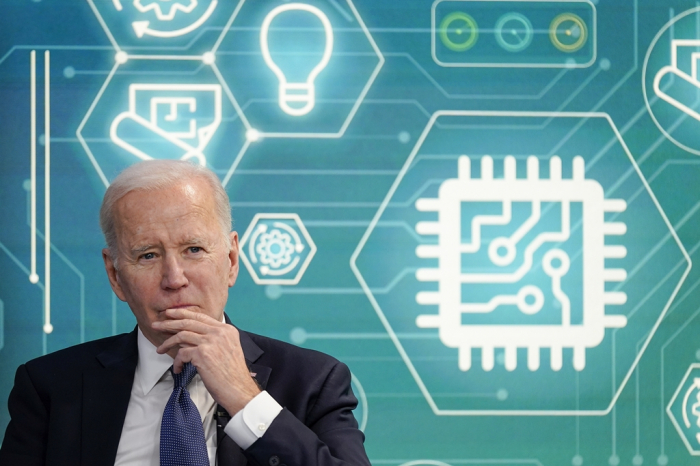

The US government is considering establishing new rules for South Korea’s chipmakers to import advanced equipment to China to upgrade their facilities there amid a protracted standoff between the two world powers for semiconductor supremacy.

The US Commerce Department is in talks with Korean officials to work out separate equipment import standards to enhance non-Chinese chipmakers’ business predictability and minimize global supply chain disruptions, people familiar with the matter said on Wednesday.

Under the new rules, Korean companies such as Samsung Electronics Co. and SK Hynix Inc. would be allowed to bring advanced chipmaking tools into China without regularly seeking US government permission as long as the machines meet certain criteria, sources said.

Besides Samsung and SK, the world’s two largest memory chipmakers, Taiwanese companies are also operating in China.

Last October, the US unveiled sweeping chip-related export controls on China, while granting a one-year reprieve to Korean companies to allow them to upgrade their facilities there.

Korean chipmakers, however, have since halted new investments in China while awaiting Washington’s next move given the approaching expiry of the one-year grace period.

It is unclear, at this point, what criteria the US government would apply to foreign chipmakers, but it will likely limit the type of chipmaking equipment and related technology levels the companies can grow into, sources said.

In February, Undersecretary of Commerce for Industry and Security Alan Estevez said at a business forum that the US is likely to put a cap on the chipmakers’ chip production in China beyond a specified technology level.

In setting new rules on chip equipment imports, the US may also require Korean chipmakers to work out measures against a possible transfer of advanced chip technologies to China, sources said.

WASHINGTON LIKELY TO EXTEND ONE-YEAR WAIVER

On Tuesday, Korea’s Industry and Trade Minister Lee Chang-yong said Seoul had asked Washington to allow its chipmakers to keep updating their facilities in China.

When asked by reporters about the fate of Korean chipmakers after the yearlong waiver, he said he expects a “significant extension of the period.” He added that the two allies will continue to talk over the matter.

Regarding the US decision to establish new rules for foreign chipmakers, Samsung and SK said they haven’t received notice from either of the two governments.

“If a long-term license rule is set up, it would be a huge relief for Samsung and SK Hynix,” said a domestic chip industry official.

In China, Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing.

Samsung’s Xian plant accounts for nearly 40% of the company’s entire NAND production globally while SK Hynix’s Wuxi plant produces about 48% of its global DRAM output.

The never-ceasing faceoff between the US and China is posing a growing risk for Samsung and SK Hynix as China plus Hong Kong account for nearly two-thirds of their exports.

Samsung is said to be making 128-layer NAND chips in China while more advanced 176-layer and 192-layer chips are produced in Korea and other overseas locations.

SK Hynix produces 1y and 1z DRAMs, not regarded as cutting-edge chips, in China.

Write to Han-Shin Park, Sul-Gi Lee and Jeong-Soo Hwang at phs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Business & PoliticsS.Korea wary of tougher US anti-China moves for chipmakers

Business & PoliticsS.Korea wary of tougher US anti-China moves for chipmakersApr 24, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investments

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investmentsMar 14, 2023 (Gmt+09:00)

4 Min read -

The KED ViewJury still out on Korean chipmakers’ tech upgrades in China

The KED ViewJury still out on Korean chipmakers’ tech upgrades in ChinaMar 24, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stunted

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stuntedMar 22, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN